Instructions 1

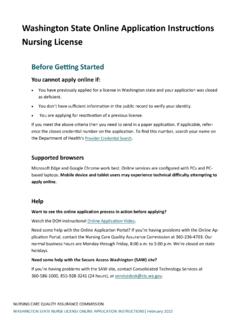

Found 10 free book(s)Washington State Online Application Instructions

doh.wa.gov1. Login to your SAW account using your user ID and password previously created. 2. Select the “Add a New Service” link. 3. On the right column, select “Department of Health.” 4. Scroll to “Online Application Portal”. Select “Apply.” o You'll be asked a series of questions based on your public record data (state

Grants.gov Form Instructions

apply07.grants.govOMB Number: 4040-0004 1 OMB Expiration Date: 10/31/2019 Grants.gov Form Instructions Form Identifiers Information Agency Owner Grants.gov Form Name Application for Federal Assistance (SF-424) V2.1 OMB Number 4040-0004 OMB Expiration Date 10/31/2019 Form Field Instructions Field Number Field Name Required or Optional Information 1. Type of

Installation Instructions for 1-Wire Alternators

www.jegs.comInstallation Instructions for 1-Wire Alternators CAREFULLY READ THESE INSTRUCTIONS BEFORE ATTEMPTING ANY MODIFICATIONS! Proper installation of this alternator is the responsibility of the installer. Improper modification or installation will void your warranty and may result in vehicle damage or personal injury.

2021 Instructions for Form 1065 - IRS tax forms

www.irs.govrecovery startup business, before January 1, 2022). Reminders Codes for Schedule K-1. Complete descriptions of codes for Schedule K-1 are provided under Specific Instructions (Schedules K and K-1, Part III, Except as Noted), later. The codes are no longer listed on page 2 of Schedule K-1 (Form 1065). Payroll credit for COVID-related paid sick

2020 PA Corporate Net Income Tax - CT-1 Instructions (REV ...

www.revenue.pa.govTo obtain tax instructions, single copies of PA corporation tax forms, coupons or brochures, use one of these services: INTERNET: www.revenue.pa.gov TOLL-FREE PHONE SERVICES: 1-888-PATAXES (1-888-728-2937) Touch-tone service is required for this automated 24-hour toll-free line. Call to order forms or check the status of a corporate tax account.

RREF-1 Instructions for Filing Annual Registration Renewal ...

oag.ca.govand disbursements. [See instructions for Form TR-1.] EXTENSIONS FOR FILING . Extensions of time for filing Form RRF-1 will be allowed if an organization has received an extension from the Internal Revenue Service for filing IRS Form 990, 990-PF, or 990-EZ. An organization shall file both forms (RRF-1 and IRS Form

2022 Form OR-W-4, Oregon withholding Instructions, 150 …

www.oregon.gov1511421 ev 11321 1 of 7 222 o 4 o Purpose of this form Use Form OR-W-4 to tell your employer or other payer how much Oregon income tax to withhold from your wages or other periodic income. Instructions for employer or other payer. Enter the business name, federal employer identification number (FEIN), and

Form CT-1 Supplement to Corporation Tax Instructions Tax ...

www.tax.ny.govbox on page 1 of your return to the right of your EIN and file number. The chart below identifies the overpayment line on each New York State corporation tax return. Note: There are various overpayment lines on these returns. See the chart below to verify the proper line(s) to use; also see the instructions for the particular return you are filing.

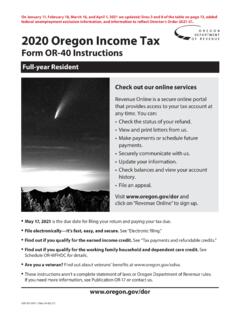

On January 11, February 18, March 16, and April 1, 2021 we ...

www.oregon.gov150-101-040-1 (Rev. 04-02-21) 32020 Form OR-40 Instructions Electronic filing E-filing is the fastest way to file your return and receive your refund. The speed and accuracy of computers

INSTRUCTIONS FOR FORM 1 2020 - Maryland

dat.maryland.govINSTRUCTIONS FOR FORM 1 THE ANNUAL REPORT & BUSINESS PERSONAL PROPERTY RETURN An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1. Maryland State Department of Assessments and Taxation, Taxpayer Services Division