Ifta Address Change Form

Found 9 free book(s)SECTION 7. MILES PER GALLON CALCULATION - Virginia

www.dmv.virginia.govnotice of change (check the following boxes if any apply to this return) amended return (refile all information, not just additions) close ifta account/cancel license (i have destroyed all ifta decals. and licenses) name and/or address change enclosed. fuel type codes: gasoline - g

International Registration Plan (IRP) Application

www.dol.wa.govProvide the Washington IFTA license number or the state where the license is held. A current stamped copy of IRS form #2290 (FHVUT) must be submitted for all vehicles with a gross weight of 55,000 . pounds or more, if applicable. Provide the IRP Established Place of Business, Residency, Change of Address form, if applicable.

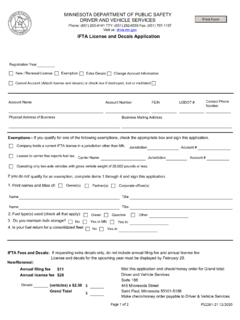

IFTA License and Decals Application - Minnesota

dps.mn.govIFTA License and Decals Application . Registration Year New / Renewal License . Exemption. Extra Decals Change Account Information Cancel Account (Attach license and decals) or check box if destroyed, lost or mutilated . Account Name Physical Address of Business Business Mailing Address Account Number FEIN USDOT # Contact Phone Number . Exemptions

Instructions for completing Forms 1 through 4 of the IRP ...

www.mto.gov.on.cabusiness address must be in Ontario and must include a street address or land location. It cannot be only a Post Office Box. An Established Place of Business Questionnaire is required to be completed for all New Fleet and Address Change transactions and must be signed and submitted with your IRP application.

IFTA Quarterly Fuel Tax Return

dor.georgia.govsubmit all pages of this form (pages 1-4 and voucher). Check the Amended box if you are amending a previously filed return for the same quarter. To cancel your license check the Cancellation box, Complete the report for your operations in this quarter, return your IFTA license and any unused decals to the address on the license.

56-101 International Fuel Tax Agreement ( IFTA ) Fuel Tax ...

comptroller.texas.govInternational Fuel Tax Agreement (IFTA) Fuel Tax Report, Form 56-101, and supplement(s), Form 56-102, with the carrier's designated base state. Failure to file this return and pay the applicable tax may result in collection action as prescribed by Title 2 of the Tax Code.

Guide to Completing the IFTA Quarterly Return

www2.gov.bc.caThe instructions in this guide are specific to the International Fuel Tax Agreement (IFTA) Quarterly Tax Return (FIN 360) listed on our website. However, information about Jurisdiction Codes, Fuel Type Codes, Fuel Conversions and Dual Fuel Vehicles are also applicable to returns filed using eTaxBC.

IFTA Quarterly Fuel Use Tax Return

www.tax.ny.govAttach a Form IFTA-101, IFTA Quarterly Fuel Use Tax Schedule, for each fuel type reported below. For fuel types listed on lines 1 through 4, enter the amount from each Form IFTA-101, page 1, column Q, Totals line. For all other fuel types enter the amount from Form IFTA-101-I, Instructions for Form IFTA-101, page 2, worksheet, column S, Total ...

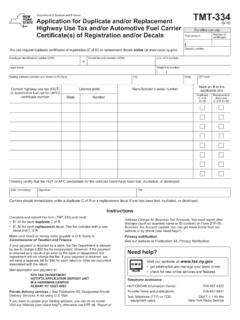

Form TMT-334:8/18:Application for Duplicate and/or ...

www.tax.ny.govComplete and submit this form (TMT-334) and remit: • $1.50 for each duplicate C of R. • $1.50 for each replacement decal. This fee includes both a new decal and C of R. Make your check or money order payable in U.S. funds to Commissioner of Taxation and Finance. If your payment is returned by a bank, the Tax Department is allowed