General Ledger Journal Entry

Found 7 free book(s)Chapter 3: Double-Entry Bookkeeping

www.bwl1.ovgu.dejournal is the book of original entry! • common to have more than one kind of journal special purpose journals, e.g. cash receipts journal or sales journal • general journal: all transactions are recorded in this journal ... • general ledger contains all accounts

How to Create, Change and Display a Journal Entry

www.bu.eduThese are the commonly used General Ledger Document Types for creating a Journal Entry using WebGUI ECC Transaction FV50 (Park G/L Account Items/Create Journal Entry). Document type “SA” is defaulted in FV50 and is used for non-grant journal entry

Journal Entry (SA, ZJ, ZB, AB, & ZZ) - ERPDB

erpdb.infoJournal Entry (SA, ZJ, ZB, AB, & ZZ) A journal entry is an accounting document containing debit and credit postings to the general ledger. Journal entries are used to transfer funds from one account to another for payment of various services, materials, etc., and used to correct postings if needed. Journal entries can be posted to

MULTIPLE CHOICE QUESTIONS CHAPTERS 1 5 CHAPTER 1

highschoolaccounts.weebly.com3. Which of the following books of original entry should be used to record credit sales? (A) Sales journal (B) Sales returns journal (C)Purchases journal (D)Purchases returns journal 4. Credit notes issued for goods returned to a supplier will be entered firstly in the (A) General journal (B) Returns inwards journal (C)Returns outwards journal

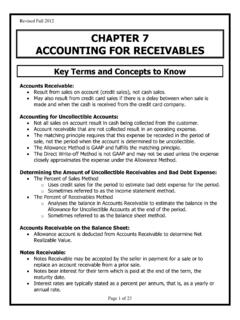

CHAPTER 7 ACCOUNTING FOR RECEIVABLES

www.harpercollege.eduthe amount of the required adjusting entry. This method is typically used by businesses with a large number of customers with relatively uniform accounts receivable balances. The balance in the Allowance account is the balance in the ledger before adjustment plus the adjusting entry for bad debt expense.

Chart of Accounts - Online Community College

78bbm3rv7ks4b6i8j3cuklc1-wpengine.netdna-ssl.comChart of Accounts Provided by Tutoring Services 1 Reviewed September 2009 Chart of Accounts A company’s Chart of Accounts is a list of all Asset, Liability, Equity, Revenue, and Expense accounts included in the company’s General Ledger.The number …

Retail Industry Audit Technique Guide - IRS tax forms

www.irs.govenvelopes and forms for rapid entry of data and for sorting. Bar coding may be an indication that the inventory is computerized. Chargebacks The retailer’s invoice for claims against a vendor resulting from items such as damaged merchandise, cooperative advertising costs, adjustments, and the recovery of transportation charges for