Search results with tag "Overpayments"

Medicare Financial Management Manual

www.cms.govChapter 3 - Overpayments. Table of Contents (Rev. 335, 01-31-20) Transmittals for Chapter 3 . 10 – Overpayments Determined by the FI or Carrier . 10.1 – Aggregate Overpayments . 10.2 – Individual Overpayments . 20 – Recovery of Cost Report Overpayments- Cost Report Filed . 20.1 – Part A Provider is Participating in Medicare and Medicaid

Recovery of Salary, Allowances, and Expenses …

circulars.gov.ie5 is an example of some of the reasons for multiple overpayments, but there may be other reasons. 2.10 Where a staff member has five (5) overpayments or more and/or overpayments

Recovery of overpayments - Law Centre NI

www.lawcentreni.orgENCYCLOPEDIA OF SOCIAL WELFARE RIGHTS 2015 A.7 Tax credits briefing 2: Recovery of overpayments Page 3 INTRODUCTION The recovery of overpayments is a major issue for advisers and claimants alike.

Recovery of Salary, Allowances, and Expenses Overpayments ...

circulars.gov.ieCircular Title: Recovery of Salary, Allowances, and Expenses Overpayments made to Staff Members/Former Staff Members/Pensioners File Reference: DPE189-002-2016

Are Businesses that Withhold Overpayments Morally Correct?

www.na-businesspress.comAre Businesses that Withhold Overpayments Morally Correct? Carolyn Ashe . University of Houston -Downtown . Business ethics is a code of moral principles and values that seek to …

SHD Paraphrased Regulations - CalWORKs 150 …

www.cdss.ca.govSHD Paraphrased Regulations - CalWORKs 150 Overpayments ParaRegs-CalWORKs-Overpayments Page: 1 Jul 9, 2016 150-1 An overpayment is that amount of aid payment an AU has received to which it was not eligible. It may be all or a portion of the aid payment. It includes an immediate need payment, a special

Medicare Part B Overpayments - Understanding Remittance …

medicare.fcso.comJun 05, 2020 · Medicare Part B Overpayments Understanding Remittance Advice . First Coast Service Options June 5, 2020 Page 2 of 26 This animation is intended to help you understand the different remittance advices you will receive when a full or partial overpayment has been made.

'I Can't Pay That!': Social Security Overpayments and Low ...

ncler.acl.govSecurity often causes alarm and confusion, and great concern about how repayment will affect their ability to . pay their ordinary living expenses. This issue brief walks through the options recipients have in understanding ... perspective, and also consider whether and how the individual’s circumstances affect a finding of fault.

Form 8958 Certain Individuals in Community Property States ...

www.irs.govYour social security number. Spouse’s or partner’s first name and initial. Spouse’s or partner’s last name. Spouse’s or partner’s social security number. A ... overpayments, see Pub. 555 for more information. For specific information that pertains to …

HEALTH SERVICE EXECUTIVE NATIONAL …

www.hse.ieHealth Service Executive National Financial Regulations Ver 2.0 20/12/2013/2013 Page 2 of 14 NFR-04 Payroll Overpayments and Underpayments 4.1 Introduction on page 3 4.2 Purpose on page 3 4.3 Scope on page 3 4.4 Assistance/Further Information on page 4 4.5 Effective Date on page 4

FACT SHEET SOCIAL SECURITY OVERPAYMENTS: WHAT TO …

www.pandasc.orgclients under the Protection and Advocacy for Beneficiaries of Social Security (PABSS) program. It was reviewed for technical accuracy by the Social Security Administration (SSA).

Overpayment of Social Security Benefits

yourtickettowork.ssa.govOverpayment of Social Security Benefits and the Role of Employment Networks. 3 Work Incentive Planning and Assistance (WIPA) projects are community-based ... Ticket to Work, Social Security Administration Subject: Fact sheet about how Employment Networks \(EN\) can assist Ticketholders with overpayments

Medicare Fraud, Waste and Abuse (FWA) Compliance Training

www.capcms.comBilling for items or services that should not be paid for by Medicare. Billing for services that were never rendered. Billing for services at a higher rate than is actually justified. Misrepresenting services resulting in unnecessary cost to the Medicare program, improper payments to providers, or overpayments.

