Tennessee department of revenue vehicle

Found 4 free book(s)Power of Attorney for Vehicle Transactions f1311401

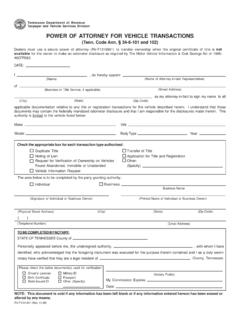

secure.tncountyclerk.comTennessee Department of Revenue Taxpayer and Vehicle Services Division POWER OF ATTORNEY FOR VEHICLE TRANSACTIONS (Tenn. Code Ann. § 34-6-101 and 102) DATE: I , do hereby appoint (Name of Attorney-in-fact Representative) of (Name) as my attorney-in-fact to sign my name to all (City) (State) (Zip Code)

Vehicle Information Request f1313801 - Tennessee County …

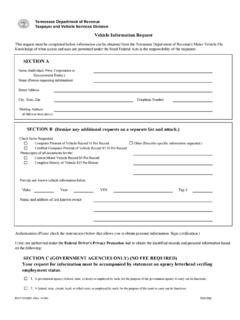

www.tncountyclerk.comTennessee Department of Revenue Taxpayer and Vehicle Services Division Vehicle Information Request This request must be completed before information can be obtained from the Tennessee Department of Revenue's Motor Vehicle file. Knowledge of what access and uses are permitted under the listed Federal Acts is the responsibility of the requester ...

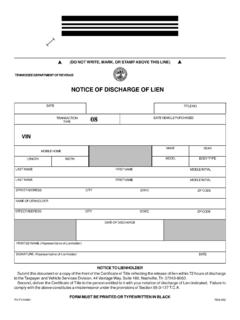

08 DATE VEHICLE PURCHASED TYPE - Tennessee County Clerk

www.tncountyclerk.comto the Taxpayer and Vehicle Services Division, 44 Vantage Way, Suite 160, Nashville, Tn 37243-8050. Second, deliver the Certificate of Title to the person entitled to it with your notation of discharge of Lien indicated. F ailure to comply with the above constitutes a misdemeanor under the …

IRP REGISTRATION FORM

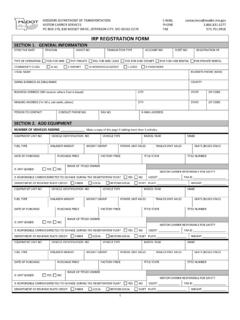

www.modot.orgFederal Heavy Vehicle Use Tax (IRS Form 2290) This is obtained from the Internal Revenue Service. Federal law requires proof of payment (or exemption) of the Federal Heavy Vehicle Use Tax for power units registered with a gross or combined gross weight of 55,000 pounds or more, by the last day of the month following the month of first use.