Year Nonresident

Found 4 free book(s)Resident or Nonresident Alien Decision Chart

apps.irs.govNO – NONRESIDENT Alien for U.S. tax purposes 5 step YES 3 Were you physically present in the United States on at least 183 days during the 3-year period consisting of the current tax year and the preceding 2 years, • counting all days of presence in the current tax year, • 1/3 of the days of presence in the first preceding year, and

Form 8233 (Rev. September 2018)

www.irs.govServices of a Nonresident Alien Individual . ... This exemption is applicable for compensation for calendar year , or other tax year beginning and ending . Part I Identification of Beneficial Owner (See instructions.) 1 : Name of individual who is the beneficial owner : 2

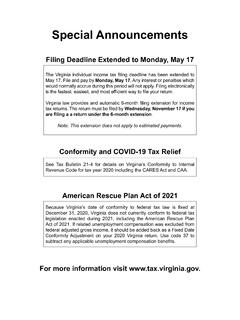

2020 Virginia Form 763 Nonresident Individual Income Tax ...

www.tax.virginia.govNonresident Individual Income Tax Instructions. Virginia Tax Online Services www.tax.virginia.gov Get Your Tax Refund Faster Using e-File Last year, over 3.6 million Virginia taxpayers used IRS e-File services to file their state and federal income tax returns. e-File is faster, safe and convenient. Use one of these Electronic Filing (e-File)

California State University Nonresident Tuition Exemption

www.calstate.eduCALIFORNIA NONRESIDENT TUITION EXEMPTION REQUEST . Education Code § 68130.5, as amended, commonly known as . AB 540. Effective January 1, 2018. INSTRUCTIONS Complete and sign this form to request exemption from nonresident tuition charged to nonresident students. Once determined to be eligible, you will