Idaho Tax

Found 9 free book(s)AND - Idaho State Bar

isb.idaho.govJul 01, 2004 · Letter to Idaho State Tax Commission transmitting Tentative Idaho 345 Transfer and Inheritance Tax Return 29. Letter to Internal Revenue Service transmitting Federal Estate 346 Tax Return 30. Letter to IRS requesting prompt audit of estate tax return 347 31. Letter to Internal Revenue Service transmitting Federal Fiduciary 348 Income Tax Return 32.

Form ST-101, Sales Tax Resale or Exemption Certificate - Idaho

tax.idaho.govJul 13, 2020 · in a nontaxing state are exempt from Idaho sales tax. This exemption applies only to materials that will become part of real property and only if the contractor isn’t subject to a use tax or a similar tax in the other state. Jobs in Alaska, Oregon, and

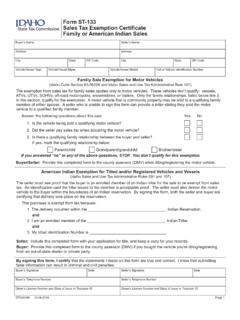

Form ST-133 Sales Tax Exemption Certificate Family ... - Idaho

tax.idaho.govOct 24, 2018 · (Idaho Sales and Use Tax Administrative Rules 091 and 107) The seller must see proof that the buyer is an enrolled member of an Indian tribe for the sale to be exempt from sales tax. An identification card the tribe issues to the member is acceptable proof. The seller must also deliver the motor

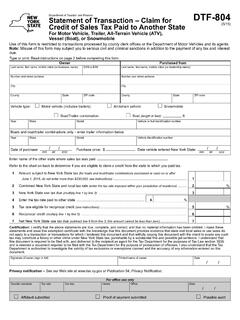

Statement of Transaction – Claim for Credit of Sales Tax ...

www.tax.ny.govIdaho Illinois Iowa Kansas Kentucky Louisiana Maine Missouri Minnesota Mississippi Montana Nebraska NewHampshire Nevada New Jersey New Mexico North Carolina North Dakota Ohio Oklahoma ... tax if the qualifying vehicle or vessel is brought into the state. However, a credit against the New York tax due may be available if all of the following

STATE APPORTIONMENT OF CORPORATE INCOME - Tax Admin

www.taxadmin.orgIDAHO * Double wtd Sales OREGON Sales ILLINOIS * Sales PENNSYLVANIA Sales INDIANA Sales RHODE ISLAND Sales IOWA Sales SOUTH CAROLINA Sales KANSAS * 3 Factor SOUTH DAKOTA No State Income Tax KENTUCKY * Sales TENNESSEE Triple wtd Sales LOUISIANA Sales TEXAS Sales MAINE * Sales UTAH Sales MARYLAND (3) 75.0% Sales, …

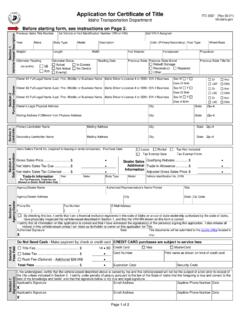

Idaho Transportation Department

itd.idaho.govcollecting tax must be listed in the “Idaho Seller’s Permit No.” field in Section 4. Leasing and rental companies must list their Idaho seller’s permit number. If a vehicle is being traded in, the vehicles information, including the VIN , is required.

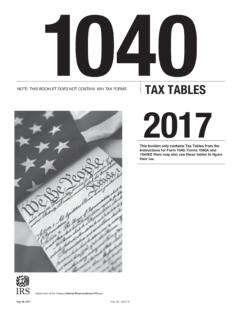

2021 Instruction 1040 TAX AND EARNED INCOME CREDIT …

www.irs.gov$2,641. This is the tax amount they should enter in the entry space on Form 1040, line 16. If line 15 (taxable income) is— ...

8716 Election To Have a Tax Year Other Than a - IRS tax forms

www.irs.govABC, a C corporation that historically used a tax year ending October 31, elects S status and wants to make a section 444 election for its tax year beginning November 1. ABC’s required tax year under section 1378 is a calendar tax year. In this case, the deferral period of the tax year being changed is 2 months.

State Sales Tax Rates and Food & Drug Exemptions - Tax …

www.taxadmin.org(1) Some state tax food, but allow a rebate or income tax credit to compensate poor households. They are: HI, ID, KS, OK, and SD. (2) Includes statewide 1.0% tax levied by local governments in Virginia. (3) Tax rate may be adjusted annually according to a formula based on balances in the unappropriated general fund and the school foundation fund.