Search results with tag "Flexible spending accounts"

2022 FLEXIBLE BENEFITS RATES

team.georgia.govFlexible Benefits Rate Summary 2022 Plan Year WageWorks Flexible Spending Accounts Health Care and Dependent Care Flexible Spending Accounts Employees enrolled in the Health Care Flexible Spending Account will be charged a $3.20 monthly administrative fee. Unum Long-Term Care Employees who are interested in enrolling or making changes to the ...

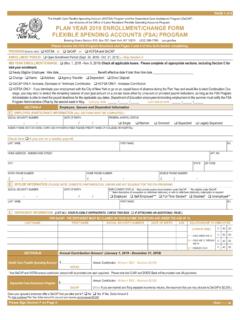

PLAN YEAR 2022 ENROLLMENT/CHANGE FORM FLEXIBLE …

www1.nyc.govThe Health Care Flexible Spending Account (HCFSA) Program and the Dependent Care Assistance Program (DeCAP) are divisions of the Office of Labor Relations’ Flexible Spending Accounts Program. PLAN YEAR 2022 ENROLLMENT/CHANGE FORM . FLEXIBLE SPENDING ACCOUNTS (FSA) PROGRAM. nyc.gov/fsa.

HEALTH SPENDING ACCOUNTS - optimedhealth.com

www.optimedhealth.comHEALTH SPENDING ACCOUNTS HEALTH SPENDING ACCOUNTS FEATURE DETAILS Health Savings Account (HSA) Accumulate savings from payroll prior to taxes. which can then be used for qualified medical expenses such as deductibles, copayments, and coinsurance. This can be used only if employee ... Flexible Spending Account (FSA)

FSA Flexible Spending Account - WEX Inc.

www.wexinc.comA flexible spending account (FSA) helps participants save on out-of-pocket qualified medical, dental, and vision expenses, or qualified dependent care expenses. Flexible Spending Accounts (FSAs) from WEX No matter what type of FSA you need, you can find it from WEX.

Welcome to NYC.gov | City of New York

www1.nyc.govThe Health Care Flexible Spending Account Program is a division of the Office of Labor Relations’ Flexible Spending Accounts Program. HEALTH CARE FLEXIBLE SPENDING ACCOUNT (HCFSA) PROGRAM ... When submitting a claim either during the Grace Period or the current Plan Year, you should check the applicable box when completing your

Consumer-Driven Health Care: What Is It, and What Does It ...

www.bls.govOct 25, 2010 · Flexible Spending Accounts Compared With Health Reimbursement Arrangements Another tax-favorable account is the flexible spending account or flexible spending arrangement (FSA). This kind of account also allows employees to be reimbursed for qualified medical expenses. FSAs are funded through a voluntary salary

PLAN YEAR 2019 ENROLLMENT/CHANGE FORM FLEXIBLE …

www1.nyc.govPAGE 1 of 4 The Health Care Flexible Spending Account (HCFSA) Program and the Dependent Care Assistance Program (DeCAP) are divisions of the Office of Labor Relations’ Flexible Spending Accounts Program.

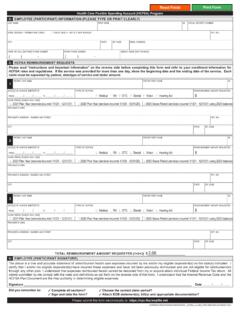

Healthcare Flexible Spending Account Reimbursement Form

f.hubspotusercontent40.netHealthcare Flexible Spending Account Reimbursement Form How to file a claim: Online: Log into your benefits portal or use the MyChoice Mobile App to submit your claim electronically Via email, fax or mail: Fill out your form electronically and submit via email, fax, or mail. • Email: claims@mychoiceaccounts.com Fax: 855-883-8542 • Mail: MyChoice Accounts, MSC …

Your Full-Time Benefits Choices Guide - My Lowe's Life

www.myloweslife.comTo enroll in the healthcare and/or child (dependent) care flexible spending accounts (FSA), click on the “Flexible Spending Account” link within eBenefits. If you would like to enroll in the life insurance, auto/home insurance, and long-term care insurance options, click on the “Life Insurance” link found within eBenefits.

