Fee Conveyance

Found 6 free book(s)DTE100 Form Real Property Conveyance Fee Statement of ...

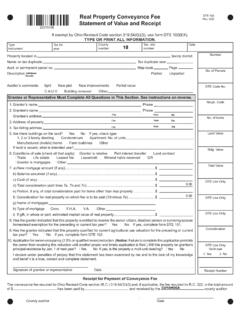

fiscalofficer.cuyahogacounty.usThe conveyance fee required by Ohio Revised Code section (R.C.) 319.54(G)(3) and, if applicable, the fee required by R.C. 322, in the total amount of $ has been paid by and received by the county auditor. County auditor Date Receipt …

TP-584-NYC-I Instructions for Form TP-584-NYC

www.tax.ny.govA conveyance of an easement or license to a public utility company, where the consideration is $2 or less and is clearly stated as actual consideration in the instrument of conveyance, does not require the filing of Form TP-584-NYC or Form TP-584.2. When and where to file File Form TP-584-NYC with the recording officer of the county

Form: Deed of Full Reconveyance - Home | saclaw.org

saclaw.orgTransfer is exempt from fee per GC § 27388.1(a)(2): recorded concurrently “in connection with” transfer subject to Documentary Transfer Tax recorded concurrently “in connection with” a transfer of residential dwelling to an owner-occupier Transfer is exempt from fee per GC 27388.1(a)(1):

Real Estate Customs by State Yes No Customary Standard Fee ...

www.republictitle.comCustomary Standard Fee Splits Buyer Seller Buyer pays instruments of conveyance & financing Seller pays instruments to clear title Buyer pays recording fees Seller pays release recording fees Seller pays pre-closing and abstract charges UCC Status: Nearly all states are authorized for UCC Insurance.

Publication 577:(2/10):FAQs Regarding the Additional Tax ...

www.tax.ny.govPublication 577 (2/10) 5 Introduction Tax Law Article 31 imposes a real estate transfer tax on each conveyance of real property, or interest in real property, when the consideration exceeds $500. The tax is computed at a rate of two dollars

TABLE OF FEES REVENUE DEPARTMENT MANTRALAYA, …

igrmaharashtra.gov.infee table.doc 1 TABLE OF FEES REVENUE DEPARTMENT MANTRALAYA, MUMBAI 17TH JULY 1961 REGISTRATION ACT, 1908 No. RGN-1558-67731-N (as amended from time to time). The following table of fees prepared by the Government of Maharashtra is exercise of