Profit Or Loss

Found 8 free book(s)SCHEDULE C Profit or Loss From Business 2019

www.irs.gov31 Net profit or (loss). Subtract line 30 from line 29. • If a profit, enter on both . Schedule 1 (Form 1040 or 1040-SR), line 3 (or . Form 1040-NR, line 13) and on . Schedule SE, line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on . Form 1041, line 3. • If a loss, you . must . go to line 32.} 31. 32

SCHEDULE C Profit or Loss From Business 2015

www.irs.gov31 Net profit or (loss). Subtract line 30 from line 29. • If a profit, enter on both . Form 1040, line 12 (or . Form 1040NR, line 13) and on . Schedule SE, line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on . Form 1041, line 3. • …

Math 1313 Section 1.5 Linear Cost, Revenue and Profit ...

online.math.uh.eduExample 7: Given the following profit function P(x) = 6x -12,000. a. How many units should be produced in order to realize a profit of $9,000? b. What is the profit or loss if 1,000 units are produced? Example 8: A bicycle manufacturer experiences fixed monthly costs of $124,992 and variable costs of $52 per standard model bicycle produced.

CHAPTER 7 PROFIT & LOSS ACCOUNT AND BALANCE SHEET …

www.accaglobal.comThe profit and loss account can be prepared for any period. A business may prepare its profit and loss account annually. A profit and loss account is prepared for the period for which the business wants to evaluate its performance. In Table 7.1 'Faisal Furniture Shop' is the name of the business. The name of the business is always shown on all the

Cost, Revenue & Profit Examples - UTEP

math.utep.eduplugging 500 into the profit function. We get This means that if they sell 500 newspapers, it will result in a loss of . c) To find the break even quantity, we can either set revenue equal to cost and solve for , or we can set profit equal to zero and solve for . If we set profit equal to zero, we get

Rental Property Profit and Loss Statement

d2zm3gcvr8kng7.cloudfront.netRental Property Profit and Loss Statement. Property Address: _____ Advertising. Total Miles Driven. Commissions & Fees: Mortgage Interest Insurance Legal & Professional Fees Cleaning and Maintenance. Client Name: _____ Travel. Management Fees: Supplies. I completed this Rental P&L statement based upon my records, I confirm I have all documen ...

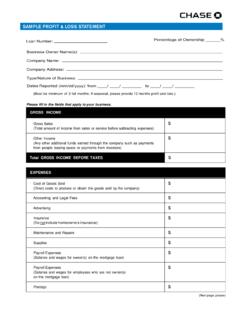

SAMPLE PROFIT & LOSS STATEMENT - Chase

www.chase.comIf seasonal, please provide 12 months profit and loss.) Please fill in the fields that apply to your business. GROSS INCOME. Gross Sales (Total amount of income from sales or service before subtracting expenses) $ Other Income (Any other additional funds earned through the company such as payments

SAMPLE PROFIT & LOSS STATEMENT OF HOTEL BUSINESS

www.frcs.org.fjSAMPLE PROFIT & LOSS STATEMENT OF HOTEL BUSINESS NOTES Each component of financial statement is to be valued at VEP amount. 1. Sales - Restaurant -Total sales (credit and cash) made during the year. 2. Sales – Bar- Total sales (credit and cash) made during the year. 3. Total Sales- Restaurant sales plus bar sales. 4.