The Recovery Audit Program and Medicare

www.cms.govRecovery Auditors are required to employ a staff consisting of nurses, therapists, certified coders and a physician CMD . 7 The Collection Process Same as for Carrier, FI and MAC identified overpayments Carriers, FIs and MACs issue Remittance Advice o Remark Code N432: Adjustment Based on Recovery Audit

Deducting Money from Workers’ Wages

dol.ny.gov2. Deductions for overpayments are limited to 12.5 percent of the gross wages (provided the deduction does not reduce wages below the minimum wage rate). Dispute Resolution: Employers are required to adopt and notify employees of the procedure to dispute the overpayment and terms of recovery, or seek a delay in the recovery of the overpayment.

Fraud, Waste and Abuse Training for Medicare and Medicaid ...

www.magellanprovider.comwhere a provider retains overpayments. Under the federal FCA, a person, provider, or entity is liable for up to triple damages and penalties between $5,500 and $11,000 for each false claim it knowingly submits or causes

UNIVERSITY OF WISCONSIN-MILWAUKEE CREDIT AGREEMENT

uwm.eduthe on-line published fee fact information sheet located at the Bursar’s website ... telephone number, or Social Security number in a timely manner. 12. Waiver of Notices, etc. ... Revenue and make a claim for the total due against refunds, overpayments, lottery payments, or vendor ...

Changes in Ownership: Medicare Rules and Other Issues

www.winston.comMedicare, certain transactions, including an asset transfer to a new owner, are typically classified by the Centers for ... including the repayment of any accrued overpayments, regardless of who had ownership of the Medicare agreement at the time the overpayment was discovered unless, under certain circumstances, ...

Statement of Claimant or Other Person (G-93)

www.rrb.govDepartment for collecting overpayments owed to the RRB or the Social Security Administration or for use in criminal and civil proceed- ings relating to this claim for benefits, to other law enforcement agencies engaged in functions related to the RRA or RUIA, and in

IB 10-454 Quick Reference Guide Income and Assests for ...

www.va.gov• Social Security Benefits and Death Benefit Payment (including retroactive Lump Sum Payment from ... • Withheld Social Security Overpayments NOTE: The above list is not all inclusive. ... IB 10-454 Quick Reference Guide Income and Assests for Financial Assessment Fact Sheet

Overpayments to SSDI Beneficiaries and SSI Recipients

www.iidc.indiana.eduThe information contained in this fact sheet has been reviewed by the Social Security Administration, Office of Employment Support Programs, for accuracy. However, the viewpoints

Request for Change in Overpayment Recovery Rate

www.ssa.govSocial Security Administration. Request for Change in Overpayment Recovery Rate. Page 1 of 8 OMB No. 0960-0037. When To Complete This Form. Complete this form if you are requesting that we adjust the current rate of withholding to recover your overpayment because you are unable to meet your necessary living expenses. We will use your answers to

PUA Overpayment Waiver Request

www.dllr.state.md.usdetermine that: (1) the overpayment was not the claimant’s fault, and (2) repayment would be contrary to equity and good conscience. When assessing the second requirement regarding equity and good conscience, the Maryland Department of Labor must consider the following factors: (a) it would cause the claimant financial hardship, (b) recovery ...

1099-G Frequently Asked Questions - Kentucky

kcc.ky.govI paid all or some of my overpayment unemployment benefits back. The 1099 reflects all payments processed out to you for the current tax year 2020. There will be a question on your tax form that will ask if you paid any unemployment back in the tax year 2020.

Department of Taxation and Finance Instructions for Form ...

www.tax.ny.govIf on line 5, column B of such Form CT-300 you did apply an anticipated overpayment amount of New York State MTA surcharge tax from the tax period for which this return is being filed to your MFI for the next MTA surcharge period, enter the amount from line 5, column B …

ATTENTION: PROVIDERS Claims Overp aym ent Informatio n

www.aetnaseniorproducts.comOverpayment Team Asset Protection Unit, Inc. Email: reply@apuinc.com Phone: 866.434.8303 Fax: 806.205.6338 Hours of operation: 8:00am—5:00pm CST Contact Information *The following companies are either owned by Aetna and/or have Medicare Supplement policy administration by

2018 HHS Poverty Guidelines

www.dllr.maryland.govstate of maryland department of labor, licensing and regulation division of unemployment insurance request reconsideration of overpayment recoupment – waiver

PUA Overpayment Waiver Request

www.labor.maryland.govdetermine that: (1) the overpayment was not the claimant’s fault, and (2) repayment would be contrary to equity and good conscience. When assessing the second requirement regarding equity and good conscience, the Maryland Department of Labor must consider the following factors: (a) it would cause the claimant financial hardship, (b) recovery ...

