Salary Deductions Under The Flsa How

Found 9 free book(s)FOH Chapter 22 - Exemptions for Executive, Administrative ...

www.dol.gov22h06 Effect of improper deductions from salary. ... 22a00 Exemptions under the FLSA and Part 541. Section 13(a)(1) of the Fair Labor Standards Act (FLSA) exempts from the FLSA’s minimum-wage and overtime requirements every “employee employed in a bona fide

Fair Labor Standards Act (FLSA): Salaried Non-Exempt ...

www.hr.uillinois.eduWhat salary must I have to remain exempt? The new minimum threshold to be categorized as exempt (if the duties test is also met) is $684/week or $35,568 per year. Per FLSA law, this salary is not annualized for part-time employees. Teaching positions are exempt under a different FLSA provision and are not subject to the salary threshold.

Department of Labor Fair Labor Standards Act (FLSA) Duties ...

www.rklcpa.comPlease note that an employee must meet the salary basis test to be exempt under the FLSA. If the person in the position earns less than the minimum required salary ($684 per week), the position is considered non-exempt and is subject to the overtime provisions of the FLSA. The salary threshold

U.S. Department of Labor

www.dol.govOct 24, 2005 · Deductions from salary for less than a full day’s absence are not permitted under the regulations. Therefore, where the employee’s absence is for less than a full day, payment of an amount equal to the employee’s guaranteed salary must be made even if the employee has no accrued vacation or other leave benefits.

DANGER: Employees Working While on Leave, Part 1 - HRHelp

www.hr-help.infoUnder both laws, an exempt employee's weekly salary can be prorated to reflect unpaid FMLA leave taken in that week. If an exempt employee normally works a 40-hour week and is taking one unpaid day off each week, the employer can reduce the salary paid in those weeks to 4/5ths (or 80%) of his usual salary.

THE FAIR LABOR STANDARDS ACT (FLSA)

www.sog.unc.eduThe FLSA requires that all compensation for employment be included in calculating the regular rate. This means that the following kinds of compensation must be included when calculating the rate on which overtime is based: a. hourly rate (or salary divided by number of hours worked) b. Any retroactive salary increases c.

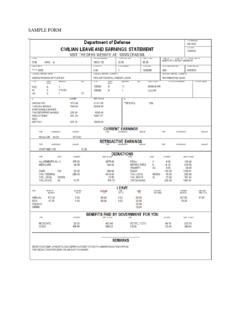

19-2 DCPS User Manual

www.dfas.milThe name of the earning is printed under the column heading 'TYPE'. The number of hours or days used in determining the amount is printed under the column heading 'HOURS/DAYS'. The dollar amount of the earnings prints under the heading 'AMOUNT'. If an entitlement is not based on hours or days worked, the 'HOURS/DAYS' column will be blank.

Agreement Between And Covering - California

www.calhr.ca.govJul 01, 2016 · State and AFSCME agree that a system of Fair Share deductions shall be operated in accordance with Government Code sections 3513(h), 3513(j), 3515, 3515.6, 3515.7, and 3515.8 subject to the following provisions:

AGREEMENT between the STATE OF MINNESOTA and the …

mn.govThe aggregate deductions of all supervisors shall be remitted by the Employer together with an itemized statement to the Middle Management Association no later than ten (10) days following the end of each payroll period. Section 4. Supervisor Lists. The Employer shall report to the Association the information on all