Mortgage Debt Relief

Found 8 free book(s)Cancellation of Debt Income – What You Need to Know

www.irs.govThe Mortgage Forgiveness Debt Relief Act of 2007 (MFDRA) • Created a new exclusion under IRC sections 108(a)(1)(E) and 108(h) for discharged qualified principal residence indebtedness. • Applies to indebtedness that is discharged on or after Jan. 1, 2007, and before

The Small Business Owner’s Guide to COVID-19 Relief ...

www.sbc.senate.govDebt Relief Program could help. ... utilities, rent and mortgage interest, but also costs ranging from essential supplier costs to worker protective equipment and adaptive investments to help a loan recipient comply with federal health and safety guidelines.

HUD’s Loss Mitigation Program

www.hud.govDebt to Income Ratios Front-End Ratio – The total first mortgage payment (PITI) divided by the Mortgagor’s gross monthly income, shall be 31%. Back-End Ratio – The total first mortgage payment plus all recurring monthly debt divided by the Mortgagor’s gross monthly income, shall not exceed 55%. Mortgagee Letter 2009-23, pg. 2

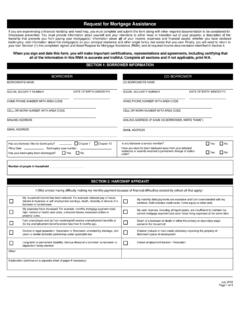

Request for Mortgage Assistance

www.usbank.com1. All of the information in this Request for Mortgage Assistance Form is truthful and the hardship that I have identified contributed to my need for mortgage relief. 2. The accuracy of my statements may be reviewed by the Servicer, owner or guarantor of my mortgage, their agent(s), or an authorized third party*, and I may

Bankruptcy Information Sheet in English

www.justice.govOct 06, 2011 · If you reaffirm a debt and then fail to pay it, you owe the debt the same as though there was no bankruptcy. The debt will not be discharged and the creditor can take action to recover any property on which it has a lien or mortgage. The creditor can also take legal action to recover a judgment against you.

Mortgage Assistance - Carrington Mortgage

www.carringtonmortgage.comany relief I receive, to any third party that deals with my first lien or subordinate lien (if applicable) mortgage loan(s), including Fannie Mae, Freddie Mac, or any investor, insurer, guarantor, or servicer of my mortgage loan(s) or any companies that provide support services to them, for purposes permitted by applicable law. Personal information

Mortgage Assistance Application 10.13 - SLS

www.sls.netReview the Information on Mortgage Relief Options Available page for an overview of these options. Remember, you need to take action by calling us at 1-800-306-6062 right away—or get started by completing and returning the Request for Mortgage Assistance (RMA) form along with other required documents as they pertain to your specific

Mortgage Assistance Application - Wells Fargo

www08.wellsfargomedia.comMonthly household expenses and debt Enter each debt once on this worksheet. For example, if you have auto loan payments, enter the amount under Auto loans. If you’re making collection payments on an auto loan, enter that amount under Collections, judgments, and liens. Don’t enter the auto loan payments on both lines. First mortgage payment