Overpayment Recovery Codes Guide - Aetna

www.aetna.comoverpayment recovery initiation is delayed for the length of time specified by state regulations or contract requirements. If the provider does not return funds within the specified period of time, overpayment recovery is then initiated and the ERA carries claim details.

Jurisdiction 15 Part B Voluntary Overpayment Refund

cgsmedicare.comTitle: Jurisdiction 15 Part B Voluntary Overpayment Refund \(A/B MAC J15\) Author: CGS - CH Subject: A/B MAC J15 Created Date: 3/26/2018 10:04:59 AM

No appeal request for waiver of overpayment - NC

files.nc.govan overpayment of benefits that the Division intends to recoup. In addition to other information, the Notice of Overpayment or Determination of Overpayment listed the type of overpayment made, the time period during which the overpayment was made, and the amount of overpayment of benefits that the Division alleges that the claimant received.

Special Overpayment and Waiver Processing (Redacted)

www.ssa.govoverpayment and complete the waiver request in an unscheduled or scheduled telephone interview. We will also apply the attestation process in lieu of obtaining a wet signature on the SSA-632. See sections G and H to determine whether the overpayment falls under the pandemic period and streamlined waiver processing instructions.

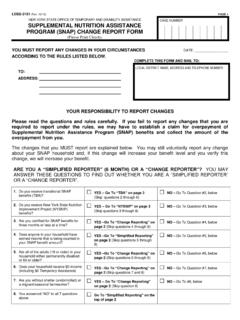

LDSS-3151 - Supplemental Nutrition Assistance Program ...

otda.ny.govthe rules, we may have to establish a claim for overpayment of Supplemental Nutrition Assistance Program (SNAP) benefits and collect the amount of the overpayment from you. The changes that you MUST report are explained below. You may still voluntarily report any change about your SNAP

Overpayment Refund/Notification Form - UHCprovider.com

www.uhcprovider.comto accommodate the information you need to submit. Please supply all available information, including a claim audit number or the unique identifier listed/UID to help ensure the proper posting of your check. Additional documentation, such as a Provider Remittance Advice (PRA) , is also helpful and should be submitted if available.

How to Handle Employee Overpayment

humanresources.reportthere was an overpayment, the employer may deduct the appropriate amount directly from the paycheck of the employee. The amount of time it takes to deduct the amount owed to the employer due to overpayment of wages depends on how much was overpaid. For example, an overpayment of $50.00 may be deducted at one time, but $500.00 might

Similar queries

Medicare Financial Management Manual, Chapter 3, Overpayments, Recovery of overpayments, Recovery, Businesses that Withhold Overpayments Morally Correct, Business, Paraphrased Regulations - CalWORKs 150, Paraphrased Regulations - CalWORKs 150 Overpayments, CalWORKs, Medicare, Pay That!': Social Security Overpayments and Low, Security, Perspective, Social Security, HEALTH SERVICE EXECUTIVE NATIONAL, Health Service Executive National Financial, FACT SHEET SOCIAL SECURITY OVERPAYMENTS: WHAT, Overpayment of Social Security Benefits, Fact sheet, The Recovery Audit Program and Medicare, Deducting Money from Workers’ Wages, Fact, Sheet, Changes in Ownership: Medicare Rules and Other Issues, Social Security Overpayments, Overpayments to SSDI Beneficiaries and SSI Recipients, Overpayment, Social Security Administration, Form, Overp aym ent, Request, Of overpayment, Waiver, Aetna, Jurisdiction 15 Part B Voluntary Overpayment Refund, For overpayment, SNAP, Change, Overpayment Refund/Notification Form, Information