Maturity Indices

Found 10 free book(s)ACI Dealing Certificate New Version - ACI FMA

www.acifma.commarket instruments, including those with an original term to maturity of more than one year. • Calculate broken dates and rates through linear (straight l ine) interpolation. • Define interest rate indices, their methodologies and outline the most internationally used benchmark indices in …

Basel Committee on Banking Supervision

www.bis.orgother within maturity categories; across maturity categories, partial offset is recognised. ... and options on volatility indices. Volatility transactions form hedging sets according to the rules of their respective asset classes. For example, all equity volatility transactions form a …

drought indices - DMCSEE

www.dmcsee.orgDROUGHT INDICES • Assessment of agricultural drought requires calculation of wate r balance on weekly scale during growing season • tools for calculating water balance • tools for quantitative analysis of the growth and production of annual field crops • Indices, used in agriculture: Agrohydropotential (AHP), Dry day

26 May 2021 J.P. Morgan ESG EMBI Global Diversified Index

www.jpmorgan.comJan 01, 2021 · Maturity: Only those instruments with at least 2.5 years until maturity are considered for inclusion. At each month-end, instruments that fall below 6 months to maturity during the upcoming month, will be excluded from the Index. Amount Outstanding: i Only issues with a current face amount outstanding of $500 million or more are considered for

Basel Committee on Banking Supervision Standards

www.bis.orgassets funded by short-maturity liabilities) and rate mismatch (eg fixed rate loans funded by variable rate deposits). In addition, there are optionalities embedded in many of the common banking products (eg non-maturity deposits, term deposits, fixed rate loans) that are triggered in accordance with changes in interest rates.

iShares National Muni Bond ETF

www.ishares.comWeighted Average Maturity is the length of time until the average security in the fund will mature or be redeemed by its issuer. It indicates a fixed income fund's sensitivity to interest rate changes. Longer average weighted maturity implies greater volatility in response to interest rate changes.

VanguardTotal Bond Market II Index Fund

institutional.vanguard.comThe chance that during periods of falling interest rates, homeowners will refinance their mortgages before their maturity dates, resulting in prepayment of mortgage-backed securities held by the fund. The fund would then lose any price appreciation above the mortgage’s principal and would be ... Bloomberg’s licensors own all proprietary ...

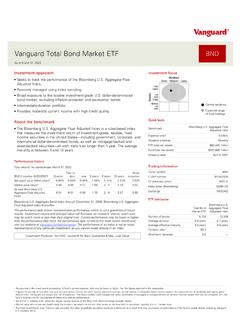

Vanguard Total Bond Market ETF BND

institutional.vanguard.commaturity is between 5and 10 years. Performance history Total returns 2 for period ended September 30, 2021 BND (Inception 04/03/2007) Quarter Year to date 1 year 3years 5years 10 years Since inception Net asset value (NAV) return 3 0.06% -1.58% …

Principles for Financial Benchmarks - IOSCO

www.iosco.orgeconomic activity, inflation or consumer price indices) is not within the scope of the s. Principle However, Benchmarks where a National Authority acts as a mechanical Calculation Agent are within the scope of the Principles. The Principles also exclude reference prices or settlement

Understanding Interest Rate Swap Math & Pricing

www.treasurer.ca.govThe maturity, or “tenor,” of a fixed-to-floating interest rate swap is usually between one and fifteen years. By conven tion, a fixed-rate payer is designated as the buyer of the swap, while the floating-rate payer is the seller of the swap. Swaps vary widely with respect to underlying asset, matu rity, style, and contingency provisions.