Flexible Spending Accounts 1

Found 11 free book(s)Sections 125 and 223 – Cafeteria Plans, Flexible Spending ...

www.irs.gov1 Sections 125 and 223 – Cafeteria Plans, Flexible Spending Arrangements, and Health Savings Accounts – Elections and Reimbursements for Same-Sex Spouses Following the Windsor Supreme Court Decision Notice 2014-1 I. PURPOSE This notice provides guidance on the application of the rules under section 125 of the

DEFINITIONS OF HEALTH INSURANCE TERMS

www.bls.govFlexible spending accounts or arrangements (FSA) - Accounts offered and administered by employers that provide a way for employees to set aside, out of their paycheck, pretax dollars to pay for the employee’s share of insurance premiums or medical expenses not covered by the employer’s health plan. The employer may also make contributions ...

Health Plans Tax-Favored Page 1 of 23 12:41 - 12-Feb-2021 ...

www.irs.gov(1-800-843-5678) if you recognize a child. Introduction. Various programs are designed to give individuals tax ad-vantages to offset health care costs. This publication ex-plains the following programs. • Health Savings Accounts (HSAs). • Medical Savings Accounts (Archer MSAs and Medi-care Advantage MSAs). • Health Flexible Spending ...

Plan Year 2022 Enrollment Book

goer.ny.govNov 29, 2021 · of flexible spending accounts, administered in compliance with Sections 125 and 129 of the Internal Revenue Code, that give you a way to pay for your dependent care, health care, or adoption expenses with pre-tax dollars. Enrollment in the FSA is voluntary— you decide how much to have taken out of your paycheck and put into your accounts.

Health Savings Accounts Frequently Asked Questions

www.healthpartners.comincluding Medicare and general-purpose flexible spending accounts (FSAs) that aren’t HDHPs. Dental and vision plans, along with accidental and disability insurance doesn’t affect your eligibility. Q What are the tax benefits of an HSA? A Here are a couple of the tax benefits of an HSA: • You’re not taxed on the money you put in your

Flexible Spending Accounts - OPM.gov

www.opm.govTitle: Flexible Spending Accounts Author: Office of Personnel Management Subject: More than 420,000 Feds use pre-tax dollars to save an average of 30% on their family's health care and dependent care expenses.

Health Flexible Spending Account – Frequently Asked …

mybenefits.wageworks.comHealth Flexible Spending Account How much money is available during the plan year? Your entire health FSA election is available on the first day of the plan year. If your FSA is active, your available funds decrease as your claims are paid. You can find out your available funds by logging in to your online account at mybenefits.conexis.com.

DoD Spending Plan Worksheet - USALearning

finred.usalearning.govSPENDING PLAN WORKSHEET ... (1/12 of annual total Public transportation (Metro, bus, etc.) parking, tolls, ride sharing ... help you achieve and maintain financial readiness at every step of your military journey through flexible, no-cost personal support services. SPENDING PLAN WORKSHEET - PAGE 2 Updated June 2020.

Your Health Care Spending Card Debit MasterCard or ...

benefits.cat.com• It’s connected to your flexible spending account (FSA). • There’s no need to write checks or submit claim forms. • Use it for eligible medical, dental, vision and pharmacy expenses. • Use it for eligible dependent care expenses (if it applies). I’ve lost my card or it was stolen! Call Customer Care immediately at 1-866-755-2648 ...

Flexible Spending Account (FSA) Frequently Asked Questions

www.flexiblebenefit.comFlexible Spending Account (FSA) Frequently Asked Questions 1. What happens if I don’t spend all of the money? Where does it go? You will forfeit the money that remains in your account. Any excess funds are kept by the employer and can be used to offset the costs of administering the program. The IRS regulations require this,

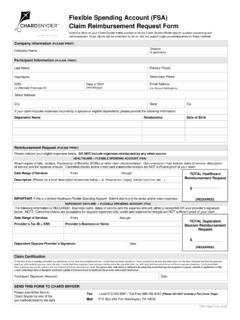

Flexible Spending Account (FSA) Claim Reimbursement ...

www.chard-snyder.comFlexible Spending Account. Claim Reimbursement Instructions. 1. Complete all company and employee information . on the front page (please print/type). NOTE: Please include your e-mail address to receive an automatic e-mail notification whenever a claim is entered into our system and when a reimbursement is approved for you to receive payment 2.