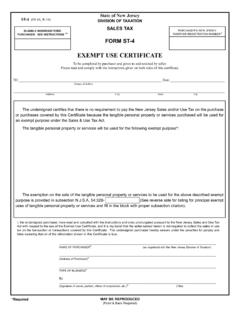

St 4 Exempt Use Certificate

Found 13 free book(s)Reg-1E, Application for ST- 5 Exempt Organization Certificate

www.myfoleyinc.com8. Q. Can my organization use an ST-4 or CA-1 Certificate of Authority for exemption from sales tax as a nonprofit? A. No. For exemption from New Jersey sales and use tax as a nonprofit organization, the required proof of exemption is the ST-5 exempt organization certificate. 9. Q.

ST-28A Resale Exemption Certificate fillable

www.ksrevenue.orgTitle: ST-28A Resale Exemption Certificate_fillable Author: rvesfzs Subject: Exemption Certificate Keywords: Pub. KS-1510 Sales Tax and Compensating Use Tax Booklet Rev. 2-19; Pub.

SALES TAX ELIGIBLE NONREGISTERED TAXPAYER …

www.nj.gov_____ INSTRUCTIONS FOR USE OF EXEMPT USE CERTIFICATES - ST-4 _____(05-12) 1. Registered sellers who accept fully completed exemption certificates within 90 days subsequent to the date of sale are relieved of liability for the collection and payment of sales tax on the transactions covered by the exemption certificate.

Form ST-12 Exempt Use Certificate - Grant Steel Company

www.grantsteelcompany.comForm ST-12 Exempt Use Certificate Vendor’s name Address City/Town State Zip I hereby certify that the property herein described is purchased or leased for the following indicated purpose and is exempt …

NONPROFITS USING ST-5 EXEMPT ORGANIZATION …

www.state.nj.usNONPROFITS USING . ST-5 EXEMPT ORGANIZATION CERTIFICATE FREQUENTLY ASKED QUESTIONS (February 2009) CERTIFICATE QUESTIONS . 1. RENEWAL - Does a nonprofit’s ST-5 certificate need annual or periodic renewal?. No. (Concerning organizational changes, see below.)

Department of Taxation and Finance ST-120.1 Contractor ...

www.tax.ny.govUse of the certificate Note: Unless otherwise stated, the customer must furnish the contractor a properly completed Form ST-121, Exempt Use Certificate. This certificate may be used by a contractor to claim exemption from tax only on purchases of tangible personal property that is: A.

Reg-1E - Application for ST-5 Exempt Organization ...

www.state.nj.usApplication for ST-5 Exempt Organization Certificate for Nonprofit Exemption from Sales Tax Read Before Completing This Form Refer to the submission and documentation requirements before starting the application. Organizations seeking exemption from Sales and Use Tax must complete all steps of this application. Carefully follow the instructions ...

FORM ST-13 CONTRACTOR’S EXEMPT PURCHASE …

www.state.nj.us“Exempt Organization”- is any organization which holds a valid exempt organization permit issued pursuant to the provisions of N.J.S.A. 54:32B-9(b) which has issued an ST-5 Exempt Organization Certificate to the contractor.

SALES TAX ELIGIBLE NONREGISTERED TAXPAYER …

www.state.nj.us1. Registered sellers who accept fully completed exemption certificates within 90 days subsequent to the date of sale are relieved of liability for the collection and payment of sales tax on the transactions covered by the exemption certificate.

Business Tax Tip #4 - Resale Certificates

www.marylandtaxes.govBusiness Tax Tip #4 – Resale Certificates If you're a buyer. . . Does my sales and use tax license entitle me to make purchases without paying sales and use tax? No, a sales and use tax license alone does not exempt you from paying sales and use tax. What type of purchases can I make without paying sales and use tax?

Exemption Certificates Pub. KS-1520 Rev. 11-15

ksrevenue.govthe seller to obtain multiple copies of this Tax-Exempt Entity Certificate. RECORD KEEPING. You must keep all sales tax records, including exemption certificates, for your current year of business and at least ... you will use a Resale Exemption Certificate (ST-28A) or Form PR-78SSTA. RESALE EXEMPTION CERTIFICATE REQUIREMENTS. A resale ...

MAINE REVENUE SERVICES

www.maine.govRetailer Certificate. Resale Certificates expire on December 31 st. A Resale Certificate issued before October 1 st is valid for the remainder of that calendar year and the following three calendar years. A Resale Certicate issued after October 1 st is valid for the remainder of that calendar year and the following four calendar years.

Virginia Form ST-9, Retail Sales and Use Tax Return for ...

www.tax.virginia.gov2 Personal Use 2 3 Exempt State Sales and Other Deductions 3 4 Total Taxable State Sales and Use. Line 1 plus Line 2 minus Line 3. 4 5 State - Qualifying Food Sales and Use. Enter taxable sales in Column A. Multiply Column A by the rate of 1.5% (.015) and enter the result in Column B. 5 x .015 = 5a State - Essential Personal Hygiene Products ...