The Social

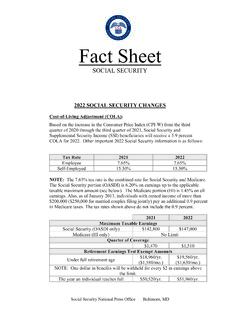

Found 8 free book(s)2022 Social Security Changes - COLA Fact Sheet

www.ssa.govThe 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see …

Social Identity Wheel Overview and Framing Material

sites.lsa.umich.eduThe Social Identity Wheel worksheet is an activity that encourages students to identify and reflect on the various ways they identify socially, how those identities become visible or more …

Military Service and Social Security

www.ssa.govSocial Security benefit based on your earnings and the age you choose to start receiving benefits. Social Security and Medicare taxes. While you’re in military service, you pay Social . …

What is Social Security?

www.ssa.govWhat is Social Security? Social Security was created to promote the economic security of the nation’s people 1930s Great Depression America facing the worst economic crisis of modern …

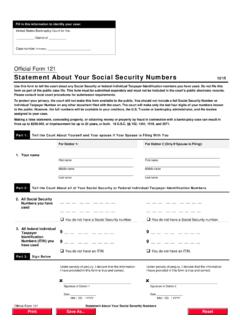

Statement About Your Social Security Numbers

www.uscourts.govStatement About Your Social Security Numbers 12/15 Use this form to tell the court about any Social Security or federal Individual Taxpayer Identification numbers you have used. Do not …

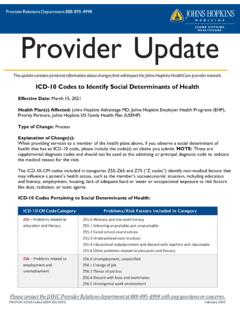

ICD-10 Codes to Identify Social Determinants of Health

www.hopkinsmedicine.orgZ59.7 Insufficient social insurance and welfare support Z59.8 Other problems related to housing and economic circumstances (please use this code to identify when transportation limits the …

What is FICA? - Social Security Administration

www.ssa.govSocial Security tax.* 1.45%. of your gross wages . goes to Medicare tax.* *Your employer matches these percentages for a total of 15.3%. An estimated 171 million workers are covered …

Notice 703 (Rev. October 2021)

www.irs.govSocial Security and Equivalent Railroad Retirement Benefits. • You received Form RRB-1099, Form SSA-1042S, or Form RRB-1042S. • You exclude income from sources outside the United …