State Withholding Requirements

Found 9 free book(s)80024 IRA State Income Tax Withholding Election (11/2021)

iradirect.ascensus.comrequired to comply with those states’ withholding requirements. If a state withholding election is not made and state withholding is required, state tax will be withheld. A state withholding election may be changed at any time and will apply to payments made after the change. STATE-SPECIFIC RULES ARKANSAS.

Applicable state tax withholding for retirement plan ...

personal.vanguard.comApplicable state tax withholding for retirement plan distributions The information in this table is our application of state requirements as of June 30, 2020. States may change their requirements at any time. Although a state may allow more than one method to calculate state tax withholding, Vanguard uses the method listed below. (over)

TSB-M-12(5)I:(7/12):Withholding on Wages Paid to Certain ...

www.tax.ny.govwithholding requirements on wages paid to certain nonresident employees who are assigned a primary work location outside of New York State, and who are expected to work 14 days or fewer in New York State during the calendar year.

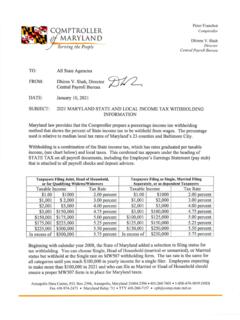

2021 Maryland State and Local Income Tax Withholding ...

www.marylandtaxes.govWithholding is a combination of the State income tax, which has rates graduated per taxable income, (see chart below) and local taxes. This combined tax appears under the heading of STATE TAX on all payroll documents, including the Employee’s Earnings Statement (pay stub) that is attached to all payroll checks and deposit advices.

An Introduction to Withholding State Income Tax By …

files.hawaii.govWithholding is not required on your employee’s wages. Keep your employee’s Form HW-6 for your records. You may treat the Form HW-6 as effective (1) on or after the date that you file Forms HW-7 and HW-6 with the Department, if withholding is not required on an employee’s wages for services performed in the state, or (2) on or after

STATE OF SOUTH CAROLINA FORM-105 SOUTH CAROLINA ...

dor.sc.govW-4 Requirements South Carolina has created its own SC W-4 for use beginning in tax year 2020. † Each employee hired after December 31, 2019 or previously hired employees who want to make changes to their state withholding must submit a signed SC W-4 to you.

State of Connecticut Form CT-W4 Employee’s Withholding ...

portal.ct.govFor more information on DOL requirements or for alternative reporting options, visit the DOL website at www.ctdol.state.ct.us or call DOL at 860-263-6310. For More Information Call DRS Monday through Friday, 8:30 a.m. to 4:30 p.m. at: • 800-382-9463 (Connecticut calls outside the Greater Hartford calling area only); or

NJ Employee’s Withholding Allowance Certificate

www.state.nj.usForm NJ-W4 State of New Jersey – Division of Taxation (1-21) Employee’s Withholding Allowance Certificate 1. SS# 2. Filing Status: (Check only one box) 1. Single 2. Married/Civil Union Couple Joint 3. Married/Civil Union Partner Separate 4. Head of Household 5. Qualifying Widow(er)/Surviving Civil Union Partner Name Address City State Zip 3.

LOUISIANA WITHHOLDING TABLES AND INSTRUCTIONS …

www.revenue.louisiana.govpublished for the Department of Revenue, Post Office Box 201, Baton Rouge, LA 70821-0201, by the Division of Administration, State Printing Office, to supply employers with withholding tables and instructions under authority of R.S. 47:112.