Health Savings Accounts Frequently Asked Questions

www.healthpartners.comincluding Medicare and general-purpose flexible spending accounts (FSAs) that aren’t HDHPs. Dental and vision plans, along with accidental and disability insurance doesn’t affect your eligibility. Q What are the tax benefits of an HSA? A Here are a couple of the tax benefits of an HSA: • You’re not taxed on the money you put in your

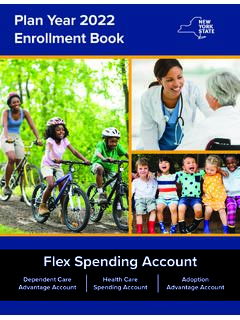

Plan Year 2022 Enrollment Book

goer.ny.govNov 29, 2021 · of flexible spending accounts, administered in compliance with Sections 125 and 129 of the Internal Revenue Code, that give you a way to pay for your dependent care, health care, or adoption expenses with pre-tax dollars. Enrollment in the FSA is voluntary— you decide how much to have taken out of your paycheck and put into your accounts.

2022 guidelines for health savings accounts (HSA)

www.uhc.comFlexible spending account (FSA) Only a limited purpose FSA may be offered alongside the HSA without impacting a member’s eligibility for HSA contributions. Consumers in a full purpose FSA can contribute to an HSA if their FSA balance is $0 at the end of the preceding year. Only a limited purpose FSA may be offered alongside the HSA

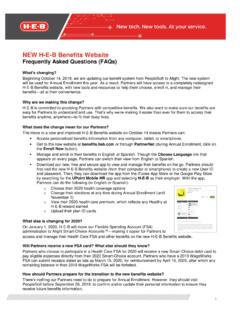

NEW H-E-B Benefits Website Frequently Asked Questions …

www.bcbstx.comOn January 1, 2020, H-E-B will move our Flexible Spending Account (FSA) administration to Alight Smart-Choice Accounts™—making it easier for Partners to access and manage their Health Care FSA and other benefits on the new H-E-B Benefits website .

Flexible Spending Accounts - OPM.gov

www.opm.govFLEXIBLE SPENDING ACCOUNTS The Federal Flexible Spending Account Program (FSAFEDS) U.S. OFFICE OF PERSONNEL MANAGEMENT. More than 420,000 Feds use pre-tax dollars to save an average of . 30%. on their family's …

Flexible Spending Accounts - Texas A&M University System

www.tamus.eduChange in Status Options For Flexible Spending Accounts Health Care Account Dependent Day Care Account Event Enroll/ Increase Withdraw/ Decrease Enroll/ Increase Withdraw/ Decrease ... Employees on leave without pay must make monthly Health Care Account contributions to retain coverage. Spending Accounts 5. the following month. However, you .

Flexible Spending Accounts Program - nyc.gov

www1.nyc.gov• the Health Care Flexible Spending Account (HCFSA) Program, • the Dependent Care Assistance Program (DeCAP), • the Medical Spending Conversion (MSC) Health Benefits Buy-Out Waiver Program, and • the Medical Spending Conversion (MSC) Premium Conversion Program.

Flexible Spending Accounts - prudential.com

www.prudential.comFlexible Spending Accounts Program applicable to eligible Employees, and to provide information regarding your benefits. If you need assistance in reading this booklet, please call the Prudential

Health Care Flexible Spending Account (HFSA) Dependent ...

www.nafhealthplans.comparticipation in the Health Care Flexible Spending Account (HFSA), the Dependent Care Flexible Spending Account (DFSA) or both. The FSA Plan is an important part of the comprehensive total compensation and benefits package that you are offered as a NEXCOM Associate.

Penn State Flexible Spending Account (FSA) and Health ...

hr.psu.eduCare Flexible Spending Account. The Health Care FSA is a voluntary flexible spending account program that provides tax savings on the money you spend for out-of-pocket medical and other health …

Flexible Spending Account (FSA) Frequently Asked Questions

www.flexiblebenefit.comFlexible Spending Account (FSA) Frequently Asked Questions 7. ... do not allow funds to be transferred or commingled between accounts. So, the money in your Health Care FSA may only be used for health care expenses and your Dependent Care FSA may only pay for dependent care expenses.

BASIC PLAN DOCUMENT - Paychex

download.paychex.comYear by filing the Flexible Spending Account Enrollment Form (“Enrollment Form”) with the Employer prior to the first day of the Plan Year for which it will be effective. Alternatively, for the flexible spending account, an Employee may complete the Enrollment Form by …

HEALTH CARE FLEXIBLE SPENDING ACCOUNT CLAIM

hr.ventura.orgHEALTH CARE FLEXIBLE SPENDING ACCOUNT CLAIM INSTRUCTIONS Please hold claims until total exceeds $50. When preparing your claim, be sure to keep photocopies of all bills or other proof of eligible expenses. The copies you send in cannot be returned to you. 1.

