Related deduction from the remuneration

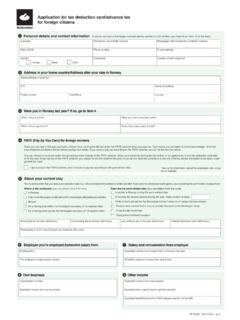

Found 10 free book(s)Application for tax deduction card/advance tax for foreign ...

www.skatteetaten.noLive/stay in Norway during the work-related stay: In Norway for several periods during the year. ... Salary and remuneration from employer: Expected income from employment in Norway this year ... general tax rules instead of the PAYE scheme. Make your choice by ticking the box below, or by applying for a new tax deduction card later : on in the ...

Overview of Medical Service Regime in Japan - mhlw.go.jp

www.mhlw.go.jp(*1) Means “total income, etc.” (an amount worked out by subtracting work -related expenses, salary earners deduction, and publi c pension deduction and so on from the total earning). ... dividing the total amount of standard remuneration with the number of subscribers).

Information about deduction of Income Tax at Source [TDS]

nbr.gov.bd24 Deduction from payment on account of purchase through local L/C [52U] Respective Bank or Financial Institute 3% [If purchase of goods through local L/C exceeds taka 5 lakh] No tax shall be deducted under this section from the payment related to local letter of credit (L/C) and any other financing agreement in respect of purchase or

TAX DEDUCTION AT SOURCE (TDS) - ICNL

www.icnl.orgA. Remuneration payments B. A resident person, when making remuneration payments to employees, must deduct TDS. TDS should be deducted at the time of payment and must be deducted at the rate given in Annex-1 of the Income Tax Act 2058. For detailed information regarding TDS calculation on remuneration income,

BUDGET - National Treasury

www.treasury.gov.zathe individual employees. The deduction is limited to 27.5% of the greater of the amount of remuneration for PAYE purposes or taxable income (both excluding retirement fund lump sums and severance benefits).The deduction is further limited to the lower of R350 000 or 27.5% of taxable income before the inclusion of a taxable capital gain.

S18A FACT SHEET FOR FILING SEASON 20/21

www.sars.gov.zaIf the deduction was made over a six month period which commenced of 1 April 2020 to 30 September 2020, a maximum deduction limited to 16,66% of the remuneration per month (after deducting employee contribution to a pension funds, provident funds, retirement annuity,

Instructions for Form 1125-E (Rev. October 2018)

www.irs.govFor the latest information about developments related to Form 1125-E and its instructions, such as legislation enacted after they were published, visit IRS.gov/ Form1125E. What’s New Limitations on compensation. For tax years beginning after 2017, for purposes of the deduction for employee compensation in excess of $1

Salary Certificate - Allied Irish Banks

aib.ieWhere non guaranteed income is part of remuneration structure please complete the below table. Last Year 2 Years Ago 3 Years Ago Annual Total Guaranteed Income € € € Annual Total non-Guaranteed Income € € € *If the income is performance related, made up of any non-basic (e.g. shift/overtime etc.) or contract income, we require 3 ...

ACT : INCOME TAX ACT 58 OF 1962 SECTION : SECTIONS …

www.sars.gov.zaamended since 1990. The most recent amendment to have an effect on the deduction of home office expenditure was the amendment to section 23(m) 2. which, subject to specific exceptions, prohibits the deduction of certain expenditure, losses and allowances that relate to employment or the holding of an office. The effect of section 23(b) and 23(m

SCHEDULE Treasury Regulations for departments, trading ...

www.treasury.gov.zaThe Minister of Finance has, in terms of Section 78 of the PFMA, published the enclosed draft Treasury Regulations for public comment in Government Gazette No. 25613 dated

![Information about deduction of Income Tax at Source [TDS]](/cache/preview/e/0/e/a/0/5/6/f/thumb-e0ea056fce856100d7180df2915dac6b.jpg)