Earnings And Redemption Allowance

Found 9 free book(s)The GM Card® Earnings and Redemption Allowance …

www.gmcard.caRedemption of Earnings Earnings must be redeemed during the operation of the GM Card Earnings Program and during the time that your GM Card Account is in Good Standing. To redeem the Earnings you have accumulated, visit gmcard.ca and select “My Earnings” or contact the GM Card Reward Centre at 1-888-446-6232 to verify

Summary of Consolidated Financial Results for the Nine ...

pdf.kabutan.jpEarnings per share Diluted earnings per share Yen Yen Nine months ended November 20, 2021 732.70 – ... Allowance for doubtful accounts (1,201) (1,149) ... Proceeds from redemption of securities 247,006 428,000 Purchase of property, plant and equipment (5,556) (6,663) ...

T-MOBILE US, INC.

s24.q4cdn.comAccounts receivable, net of allowance for credit losses of $129 and $194 4,109 4,254 ... Earnings per share Basic earnings per share: Continuing operations $ 0.55 $ 1.01 $ 2.09 $ 1.79 ... Losses on redemption of debt 55 108 184 271 ...

Basel III Pillar 3 - CommBank

www.commbank.com.auThis was primarily driven by capital generated from earnings (+54 basis points) and a $7.0 billion (+20 basis points) decrease in total ... Partial redemption of EUR660 million and USD653 million respectively from the existing EUR1,250 million subordinated note and ... and its Supplementary Allowance of $13.0 billion and Additional Allowance of ...

Extra-Statutory Concessions

assets.publishing.service.gov.ukTravelling and subsistence allowance when public transport disrupted . A59. Home to work travel of severely disabled employees ... calculating total earnings for the £8,500 benefits threshold . ... B35. Borrowing and lending of securities: gilt lending to redemption B36. Borrowing and lending of securities: replacement loans

FINANCIAL STATEMENTS For FANCY TECHNOLOGIES …

www.marsdd.comof income and retained earnings and cash flows for the year then ended. Our review was made in accordance ... Redemption of capital stock ... The allowance for doubtful accounts was $3,000 (2012 - $6,000). Interest Rate Risk.

Summary of Consolidated Financial Results for the Nine ...

www.takashimaya.co.jpEarnings per share ... Allowance for doubtful accounts (664) (703) Total current assets 283,607 302,480 ... Proceeds from sales and redemption of short-term and long-term investment securities 55 244 Purchase of property, plant and equipment and intangible assets

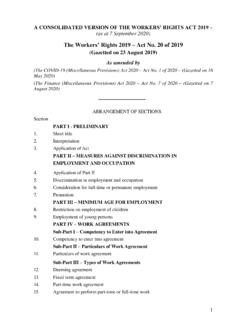

The Workers’ Rights 2019 – Act No. 20 of 2019 (Gazetted on ...

labour.govmu.org42. Redemption of claim 43. Recovery of overpayment of benefit Sub-Part IV – Other Conditions of Employment Section A – Meal allowance 44. Meal allowance Section B – Entitlement to leaves 45. Annual leave 46. Sick leave 47. Vacation leave 48. Special leave 49. Juror’s leave 50. Leave to participate in international sport events 51.

Tax year 6 April 2019 to 5 April 2020 (2019 20)

assets.publishing.service.gov.ukSA101 2020 Page Ai 1 HMRC 12/19 Additional information Tax year 6 April 2019 to 5 April 2020 (2019–20) 12 Stock dividends – the amount received £ • 0 0 13 Bonus issues of securities and redeemable shares £ • 0 0 13.1 Close company loans written off or released £ • 0 0 Complete these pages for less common types of income, deductions and tax reliefs, and for any other …