PEBP FLEXIBLE SPENDING ACCOUNT (FSA) HEALTH CARE …

pebp.state.nv.usA Limited Purpose/Scope Flexible Spending Account is a savings option for active employees covered under the PEBP Consumer Driven Health Plan (CDHP) with a Health Savings Account (HSA).

Get your money faster. How to Submit Claims

webdocs.asiflex.comFlexible Spending Account (FSA) Claim Form . Your Name (Last, First, MI) Social Security No. or EID or PIN Your Employer’s Name Address City State Zip Code Dependent Care Flexible Spending Account Claims. Follow the instructions on page 1 and submit correct documentation or have your provider sign below to certify the care provided.

Optum Bank Flexible Spending Account (FSA) with carryover

www.optumbank.comFlexible Spending Account (FSA) with carryover. Expense. Estimated our of pocket cost: Prescriptions Prescription drugs $ ... FSA is the smart way to save and pay for IRS eligible health care expenses. It’s smart because you can set aside pre-tax dollars in your FSA.

Your Health Care Spending Card Debit MasterCard or …

benefits.cat.com• It’s connected to your flexible spending account (FSA). • There’s no need to write checks or submit claim forms. • Use it for eligible medical, dental, vision and pharmacy expenses. • Use it for eligible dependent care expenses (if it applies). I’ve lost my card or it was stolen! Call Customer Care immediately at 1-866-755-2648 ...

Health Flexible Spending Account – Frequently Asked …

mybenefits.wageworks.comOnly eligible expenses can be reimbursed under the FSA. These expenses are defined by IRS rules and your employer’s plan. You can learn about your employer’s plan by reading the Summary Plan Description (SPD). Eligible health FSA expenses are those that you pay for out of your pocket for medical care that’s provided to

myClaims Manager - myuhc

www.myuhc.coma Health Reimbursement Account (HRA) or Flexible Spending Account (FSA), if applicable. This amount does not include payments that may have already been paid at the doctor’s office, and it may be different than the bill you receive from the provider. 13 The “Make Payment” link allows subscribers to pay their health care provider online ...

NCFLEX Sample List of FSA Eligible Expenses 2020

files.nc.govunsure if an expense is eligible for reimbursement, please call P&A Group at (866) 916-3475 or chat with a customer service rep through online chat at ncflex.padmin.com. SAMPLE ELIGIBLE EXPENSES FOR FSA REIMBURSEMENTS Flexible Spending Account Never Eligible Eligible Dependent Care FSA Expenses • Babysitters • Daycare centers

A Fee for Service Plan (Standard Option and Value Plan ...

www.opm.govTo reconsider an urgent care claim . To file an appeal with OPM . The Federal Flexible Spending Account Program - FSAFEDS . Section 4. Your Costs for Covered Services . Cost sharing . Copayment . Deductible . Coinsurance . If your provider routinely waives your cost . Waivers 24 . Differences between our allowance and the bill

New Employee Benefits Guide - mecknc.gov

www.mecknc.govHealth Care Flexible Spending Account is a pre-tax account used to pay for eligible medical, dental, and vision care expenses that aren't covered by your insurance plan or elsewhere. The funds you contribute on a bi-weekly basis are front loaded at the beginning of the plan year. This means you may use the funds as soon as they are available.

Employee Benefits Guide 2021 - Milwaukee

city.milwaukee.govUse this guide to learn more about your 2021 benefit options, including a new Voluntary/Vision insurance plan, a change to the Flexible Spending Account and Health Reimbursement Account administrator and health plan benefit design changes. The City is committed to providing programs that support you and your family’s total health and

HEALTH CARE FSA ELIGIBLE EXPENSES - TASC - Partner

partners.tasconline.comOnce you have contributed money into your Health Care Flexible Spending Account (FSA), you can use it to pay for eligible medical expenses tax free. Below is a partial list of eligible expenses that are reimbursable through a Health Care FSA. Eligible expenses can be incurred by you, your spouse, or qualified dependents. For more information, see

2022 STATE OF WISCONSIN EMPLOYEE BENEFITS SUMMARY

wisconsindot.govOptum Financial/Connect Your Care Website Flexible Spending Account (FSA) plan that allows you to set up an account for eligible medical and dependent care expenses. Deductions taken before tax. Health Care FSA: used to pay for eligible medical, dental, vision and prescription expenses that are an out of pocket expense to the employee.

