Taxability Of Property Distributions From Trusts Trusts

Found 4 free book(s)Taxability of Property Distributions from Trusts

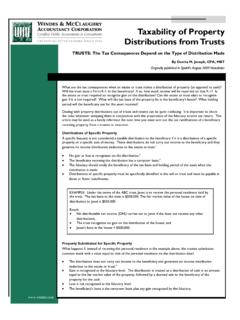

www.cchwebsites.comTaxability of Property Distributions from Trusts TRUSTS: The Tax Consequences Depend on the Type of Distribution Made By Donita M. Joseph, CPA, MBT Originally published in Spidell’s August 2009 Newsletter What happens if, instead of receiving the personal residence in …

TAXREFORMCODEOF1971 AN ACT Relating to tax reform and ...

www.legis.state.pa.usPart III. Estates and Trusts Section 305. Taxability of Estates, Trusts and Their Beneficiaries. Part IV. Partnerships Section 306. Taxability of Partners. Section 306.1. Tax Treatment Determined at Partnership Level. Section 306.2. Tax Imposed at Partnership Level. Part IV-A. Pennsylvania S Corporations Section 307. Election by Small ...

1040 Workshop

www.cpe247.comiv Employer Educational Trusts - §83..... 1-64 Qualified Tuition Programs (QTP) - §529 ..... 1-64

2022 Annual Federal Tax Refresher - ceselfstudy.com

www.ceselfstudy.com2022 Annual Federal Tax Refresher - ceselfstudy.com ... 2