Of estate

Found 9 free book(s)State of Washington REAL ESTATE EXCISE TAX Department of ...

dor.wa.govREAL ESTATE EXCISE TAX SUPPLEMENTAL STATEMENT (WAC 458-61A-304) This form must be submitted with the Real Estate Excise Tax Affidavit (FORM REV 84 0001A for deeded transfers and Form REV 84 0001B for controlling interest transfers) for claims of tax exemption as provided below. Completion of this form is 1. 3. DEPARTMENT OF REVENUE

DECEASED OWNER TITLE TRANSFER GUIDE

select.dmv.virginia.govestate falls under the small estate laws (estate less than $50,000) NOTES . 1 Although Virginia titles may not be . issued with “tenants by the entirety”, some Virginia titles may have been issued as “tenants by the entirety” or “tenants by the entireties” in the past. 2 .

Form 4768 Application for Extension of Time To File a ...

www.irs.govpay the full amount of the estate (or GST) tax by the return due date. If the taxes cannot be determined because the size of the gross estate is unascertainable, check here ' and enter “-0-” or other appropriate amount on Part IV, line 3. You must attach an explanation. Enter extension date requested (Not more than 12 months)

DE-120 NOTICE OF HEARING—DECEDENT'S ESTATE OR TRUST

www.courts.ca.govIf the filing described in 1 is a report of the status of a decedent's estate administration made under Probate Code section 12200, YOU HAVE THE RIGHT TO PETITION FOR AN ACCOUNTING UNDER SECTION 10950 OF THE PROBATE CODE. 2. A HEARING on the matter described in 1 will be held as follows: Date: Time:

INVENTORY FOR DECEDENT’S ESTATE COMMONWEALTH …

www.vacourts.govThe decedent’s personal estate under your supervision and control, valued at the date of death. DESCRIPTION OF PROPERTY VALUE . TOTAL VALUE OF PART 1: Page 1 of 4 . FORM CC-1670 MASTER 10/12 : Part 2. The decedent’s interest in multiple party accounts and multiple party certificates of deposit in banks and

TP-584.1 Real Estate Transfer Tax Return Supplemental ...

www.tax.ny.govPursuant to section 575.11(a)(2)(ii) of the real estate transfer tax regulations, a debt is recourse debt to the extent that, as of the date of conveyance, the grantor or a person related to the grantor, including any guarantor, bears the economic risk of loss for the debt beyond any loss attributable to the value of the property securing the debt.

Common Level Ratio (CLR) Real Estate Valuation Factors ...

www.revenue.pa.govThe following real estate valuation factors are based on sales data compiled by the State Tax Equalization Board. These factors are the mathematical reciprocals of the actual common level ratios. For Pennsylvania Realty Transfer Tax purposes, these factors are applicable for documents accepted for the periods indicated below.

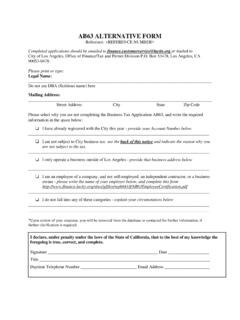

AB63 ALTERNATIVE FORM - Los Angeles

finance.lacity.orgReal Estate Agent Religious leaders in their religious capacity Residential care facility for the elderly, which serves six or fewer residents Licensed …

AFFIDAVIT OF DEATH OF TRUSTEE - California

arcc.sdcounty.ca.govAbove Space for Recorder’s Use Only WHEN RECORDED MAIL TO: Name:_____ Address:_____ City:_____