Employee FAQ: Limited Purpose FSA - amben.com

amben.comWhat is a Limited Purpose FSA? A Limited Purpose Health Flexible Spending Account (referred to as a Limited Purpose FSA) is much like a typical,

WageWorks - HealthEquity

healthequity.comwhere you will find answers to frequently asked questions, important forms, ... Here’s How. Welcome to your healthcare and/or dependent care flexible spending account (FSA) sponsored by your employer and brought to you by HealthEquity. Your FSA is a great way to save on hundreds of eligible expenses like prescriptions, copayments, over-

FSA Eligible Expense List - Optum

www.optum.comUsing a flexible spending account (FSA) is a great way to pay for eligible expenses with income tax-free dollars. The following lists are not all-inclusive but will highlight some common eligible expenses for your health care FSA, limited purpose FSA or dependent care FSA. The Internal revenue service (IRS) decides which expenses can be paid ...

Section 125 Cafeteria Plan Summary Plan Document (SPD)

www.employersresource.comClaims Administrator: TASC- Total Administrative Service Corp 2302 International Lane Madison, WI 53704 877-933-3539 www.tasconline.com Plan Year: 01/01-12/31 Employer EIN: 54-1340867 Plan Number: 501 ... Health Flexible Spending Account Benefits ...

What do I need to file my taxes?

www.hrblock.comExpenses paid through a dependent care flexible spending account at work Educational Expenses Forms 1098-T from educational institutions Receipts that itemize qualified educational expenses Records of any scholarships or fellowships you received Form 1098-E if you paid student loan interest K-12 Educator expenses

Flexible Spending Account Enrollment Guide

humanresources.vermont.goveligibility for health insurance, the Health Care Flexible Spending Account or the Dependent Care Flexible Spending Account with the State of Vermont or a plan maintained by your spouse's or any dependent's employer.

FLEXIBLE SPENDING ACCOUNT - xavier.edu

www.xavier.eduaccount and pay for health and wellness expenses using tax-free dollars. Without the FSA you pay for those expenses with what’s left after taxes have ... Flexible Spending Account Annual Expense Estimate Worksheet Dependent Daycare Account Annual Expense Estimate CHILD DAYCARE *

Flexible Spending Account - state.nj.us

www.state.nj.usWhat is a Flexible Spending Account (FSA)? An FSA is an account you set up to pre-fund your anticipated eligible medical services, medical supplies, and dependent care expenses that are ... • WageWorks® Health Care Card. Use it instead of cash at health care providers and wherever accepted for health-related services and health expenses.

Flexible Spending Account - gannon.edu

www.gannon.eduFlexible Spending Account? What Expenses are Covered by an FSA? Who’s Health Care Expenses May I Include? What is Dependent Care (DCAP) under a FSA centers, day camps, prePlan What is the Maximum FSA Amount I can Elect? 100% of your FSA Election will …

Flexible Spending Account Enrollment Form

enrollment4.acadiabenefitsportal.comFlexible Benefit Plan Pre-Tax Elections: Health Care Reimbursement Account: Eligible health expenses include professional medical expenses incurred by my dependents or myself during the Plan Year for the diagnosis, cure mitigation, treatment or prevention of disease, or for the purpose of affecting any structure or function of the body.

Flexible Spending Account (FSA)

www.tasconline.com1. Healthcare FSA Election: The amount you expect to pay out-of-pocket toward eligible medical expenses throughout the plan year, which may include deductible and co-insurance portions of health insurance (NOT premiums), dental, orthodontic, and eye care expenses. Participants may elect a maximum based on the current IRS limits.

Similar queries

Flexible, Flexible Spending, Flexible Spending Account, Health, HEALTH SPENDING, Account, FSA Flexible Spending Account, Dependent care, HCFSA, Claim, Accounts, My Lowe's Life, Flexible Spending Accounts, Frequently asked questions, Flexible Spending Accounts Health Care Account, Care Account, Health Care Account, Spending, Health care, Care, Paychex, Expenses, Your, FSA expenses, Medical, MyClaims Manager, Myuhc, Reimbursement, Benefits Guide, Milwaukee, TASC, Limited purpose FSA, WageWorks, HealthEquity, FSA Eligible Expense List, Optum, Eligible, Form, Medical expenses, Orthodontic