Transactions Of Exempt Persons

Found 6 free book(s)Chapter 237, HRS, General Excise Tax Law - Hawaii

files.hawaii.govPersons with impaired sight, hearing, or who are totally disabled 237-18 Further provisions as to application of tax ... 237-23 Exemptions, persons exempt, applications for exemption 237-23.5 Related entities; common paymaster; certain exempt transactions 237-24 Amounts not taxable 237-24.3 Additional amounts not taxable 237-24.5 Additional ...

CONTENTS

home.treasury.gov, unless exempt or authorized by OFAC, U.S. persons are prohibited from engaging in transactions with SDNs or blocked persons, directly or indirectly, and must block any property in their possession or control in which an SDN or a blocked person has an interest. *To learn more about other sanctions lists maintained by OFAC, visit OFAC’s “

Notice 2014-21 SECTION 1. PURPOSE - IRS tax forms

www.irs.govthe Application of FinCEN’s Regulations to Persons Administering, Exchanging, or Using Virtual Currencies (FIN-2013-G001, March 18 ... transactions using virtual currency must be reported in U.S. dollars. ... virtual currency with a value of $600 or more to a U.S. non-exempt recipient in a taxable year is required to report the payment to the ...

Supplies of second-hand goods - [Supplies of ... - Revenue

www.revenue.ieAccountable dealers are persons who deal in margin scheme goods as set out in paragraph 5, either on their own behalf or on commission for others. Finance houses involved in hire purchase transactions of margin scheme goods are also accountable dealers for the purposes of the scheme. 5. What are margin scheme goods?

Kenya Tax Alert - Finance Bill, 2021 - Deloitte

www2.deloitte.comMay 05, 2021 · •The EBITDA amount should exclude any income which is exempt from tax; and •The amounts that are subject to these rules include interest on loans, payments that are economically equivalent to interest and expenses incurred in connection with raising finance. Who will be affected All persons with relying on debt financing. When

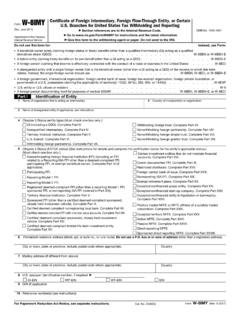

Form W-8IMY Certificate of Foreign Intermediary, Foreign ...

www.irs.govspecified U.S. persons as permitted under Regulations sections 1.6049-4(c)(4)(i) or (c)(4)(ii) in lieu of Form 1099 reporting for each account identified on a withholding statement attached to this form (or, if no withholding statement is attached to this form, for all accounts). g