Tax Tables For Taxable Years Beginning After December

Found 6 free book(s)2018 I-111 Form 1 Instructions - Wisconsin Income Tax

www.revenue.wi.govOn Friday, December 14, 2018, Governor Scott Walker signed . 2017 Wisconsin Act 368. The law allows tax-option (S) corporations to elect to be taxed at the entity level effective for taxable years beginning on or after January 1, 2018. As a result of the new law, tax-option (S) corporations may now elect to be taxed at the entity level

26 CFR 601.602: Tax forms and instructions. 6651, 6652 ...

www.irs.gov.01 Tax Rate Tables . For taxable years beginning in 2020, the tax rate tables under § 1 are as follows: TABLE 1 - Section 1(j)(2)(A) - Married Individuals Filing Joint Returns and Surviving . Spouses . If Taxable Income Is : The Tax Is: Not over $19,750 10% of the taxable income . Over $19,750 but $1,975 plus 12% of

FUND FACTS - RBC Select Balanced Portfolio - Series A

funds.rbcgam.comJun 30, 2021 · Date series started: December 31, 1986 Total value of the fund on May 31, 2021: $46,142.2 Million ... you'll have to include in your taxable income any money you make on ... The following tables show the fees and expenses you could pay …

The Section 179 and Section 168(k) Expensing Allowances ...

sgp.fas.orgin tax years beginning in 2018 under Section 179 of the federal tax code. They also have the option under Section 168(k) of expensing the entire cost of qualified assets they acquire and place in service between September 28, 2017, and December 31, 2022. Many of the assets that qualify

Rhode Island Department of Revenue Division of Taxation

tax.ri.govdeduction amounts, tax bracket ranges, and other key items for the Rhode Island personal income tax for tax years beginning on or after January 1, 2021. The inflation-adjusted amounts apply for tax year 2021, and therefore will not appear on tax returns until early 2022 (covering the 2021 tax year). Nevertheless, they are important to know

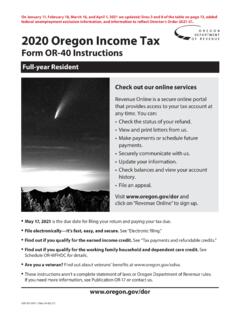

On January 11, February 18, March 16, and April 1 ... - Oregon

www.oregon.govtax years beginning on or after January 1, 2020, a tax credit based on your contributions to an Oregon College or MFS 529 Savings Plan account or an ABLE account may now be claimed. For additional information, see Publication OR-17. Charitable deduction. This federal deduction is from the CARES Act and is for taxpayers who made chari-