Tax Equalization

Found 6 free book(s)Instructions for REV-183

www.revenue.pa.govlevel ratio established by the State Tax Equalization Board. The common level ratio is a ratio of assessed values to. current fair market values as reflected by actual sales of. real estate in each county. A statewide list of the factors is. available at the Recorder of Deeds’ office in each county.

Common Level Ratio (CLR) Real Estate Valuation Factors ...

www.revenue.pa.govThe following real estate valuation factors are based on sales data compiled by the State Tax Equalization Board. These factors are the mathematical reciprocals of the actual common level ratios. For Pennsylvania Realty Transfer Tax purposes, these factors are applicable for documents accepted for the periods indicated below.

Application for Farm Residence Property Tax Exemption

www.tax.nd.govSignature of Property Owner Date Signature of Assessor or Director of Tax Equalization Date. Application For Farm Residence Property Tax Exemption Instructions. SFN 24737 (9-2019) Purpose of form. Use this application form to apply for either of the following two farm .

Understanding Your Tax Bill - Pinal County, Arizona

www.pinalcountyaz.gov2010 School Equalization PRM 49.42 49.98 4164 City of Maricopa PRM 498.68 523.58 4164 City of Maricopa - Bonds SEC 116.94 129.90 ... A tax area code is a four (4) digit code used by the Assessor to designate which tax authority districts a property is located within. A Tax Authority District is a self -

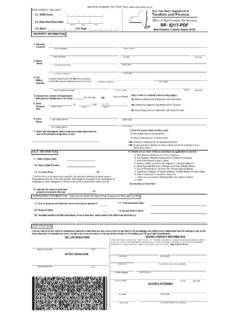

RP- 5217-PDF - Federal Standard Abstract

federalstandardabstract.comIndicate where future Tax Bills are to be sent 3. Tax if other than buyer address(at bottom of form) FIRST NAME STREET NUMBER AND NAME CITY OR TOWN STATE ZIP CODE 4. Indicate the number of Assessment Roll parcels transferred on the deed Part of …

Pub 52, Vehicles and Vessels: Use Tax - California

www.cdtfa.ca.govTax Section at 1-916-445-9524 for additional information. If I am required to pay use tax, how is the tax amount calculated? The tax rate for use tax is the same as that for sales tax, but it is determined by the address where the vehicle is registered or the vessel is moored. 1. The use tax is based on the total purchase price of the vehicle ...