Search results with tag "Stamp duty"

C2 STAMP DUTY - Malaysian Institute of Accountants

www.mia.org.my(iii) For projects that are cancelled by the parties who had offered the contracts, and stamp duty for all such contracts had been paid, only the stamp duty at the Ad valorem rate will be refunded. Stamp duty at the fixed rate of RM50.00 will not be refunded. The remission of stamp duty is effective from 15 July 2009.

R11 Apply to register a vehicle in the NT or transfer an ...

nt.gov.auStamp duty – Use the vehicle stamp duty calculator to determine the applicable stamp duty payable based on the sale price or market value of the vehicle. To claim exemption from stamp duty, the exemption for stamp duty form must be completed; accompanied with supporting documents and submitted with this application.

THE UNITED REPUBLIC OF TANZANIA THE STAMP DUTY ACT …

www.tra.go.tz49. Stamp Duty Officer may refund penalty paid under section 48(1). 50. Stamp Duty Officer may stamp instruments impounded. 51. Instruments unduly stamped by accident. 52. Endorsement of instruments on which duty has been paid under sections 47, 50 and 51. 53. Proceedings under this Part not to bar prosecution. 54.

Part 7: Exemptions and Reliefs from Stamp duty

www.revenue.ieStamp Duty Return must be filed under the eStamping system in order to obtain exemption or relief 1. Section 79 - Conveyances and transfers of property between certain bodies corporate This section provides for a relief from stamp duty on certain transfers of property in a corporate group. The Tax and Duty Manual Section 79: Associated Companies

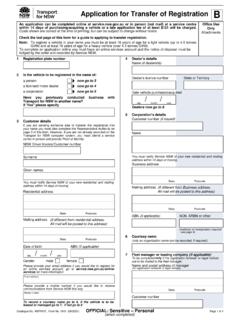

Application for Registration - NSW Government

www.nsw.gov.auStamp duty charges: Stamp duty is collected by Transport for NSW on behalf of Revenue NSW when registration is issued to a different person or corporation. Stamp duty is based on the market value of the vehicle or the price you paid, whichever is greater. Stamp duty is calculated at $3 per $100, or part of the vehicle's value.

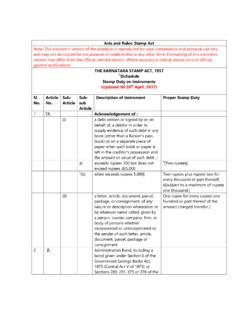

Acts and R ules: Stamp Act THE KARNATAKA STAMP ACT, …

karunadu.karnataka.gov.inTHE KARNATAKA STAMP ACT, 1957 1[Schedule Stamp Duty on Instruments (Updated till 20th April, 2017) Sl No. Article No. Sub - Article Sub - sub Article Description of Instrument Proper Stamp Duty 1 2[1. Acknowledgement of : (i) a debt written or signed by or on behalf of, a debtor in order to supply evidence of such debt in any

A.P. STAMP DUTY DETAILS - Maaproperties

www.maaproperties.com1 A.P. STAMP DUTY DETAILS Sl. No. Nature of Document Stamp Duty Rates for Andhra Pradesh Transfer Duty Registration Fee. Sale Deeds (a) Corporations 8% 5% 1% up to

IMPORTANT PROVISIONS OF STAMP DUTY AND …

www.wirc-icai.orgThe Act is intended to levy stamp duty on certain types of documents executed in the state or brought from outside for acting upon the same in the state. The various instruments/documents are broadly covered under different 62 articles listed in Schedule-I appended to the Act. The rates at which stamp duty is levied on these documents are mentioned

Sr. Deed Name Stamp Duty Registration Fee Facilitation ...

revenue.punjab.gov.inDocument wise detail of Stamp Duty, Registration Fee and Facilitation charges Sr. No Deed Name Stamp Duty Registration Fee Facilitation charges PIDB 1 Sale/ Gift 5% of the Consideration amount + 1 % of SIC (Social Infrastructure Cess) 1 % of the Consideration amount (Max. Rs. 2 lac ) Rs.1000/- (for Consideration amount upto

Attach separately Non-Judicial stamp paper for the value ...

www.ccavenue.comStamp Duty Paid By Stamp Duty Amount(Rs.) "This Non-Judicial Stamp paper forms an integral part of the Avenues India Pvt Ltd. Internet Gateway Merchant Legal Agreement Executed by on 01.01.2015 . a Rq0000600J-pesao sub a OTHER REAS Sob NOW AGREE AS this Sub at Sub by at Sign and S tamp .

Frequently Asked Questions (FAQs) on Indian Stamp Act ...

dea.gov.inunder the Stamp Act vide gazette notification dated 8th Jan, 2020, the entire mutual fund business gets covered under Section 9A of the Indian Stamp Act. Section 9B is not applicable to them. RTAs have to function like a Depository in respect of collection of Stamp Duty on issue and sale or transfer of mutual funds in SoA form.

