Example: confidence

Search results with tag "Fidelity ira"

Go to Fidelity.com/pws or call 800-343-3548. Automatic ...

www.fidelity.comthe Fidelity IRA, Fidelity Management Trust Company and its agents, affiliates, employees, or successor custodians (Fidelity), to make the withdrawals indicated in this form from the IRA account indicated in Section 1. • Acknowledge that non-Roth IRA distribu-tions will generally be taxed as ordinary income, and may be subject to a 10% early

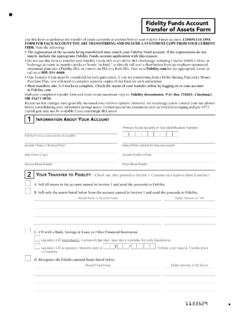

Fidelity Funds Account Transfer of Assets Form

personal.fidelity.commatch, include the appropriate Fidelity Funds account application with this request. • Do not use this form to transfer your Fidelity Funds IRA to a Fidelity IRA (brokerage including Fidelity SIMPLE IRAs) or brokerage account; to transfer stocks or bonds “in kind;” to directly roll over a distribution from an employer-sponsored