Rehabilitation Income And Expense Information

Found 4 free book(s)4350.1 REV-1 CHAPTER 4. RESERVE FUND FOR REPLACEMENTS

www.hud.govrehabilitation where the mortgage does not exceed $200,000, a fund for replacements shall be established and ... incapable of producing an annual income sufficient to offset the expense of operation and maintenance, insurance, and taxes, and to produce returns upon the

WORKERS’ COMPENSATION HANDBOOK

sbwc.georgia.govYour authorized doctor bills, hospital bills, rehabilitation in some cases, physical therapy, prescriptions and necessary travel expenses will be paid if injury was caused by an accident on the job. 4. You are entitled to weekly income benefits if you have more than seven days of lost time due to an injury.

26 CFR 601.602: Tax forms and instructions. 6651, 6652 ...

www.irs.gov.25 Gross Income Limitation for a Qualifying Relative 152(d)(1)(B) .26 Election to Expense Certain Depreciable Assets 179 .27 Qualified Business Income 199A .28 Eligible Long-Term Care Premiums 213(d)(10) .29 Medical Savings Accounts 220

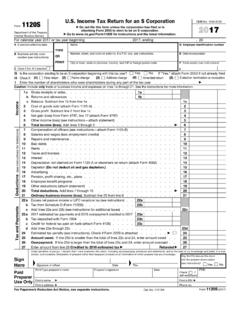

1120-S U.S. Income Tax Return for an S Corporation

www.irs.govThe corporation owns a pass-through entity with current, or prior year carryover, excess business interest expense. b The corporation’s aggregate average annual gross receipts (determined under section 448(c)) for the 3 tax years