Of accounts

Found 3 free book(s)Checking, Savings and Money Market Accounts Foundation ...

www.pnc.comYou may link accounts with at least one common account owner for purposes of receiving pricing benefits (for example, waiver of a monthly service charge if balance requirements are met). When you link accounts with other accounts, any account owner on any linked accounts may have access to limited information about any of the linked accounts.

Health Plans Tax-Favored Page 1 of 23 12:41 - IRS tax forms

www.irs.govHealth Savings Accounts (HSAs) A Health Savings Account (HSA) is a tax-exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur. You must be an eligible individual to qualify for an HSA.

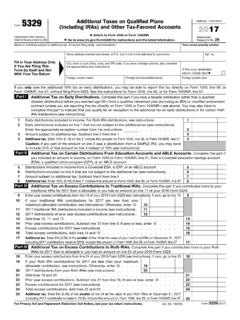

2021 Form 5329 - IRS tax forms

www.irs.govAdditional Tax on Excess Contributions to Health Savings Accounts (HSAs). Complete this part if you, someone on your behalf, or your employer contributed more to your HSAs for 2021 than is allowable or you had an amount on line 49 of your 2020 Form 5329. 42 . Enter the excess contributions from line 48 of your 2020 Form 5329.