Estimated Tax Vouchers

Found 5 free book(s)K-40ES Individual Estimated Income Tax Vouchers and ...

ksrevenue.govK-40ES Individual Estimated Income Tax Vouchers and Instructions Rev. 7-20 Author: rvesfzs Subject: Estimated tax payments are required on income not subject to withholding, such as earnings from self-employment, unemployment, interest and dividends \(including income earned in another state while living in Kansas\). Created Date: 9/22/2020 9 ...

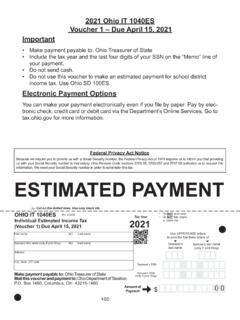

2021 Ohio IT 1040ES Voucher 1 – Due April 15, 2021 ...

tax.ohio.govEstimated payments are made quarterly according to the following schedule: 1st quarter - April 15, 2021 2nd quarter - June 15, 2021 3rd quarter - Sept. 15, 2021 4th quarter - Jan. 18, 2022 Use the Ohio IT 1040ES vouchers to make estimated Ohio income tax payments. Joint filers should determine their combined estimated Ohio tax liability and ...

STATE OF MAINE ESTIMATED TAX FOR INDIVIDUALS Maine …

www.maine.govextension of time to pay the estimated tax or to request a waiver of the penalty associated with unusual event income. See note under item 2 above. Maine EZ Pay You may pay your income taxes electronically at www.maine. gov/revenue. Electronic payments eliminate the necessity of ling Forms 1040ES-ME (income tax estimated payment vouchers).

2021 Form 1040-ES (NR) - IRS tax forms

www.irs.govestimated tax payments. To do so, make a copy of one of your unused estimated tax payment vouchers, fill it in, and mail it with your payment. If you make more than four payments, to avoid a penalty, make sure the total of the amounts you pay during a payment period is at least as much as the amount required

Form MO-1040ES - Declaration of Estimated Tax for Individuals

dor.mo.govMissouri; the Missouri estimated tax is $360 (90% of $400) . 6 . Changes in income - Even if your Missouri estimated tax on April 15 is such that you are not required to file a declaration at that time, the Missouri estimated tax may change so that you