Taxation Resale Certificate For Goods

Found 8 free book(s)Streamlined Sales and Use Tax Agreement for New Jersey

www.nj.govG Resale # _____ 6. Sign here. I declare that the information on this certificate is correct and complete to the best of my knowledge and belief. ... information on the taxability of common goods and services, and the applicability of the sales tax exemptions allowed under New Jersey law, see the Division’s website at: ... NJ Taxation Subject ...

2021 FR-800M/Q/A

mytax.dc.govvendor that did not resell goods purchased under a resale certificate is liable for use tax for those goods used as complimentary gifts. For additional information see DC Code §47-2201 et seq. _____ Which other DC forms may sales and use taxpayers need to file? Combined Registration Application for Business DC

UNIFORM SALES & USE TAX …

giftcraftprod.azureedge.netD. A valid resale certificate is effective until the issuer revokes the certificate. 4. The state of Colorado, Hawaii, Illinois, and New Mexico do not permit the use of this certificate to claim a resale exemption for the purchase of a taxable service for resale. 5 Connecticut: This certificate is not valid as an exemption certificate.

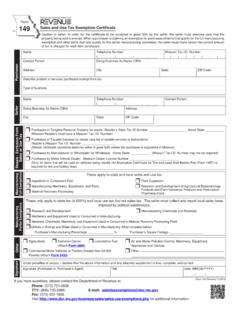

149 - Sales and Use Tax Exemption Certificate

dor.mo.govPurchases of Taxable Services for resale (see list of taxable services in instructions) Retailer’s Missouri Tax I.D. Number _____. (Resale certificate cannot be taken by seller in good faith unless the purchaser is registered in Missouri) r Purchases by Manufacturer or Wholesaler for Wholesale: Home State:

Guide to taxation in Cambodia - 2020 Reach, relevance and ...

www2.deloitte.comGuide to taxation in Cambodia - 2020 5.0 Value-added tax 5.1 Overview 5.2 Taxable supply of goods and services 5.3 Non-taxable supply of goods and services 54. VAT ccaul olaint 5.5 Block input VAT 6.0 Other taxes 61. Property tax 6.2 Tax on unused land 6.3 Registration tax/ transfer tax/ stamp duty 46. Stamp atx

Publication 18, Nonprofit Organizations - California

www.cdtfa.ca.govRevenue and Taxation Code section 23701. You may also need to know if your group is exempt from property taxes under Revenue and Taxation Code section 214, commonly known as the “welfare exemption.” For information on the welfare exemption, contact your county assessor or visit the Property Tax section of our website at www.cdtfa.ca.gov.

S&U-4 - New Jersey Sales Tax Guide

www.state.nj.uscities in the State. Within these zones, qualified businesses that have a UZ-2 certificate may charge Sales Tax at half of the regular rate on sales of tangible personal property qualified for the reduced rate. In order for the qualified UEZ seller to offer this reduced rate, the purchaser

District Taxes (Sales and Use Taxes) - California

www.cdtfa.ca.govDistrict taxes are either transactions (sales) or use taxes. The Revenue and Taxation Code provides that transactions (sales) taxes are due from retailers on their sales of tangible personal property, and use taxes are due from purchasers for their use of tangible personal property in the district. “Use” is defined as the use, storage, or