Exhibit A Commission Agreement Addendum To Broker

Found 5 free book(s)Sample Franchise Disclosure Document FDD

www.franchiseprep.comNOTE: THE AGREEMENT PROVISIONS REFERRED TO IN THE RISK FACTORS MAY BE VOID UNDER SOME STATE FRANCHISE LAWS AND SOME STATE FRANCHISE LAWS MAY REQUIRE DISCLOSURE OF ADDITIONAL RISK FACTORS. SEE EXHIBIT “G”. We use the services of one or more FRANCHISE BROKERS or referral sources to assist us in selling our …

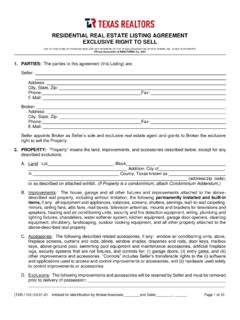

RESIDENTIAL REAL ESTATE LISTING AGREEMENT EXCLUSIVE …

content.har.comor as described on attached exhibit. (If Property is a condominium, attach Condominium Addendum.) B. Improvements: The house, garage and all other fixtures and improvements attached to the above-described real property, including without limitation, the following permanently installed and built -in

CAA Compensation Disclosure Resource Guide

www.uhc.comthe proposal that is sent from UnitedHealthcare to the broker when we quote the business. Therefore, information on the base commission would be within that document. • Service Fee or Consulting Fee: compensation is paid to the covered service provider under an agreement in place with the group health plan. • Contingent Compensation:

PROMULGATED BY THE TEXAS REAL ESTATE COMMISSION …

www.trec.texas.govAddendum Regarding Residential Leases is attached to this contract. B. FIXTURE LEASES: Fixtures on the Property are subject to one or more fixture leases (for example, solar panels, propane tanks, water softener, security system) and the Addendum Regarding Fixture Leases is attached to this contract.

Form W-9 (Rev. October 2018) - IRS tax forms

www.irs.govdividends, broker and barter exchange transactions, rents, royalties, nonemployee pay, payments made in settlement of payment card and third party network transactions, and certain payments from fishing boat operators. Real estate transactions are not subject to backup withholding. You will not be subject to backup withholding on payments you