Search results with tag "Substantially equal periodic"

Notice 2020–51 Guidance on Waiver of 2020 Required …

www.irs.govsubstantially equal periodic payments). Specifically, the following distributions from a plan (other than a defined benefit plan) may be rolled over, provided the other rules of § 402(c) are satisfied (and regardless of whether the distributions would otherwise be made as part of a series of substantially equal periodic payments): 1.

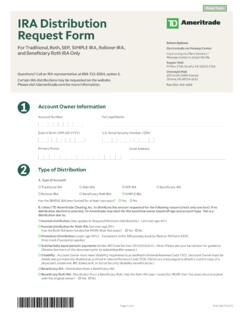

IRA Distribution Request Form-TDA 0122 - TD Ameritrade

www.tdameritrade.comM Substantially equal periodic payments (under IRS Code Section 72(t)(2)(A)(iv)). Note: Please see your tax advisor for guidance. (Review Section 6 of this document prior to submitting this request.) M Disability – Account Owner must meet disability requirements as outlined in Internal Revenue code 72(m).

A guide to your 2021 1099-R Tax Reporting Statement - Merrill

olui2.fs.ml.comhigher education expenses, substantially equal periodic payments, etc., but distribution code 2, 3, or 4 is not shown in Box 7 of Form 1099-R or the distribution code shown is incorrect. ou owe taxes because of excess contributions to your traditional IRA, Roth IRA.

Fidelity Advisor IRA Transfer or Direct Rollover

institutional.fidelity.comsubstantially equal periodic payments pursuant to Section 72(t) of the IRC or any hardship distributions from a 401(k). I certify that the distribution(s) from an employer-sponsored retirement plan that is hereby being rolled over to my Fidelity Advisor Traditional, Rollover, BDA, and/or Roth IRA qualifies for rollover treatment, and

Hurricane Katrina Relief under sections 101 and 103 of the ...

www.irs.govthe employee’s disability, and distributions that are a part of substantially equal periodic payments made over the employee’s life or life expectancy. 3 Section 401(k)(2)(B)(i) generally provides that amounts attributable to elective contributions under a qualified cash or deferred arrangement may not be