Instructions For Forms 1099 Misc

Found 7 free book(s)2020 Instructions for Forms 1099-MISC and 1099-NEC

www.irs.gov1099-MISC. Canceled debts reportable under section 6050P must be reported on Form 1099-C. See the Instructions for Forms 1099-A and 1099-C. Reportable payments to corporations. The following payments made to corporations generally must be reported on Form 1099-MISC. • Medical and health care payments reported in box 6. •

IP 2021(12) Forms 1099-R, 1099-MISC, 1099-K, 1099-NEC, …

portal.ct.govThis booklet contains specifications and instructions for filing Forms 1099-R, 1099-MISC, 1099-K, 1099-NEC, and W-2G information electronically with the Department of Revenue Services (DRS). DRS requires every state copy of the following: • Federal Form W-2G for (1) Connecticut Lottery Winnings paid to resident and nonresident individuals

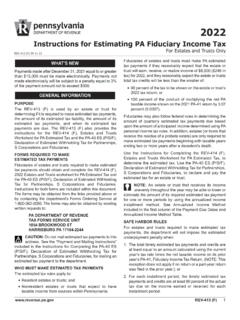

2022 Instructions for Estimating PA Fiduciary Income Tax ...

www.revenue.pa.govreported on federal Forms 1099-MISC or 1099-NEC. ESTIMATED 2022 RESIDENT CREDIT FOR TAXES PAID TO OTHER STATES If a resident estate or trust is an owner in a business that or trust must pay taxes in: another state of the United States; the District of Columbia; the Commonwealth of Puerto Rico;

Instructions for Forms 1099-MISC and 1099-NEC (Rev ...

www.irs.govForms 1099-MISC and 1099-NEC and their instructions, such as legislation enacted after they were published, go to IRS.gov/Form1099MISC or IRS.gov/Form1099NEC. What’s New Continuous-use form and instructions. Form 1099-MISC, Form 1099-NEC, and these instructions have been converted from an annual revision to continuous use.

2020 Nebraska

revenue.nebraska.govFederal Forms W-2, W-2G, 1099-R, 1099-MISC, and 1099-NEC. A form should be received from your employer or payor by February 15 or by March 1 if furnished by a broker. If you have not received the form by the required date, you should immediately contact your employer or payor.

1099-MISC Withholding Exemption Certificate (REV-1832)

www.revenue.pa.gov1099-MISC Withholding Exemption Certificate (REV-1832) Author: PA Department of Revenue Subject: Forms/Publications Keywords: 1099-MISC Withholding Exemption Certificate (REV-1832) Created Date: 10/21/2011 2:20:38 PM

W-2G and 1099 Filing Requirements - Indiana

www.in.gov3. Form 1099 distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts or like distributions. Note: WH-18 forms have been replaced by the IN K-1 form which is filed electronically with the appropriate annual form. WH-18 forms will not be accepted for any tax year after 2015.