Income Questionnaire

Found 8 free book(s)SUPPORT QUESTIONNAIRE - California Department of …

cdss.ca.govCW 2.1 (Q) (10/16) SUPPORT QUESTIONNAIRE REQUIRED FORM–SUBSTITUTE PERMITTED 1st Copy – Local Child Support Agency 2nd Copy – County Welfare Department 3rd Copy – Applicant STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY CALIFORNIA DEPARTMENT OF SOCIAL SERVICES SUPPORT QUESTIONNAIRE …

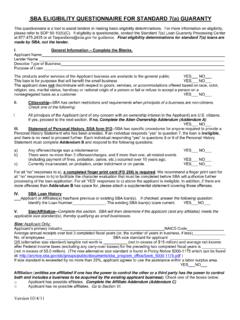

SBA ELIGIBILITY QUESTIONNAIRE FOR STANDARD 7(a) …

www.sba.govSBA ELIGIBILITY QUESTIONNAIRE FOR STANDARD 7(a) GUARANTY This questionnaire is a tool to assist lenders in making basic eligibility determinations. For more information on eligibility, please refer to SOP 50-10(5)(C). If eligibility is questionable, contact the Standard 7(a) Loan Guaranty Processing Center at 877.475.2435 or at

TYPES OF EMPLOYMENT

edd.ca.govIncome Tax Withholding Personal Income Tax Wages . Agricultural Labor Also, refer to federal Agricultural Employer’s Tax Guide, (Internal Revenue Service [IRS] Publication 51, Circular A). A. Workers hired, trained, and paid by a farm operator. B. Workers supplied to a farm ...

Financial Stress, Self-Efficacy, and Financial Help ...

files.eric.ed.govfinancial knowledge, and lower predicted income satisfaction were more likely to seek on-campus financial counseling. Results from the logistic regression analysis confirmed that students who were older, had less net worth, and less financial knowledge were more likely to be help-seekers (Britt et al., 2011).

The impact of using smartphones on the academic ... - ed

files.eric.ed.govbe said to consist of students from middle- to lower-income families (Chukwuere, Mbukanma, & Enwereji, 2017) or disadvantaged societies, and using smartphones is becoming a norm. Students who have smartphones connect easily to the wireless networks and gain limitless access to internet connections that are aimed at advancing ...

83 College Student Financial Literacy Survey

vtechworks.lib.vt.edub. I feel capable of usln myfuture income to achieve my financial goals Cl C2 C3 C4 '5 c. Myfinances are a significant source ofworry or "hassle" forme 12 3C4 5 d. I am uncertain aboutwhere my money is spent 1 C2 3 C4 C5 e. I feel credit cards are safe and risk free 1 2 3 C4 5 f. Purchasin thin s is very important to my happiness Cl C2 3 4 C5 g.

13844 (February 2022) Application For Reduced User Fee …

www.irs.govCatalog Number 49443R. www.irs.gov Form 13844 (Rev. 2-2022). Form 13844 (February 2022) Application For Reduced User Fee For Installment Agreements Department of the Treasury - Internal Revenue Service For low income taxpayers, the user fee for entering into an installment agreement (payment plan) is reduced to $43 and

Paid Preparer Due Diligence - IRS tax forms

www.irs.govBy law, if you are paid to prepare a tax return or claim for refund claiming one or more of the following tax benefits, you must meet four due diligence requirements. The tax benefits are the earned income tax credit (EITC), the child tax credit (CTC), the additional child tax credit (ACTC), the credit for other dependents (ODC), the American opportunity tax credit (AOTC),