Employee Premium

Found 8 free book(s)Federal Employees Health Benefits Program (FEHB) …

www.opm.govThis form is used to elect or waive pre-tax treatment of employee premium contributions to the FEHB Program. Pre-tax treatment is automatic. You do not need to complete this form unless you elect not to have your FEHB premium contribut ions deducted on a pre-tax basis, or you previously waived this benefit and now elect to participate.

Form 14765 Employee Premium Tax Credit (PTC) Listing

www.irs.govCatalog Number 68863V. www.irs.gov Form . 14765 (Rev. 5-2021) Form . 14765 (May 2021) Department of the Treasury - Internal Revenue Service. …

An Employee’s Guide to Health Benefits Under COBRA - DOL

www.dol.govThe continuation coverage premium is often more expensive than the amount that active employees are required to pay because the employer usually pays part of the cost of active employees’ coverage. COBRA continuation coverage lasts only for a ... part-time employee who works 20 hours per week counts as half of a full-time employee, and a part-

Notice of Conversion Privilege Federal Employees' Group ...

www.opm.govThe premium is the guaranteed cost to the policyholder. No dividends are paid under these policies. The following are approximate premium rates on a participating basis for Ordinary Life policies with premiums payable for life (or to age 100) and for Ordinary Life policies with premiums payable to age 95. Premium rates for non-participating

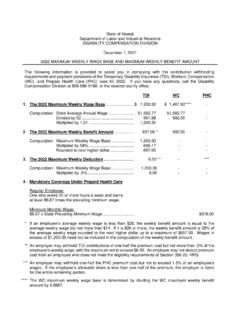

2022 Maximum Weekly Wage Base and Maximum Weekly …

labor.hawaii.govDec 01, 2021 · employee’s weekly wage, with the maximum not to exceed $6.00. An employer may not deduct premium cost from an employee who does not meet the eligibility requirements of Section 392-25, HRS. *** An employer may withhold one-half the PHC premium cost but not to exceed 1.5% of an employee’s wages.

Accessing PeopleSoft Employee Self Service

dcps.dc.govPeopleSoft Employee Self Service Guide for New Hires . Health Coverage Options . The most up-to-date premium rates are provided within the health coverage options section. Please note that before-tax deductions allow your premiums to be deducted from your gross pay prior to taxes being calculated.

Employee Benefits in the United States - March 2021

www.bls.govThe average flat monthly premium paid by employers was $475.69 for single coverage and $1,174.00 for family coverage. State and local government workers ... The Employee Benefits in the United States, March 2021 bulletin includes additional details on the coverage, costs, and provisions of employer-sponsored benefits, and will be published ...

The Employee’s Guide to the Family and Medical Leave Act

www.dol.govemployee when the employee was a child. This term does not include parents-in-law. Son or Daughter Son or daughter (or child) means a biological, adopted, or foster child, stepchild, legal ward, or child of a person standing in loco parentis, who is either under age 18, or age 18 or older and “incapable of self-care because of a mental or ...