Registration of Titles

moj.gov.jmStamp duty where applicant directs mrtificate of title l-0 .hue 175. Stamp duty where applicant claims to be owner of fee simple id 176. Registrar to see that transfers am duly stamped. 177. Full consideration for transfer to be expressed the& in name of any other person. csuity. o&ntxs 178.olftnCes against this Act. Misdemeanours 179.

1976 : 14 PART II - Bermuda Laws

www.bermudalaws.bmF A E R N A T F T QU O U BERMUDA STAMP DUTIES ACT 1976 1976 : 14 TABLE OF CONTENTS PART I Interpretation PART II LIABILITY TO STAMP DUTY Instruments chargeable to stamp duty

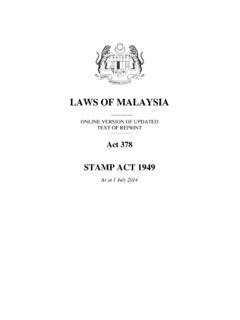

LAWS OF MALAYSIA

phl.hasil.gov.myPART II PROVISIONS APPLICABLE TO INSTRUMENTS GENERALLY Liability of Instruments to Duty 4. Instruments chargeable with duty 4A. Stamp duty on instruments executed outside Malaysia effecting transfers of property in Malaysia Payment of Duty 5. All facts and circumstances to be set out 5A. (Deleted) 6. Instrument relating to distinct matters

Information published as per Act 4(1)(b) of The Right to ...

www.tn.gov.in• The Website enables you to ascertain the stamp duty / registration fees payable for a particular property transaction. OR • Ascertain the guideline value of the property and the stamp duty, registration fees etc, to be paid for a document from the Registering officer.

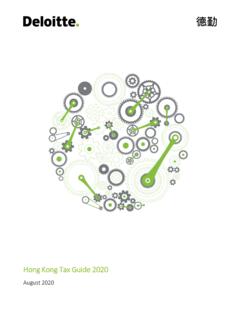

Hong Kong Tax Guide 2020 - Deloitte

www2.deloitte.comMajor levies include stamp duty, customs and excise duty, betting duty and hotel accommodation tax. Characteristics of Hong Kong tax system: Simple tax system Territorial source concept No tax on dividends No sales tax, consumption tax or value added tax No withholding tax on dividends and interests ...

Lending Fees & Charges – A Simple Guide Home Loans

www.bendigobank.com.aufee of $150 is payable per document we produce to any Land Titles Office. For example, a lender has the 1st mortgage, and you consent to obtaining a 2nd mortgage on your property. Registration Fees and Stamp Duty – is payable to any government body for registration and/or stamp duty payable. This is debited to

APPLICATION FOR REFUND OF STAMP DUTY UNDER …

www.ird.gov.hkINLAND REVENUE DEPARTMENT STAMP OFFICE 3/F, Revenue Tower, 5 Gloucester Road, Wan Chai, Hong Kong. FOR OFFICIAL USE el. No.: 2594 3202 T Fax No.: 2519 9025

irsd 112 - Stamping Request – Agreement / …

www.ird.gov.hk(G) Application for Charging Ad Valorem Stamp Duty (AVD) at Lower Rates (Scale 2) (Note 8) For residential property only 1. Is the purchaser(s) of residential property a Hong Kong permanent resident acting on his/her own behalf and not a

Table of Contents

www.mca.gov.inPart III - Important Points for Successful Submission ... require that the stamp duty payable thereon be adjudicated under section 31 of the Indian Stamp Act, 1899. ... shall be filed with the Registrar with fee as provided in Companies (Registration Offices and Fees) Rules, 2014 and where the company is listed, with the Securities and Exchange ...

MR22 Application for Client Concession - SA.GOV.AU

www.sa.gov.auowner of the vehicle, the registration will, subject to this Act, continue in force for a period of one month after death, or the cessation of ownership, and will, unless the balance of the prescribed registration fee is paid, become void upon the expiration of that period. PENSIONER EXEMPTION FROM PAYMENT OF STAMP DUTY ON THIRD PARTY INSURANCE

Tenancy Agreement Template for Lease of Private ...

www.cea.gov.sgOF PRIVATE RESIDENTIAL PROPERTIES 1. The Digitalised Property Transactions Workgroup* (DPTWG), ... the Tenant shall be liable to pay stamp duty. P R I V A T E R E S I D E N T I A L T E N A N C Y A G R E E M E N T P a g e 3 of 19 15. ... including any tax payable thereon such as Goods and Services Tax (“GST”). ...

Application for Transfer of Registration

www.nsw.gov.auTransfer and Stamp Duty charges: Representative Authority If you send someone else to the service centre to apply to transfer the registration to your name, fill in the Representative Authority section of this form. If the vehicle is being registered in the name of a corporation, the Representative Authority must be filled in.

