Search results with tag "New jersey s"

CBT-2553 - R New Jersey Retroactive S Election Application

www.nj.govINSTRUCTIONS FOR FORM CBT-2553-R 1. This form is to be used by a currently authorizedcorporation electing New Jersey S corporation status effective retroactively to a prior return period. Submit a copy of the original CBT-2553 if previously approved.

CBT-2553 New Jersey S Corporation or New Jersey …

www.state.nj.usCBT-2553 - Cert Mail to: (8-05) PO Box 252 Trenton, NJ 08646-0252 (609) 292-9292 State of New Jersey Division of Taxation New Jersey S Corporation Certification

S Corporation Status

www.state.nj.usFile a New Jersey S Corporation Election using the online SCORP application. For the election to be in effect for the current tax year, the New Jersey S Corporation Election must be filed within 3 ½ months from the beginning of the fiscal year. For example, filing of the election for a fiscal period beginning July 1 must be done by October 15 ...

NEW JERSEY 2017 CBT-100

www.state.nj.usperiod exceeding twelve (12) months, even by a day. (2) Every corporation that elects to be a New Jersey S Corporation must file a “New Jersey S Corporation or New

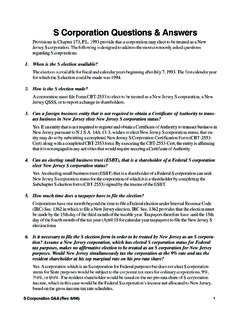

S Corporation Questions & Answers

www.state.nj.usS Corporation Q&A (Rev. 8/06) 1 Provisions in Chapter 173, P.L. 1993 provide that a corporation may elect to be treated as a New Jersey S corporation.