The Aicpa Professional Valuation Standards Statement

Found 9 free book(s)Fundamentals of the Asset-Based Business Valuation Approach

www.willamette.comvaluation professional standards. For example, professional standards such as the American Institute of Certified Public Accountants (“AICPA”) Statement on Standards for Valuation Services (“SSVS”) and the Uniform Standards of Professional Appraisal Practice (“USPAP”) require the valuation analyst to at least consider the appli-

Sample Disclosures: Accounting for Income Taxes

www2.deloitte.comstatements, as well as other professional literature such as AICPA audit and accounting guides. ... ASB Accounting Standards Codification Topic 740, F Income Taxes. ... the valuation allowance on net deferred tax assets may change materially; and (4) tax positions taken during ...

Chapter 7--Accepting the Engagement and Planning the Audit

ruby.fgcu.eduIn 1992, the AICPA recommended the use of an engagement risk approach in ... 3--the professional standards to be followed by the auditor ... and distribution practices and methods of inventory valuation that are unique to the industry.

Auditing and Attestation (AUD) AICPA Released Questions - …

cdn.mileseducation.comitems of a financial statement A. Must adhere to the compilation performance requirements contained in the Statements on Standardsfor Attestation Engagements. B. Should attest whether such compiled elements, accounts, or items of a financial statement are free ofmaterial errors. C.

Understanding the Entity and Its Environment and ... - AICPA

us.aicpa.orgstandards and guidance provided in other sections. In particular, the auditor's responsibility to consider fraud in an audit of financial statements is discussed in section 316, Consideration of Fraud in a Financial Statement Audit..02 The following is an overview of this standard: • Risk assessment procedures and sources of information ...

Plain English guide to independence - AICPA

us.aicpa.org©2020, AICPA iii Preface Purpose of this guide The purpose of the AICPA Plain English Guide to Independence is to help you understand independence requirements under the AICPA Code of Professional Conduct (the code) and, if

ACCOUNTING FOR REAL ESTATE - Wiley

catalogimages.wiley.comThe AICPA undertook another project to develop a comprehensive framework for cost capitalization and, in 2003, issued for public comment the proposed Statement of Position, Accounting for Certain Costs and Activities Related to Property, Plant, and Equipment. That proposed SOP was approved • • • 1.8 FINANCIAL STATEMENT PRESENTATION AND ...

CHAPTER 9 AUDITING THE REVENUE CYCLE - Yola

audit-uii.yolasite.com• International Accounting Standards Board (IASB) • Securities and Exchange Commission (SEC) • Financial Accounting Standards Board (FASB) • American Institute of Certified Public Accountants (AICPA)

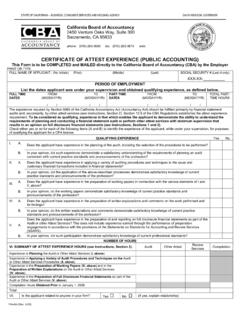

Certificate of Attest Experience – Public Accounting

www.dca.ca.govOTHER NOTES TO EMPLOYER COMPLETING Certificate of Attest Experience (Public Accounting). See Instructions Sections 1, 2, and 3. For the authorization to sign attest reports, applicants applying for licensure under either Pathway 1 or Pathway 2 must obtain a minimum of 500 hours of qualifying attest experience. Section 69 of the CBA Regulations provides that the …

Similar queries

Business Valuation, Valuation professional standards, Professional standards, The American Institute of Certified Public Accountants, AICPA, STATEMENT, Standards, Valuation, Professional, Accepting, Engagement, The AICPA, Understanding the Entity and Its, Plain English guide to independence, The AICPA Plain English Guide to Independence, REAL ESTATE, American Institute of Certified Public Accountants