Land And Property Taxation

Found 11 free book(s)Wisconsin Guide for Property Owners

www.revenue.wi.gov• Taxation of agricultural land and undeveloped land does not need to be uniform with the taxation of other real property The state legislature enacts all property tax and assessment laws . The property tax assessment laws are covered in Chapter 70 of the Wisconsin Statutes . D. Taxable/nontaxable property All property is taxable unless ...

8. Real Property Taxation in the Philippines1

www1.worldbank.orgimprovements on land and collection from delinquencies. The real property tax effort of LGUs or the ratio of the real property tax (including the SEF, described below) to GDP in 1999 was 0.48 percent. The rate elasticity or the ratio of the growth in revenues to the growth in tax base is almost unitary implying a …

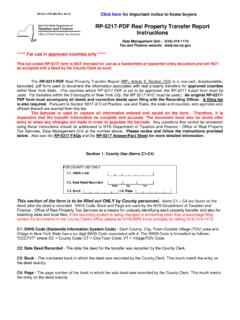

RP-5217-PDF Real Property Transfer Report Instructions

www.tax.ny.govReal Property Transfer Report (RPL Article 9, Section 333) is a one-part, downloadable, ... using these instructions should be addressed to NYS Department of Taxation and Finance - Office of Real Property Tax Services, Data Management Unit at the number above. ... Residential Vacant Land - a vacant lot or acreage that is located in a ...

Introduction to the taxation of foreign investment in US ...

www2.deloitte.comproperty, but that is not engaged in a US trade or business (e.g., the investment is raw land or net leased property) to elect to be taxed on a net basis at graduated rates as if the income were ECI. This “net basis election” can be beneficial, because the production of realty income generally involves substantial expense. Upon making the

Stamp Duty Land Tax: mixed-property purchases and …

assets.publishing.service.gov.uk2.1 Stamp Duty Land Tax (SDLT) is charged on the purchase of land and buildings situated in England and Northern Ireland. Responsibility for property transaction taxes equivalent to SDLT in Scotland and Wales are devolved to their national administrations with effect from 1 April 2015 and 1 April 2018 respectively.

Leases and Rentals - State

www.state.nj.usThe rental or lease of most tangible personal property in New Jersey is subject to the State’s Sales and Use Tax. Tangible personal property means physical property other than real property, such as land and buildings. The Division treats rental/lease transactions as retail sales. A lessor is any owner of leased or rented property.

SUMMARY OF TAXABLE AND EXEMPT GOODS AND SERVICES

www.gov.mb.caproperty - TPP) and services. While a summary of both taxable and exempt goods and services is provided for your reference, the focus of this bulletin is on the types of goods that are exempt and ... •Real property commonly consists of land andbuildings. So me exa ples of real property are homes, roads, bridges, fences and parking lots.

Handbook for New Jersey Assessors - State

www.state.nj.usApril 2021 Handbook For New Jersey Assessors PHIL MURPHY, Governor ELIZABETH MAHER MUOIO, State Treasurer Issued by Property Administration – Local Property Division of Taxation – Department of the Treasury State of New Jersey

LAND ADMINISTRATION GUIDELINES - UNECE

unece.orgB. Taxing land and property 28 C. Central valuation agencies 29 D. Land and property markets 30 E. Costs and benefits of land administration 31 F. Financing and sources of funding 35 G. Marketing land registry and cadastral data 35

What is Proposition 13? California

www.californiataxdata.comto 100% in just one year and their owners’ property tax bills increased accordingly. Proposition 13 Tax Reform Under Proposition 13 tax reform, property tax value was rolled back and frozen at the 1976 assessed value level. Property tax increases on any given property were limited to no more than 2% per year as long as the property was not sold.

For conveyances of real property, or interest therein ...

www.tax.ny.govPage 2 of 4 TP-584 (9/19) Part 3 – Explanation of exemption claimed on Part 1, line 1 (mark an X in all boxes that apply) The conveyance of real property is exempt from the real estate transfer tax for the following reason: a. Conveyance is to the United Nations, the United States of America, New York State, or any of their instrumentalities, agencies,