Myanmar Tax Booklet 2018 - VDB | LOI

www.vdb-loi.comSGT exemptions ... Annex 6: Selected Stamp Duty Schedules .....37 Annex 7: Classification of zones under Myanmar ... However, in order to enjoy the reliefs under the DTA, an application must be made to the Internal Revenue Department (“IRD”) for approval. Page 5 Capital Gains Tax

Current and Deferred Tax Slides Tax Training PPT

www2.deloitte.com• Legal costs and stamp duty relating to leases for premises if the lease does not exceed 99 years • Non-resident branch taxeswhere the income is taxable in the hands of the Kenyan parent company • Cash donations to registered charitable organizations whose …

Rental properties - borrowing expenses

www.ato.gov.auTo secure a 20-year loan of $209,000 to purchase a rental property for $170,000 and a private motor vehicle for $39,000, the Hitchmans paid a total of $1,670 in establishment fees, valuation fees and stamp duty on the loan. As the Hitchmans’ borrowing

COMPANIES ACT - Kenya Law

kenyalaw.orgPART II – INCORPORATION OF COMPANIES AND MATTERS INCIDENTAL THERETO ... Criminal liability for mis-statements in prospectus. 47. Document containing offer of shares or debentures for sale to be deemed ... Stamp duty in case of transfer of shares registered in branch registers.

Stamp Duty and Registration Fee Detail Category General ...

igrs.rajasthan.gov.inStamp Duty Applicable . Applicable Stamp Duty . Stamp Duty after Rebate Max. Stamp Duty . Rebate Noti. date . RF applicable . RF after Rebate . Rebate Noti. date . Scanni ng Fees (Rupe es) Surcha rge Payabl e Y/N . Proper ty detail Y/N . Registration Compulsory/ Optional . Boo k No. Rando m Site Inspec tion <25 lac) Compulso ry Site Inspectio n ...

Stamp Duty (Special Provisions) Act No 12 of 2006

www.ird.gov.lk(2) Stamp duty payable on any specified instrument relating to a mortgage or lease of any immovable property may be paid, prior to, or at the time of, the execution of the specified instrument, to a prescribed bank. Where however, the stamp duty cannot be so paid due to reasons beyond the control of the person by whom the stamp duty is

STAMP DUTY MPLICATIONS OF MERGERS AND ACQUISITIONS

www.wirc-icai.orgIn the State of Karnataka, stamp duty payable on a share certificate is Rs 1 for every one thousand rupees or a part thereof of the value of the share, scrip or stock (Article 16 of the Karnataka Stamp Act). Stamp duty payable letter of allotment of shares is Rs. 1. As per the Depositories Act, the investors have been granted an option

STAMP DUTY ACT - Kenya Law Reports

kenyalaw.orgStamp Duty 9 [Issue 1] CHAPTER 480 STAMP DUTY ACT [Date of assent: 11th August, 1958.] [Date of commencement: 1st October, 1958.] An Act of Parliament to make provision for the levying and management of stamp duties; and for purposes connected therewith and …

Stamp Duty (Special Provisions) Act No 12 of 2006

www.ird.gov.lkStamp Duty (Special Provision) Amendment Act No 10 of 2008 Certified on 29th February 2008 BE it enacted by the Parliament of the Democratic Socialist Republic of Sri Lanka as follows:- 1. (1) This Act may be cited as the Stamp Duty (Special Provisions) Act, No. 12 of 2006. Short title.

STAMP DUTY MPLICATIONS OF MERGERS AND …

www.wirc-icai.orgSTAMP DUTY LAW IN INDIA- CONSTITUTIONAL PROVISIONS …CONTD Entry 63 of List II of Schedule 7(“State List”) of the Constitution vests the power to prescribe the rates of duties on instruments other than those specified in the Union List in the state legislature.

Stamps Act 1899 - sindhzameen.gos.pk

sindhzameen.gos.pk13.A. Notwithstanding anything contained in these rules whenever the stamp duty payable under the Act in respect of any instrument cannot be paid exactly by reason of the fact that the necessary stamps are not in circulation, the amount

Stamp Duty Land Tax: mixed-property purchases and …

assets.publishing.service.gov.uk1.1 Stamp Duty Land Tax (SDLT) is an important source of government revenue, raising over £8.6 billion in 2020-21. It is also an important factor for people buying a place to live and for business when investing in property as an asset or a place from which to trade.

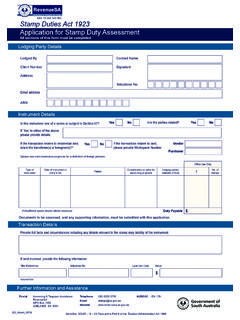

Stamp Duties Act 1923 Application for Stamp Duty Assessment

www.revenuesa.sa.gov.auLodging Party Details Lodged By Contact Name Client Number Signature Address Telephone No. Email address ABN Instrument Details Is this instrument one of a series or subject to Section 67?

Similar queries

Stamp Duty, Stamp, Duty, Part, Application, Registration, Stamp Act, STAMP DUTY DETAILS, Stamp Duty Registration Fee, Registration fee, S tamp, PART II LIABILITY TO STAMP DUTY, PART II, Liability, Document, Rates, Tenancy Agreement Template for Lease, PROPERTIES, Transfer, Myanmar Tax Booklet 2018, Exemptions, Reliefs, Rental, COMPANIES ACT, The stamp duty, STAMP DUTY ACT, OF MERGERS AND