Search results with tag "Vehicle sales"

Motor Vehicle Sales Tax Rates by State as of November 30 ...

floridarevenue.comTax is calculated on the sales price of a new or used motor vehicle, less credit for trade-in. Occasional or isolated sales ARE exempt from sales tax, but NOT exempt from the Title Ad Valorem Tax Fee. Local taxes authorized. Sales of motor vehicles to resident military personnel are NOT exempt. Effective March 1, 2013, a 6.5% Title Ad

Motor Vehicle Sales Tax - Louisiana

revenue.louisiana.govVehicles Brought into Louisiana by New Residents A use tax is due on the fair market value of a motor vehicle brought into Louisiana by a new resident who previously registered the vehicle in another state or a foreign country. This use tax is payable by the 30th day following the month the vehicle first enters Louisiana.

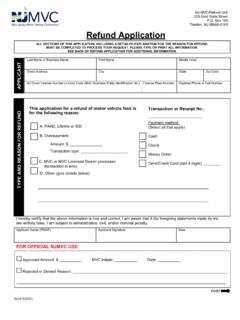

NJ MVC/Refund Unit Trenton, NJ 08666-0 Refund Application

www.state.nj.usNote- Vehicle sales tax refunds are only handled by the NJ Division of Taxation. To request a refund for vehicle sales tax, please complete the NJ Division of Taxation form A-3730 and mail to: NJ Division of Taxation Sales Tax Refund Section PO …

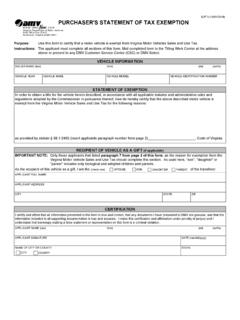

PURCHASER'S STATEMENT OF TAX EXEMPTION - Virginia

www.dmv.virginia.govVirginia Motor Vehicle Sales and Use Tax should complete this section. As used here, "son", "daughter" or "parent" includes only biological and adopted children and parents. As the recipient of this vehicle as a gift, I am the (check one) of the transferor. APPLICANT SIGNATURE NAME OF CITY OR COUNTY DATE (mm/dd/yyyy) APPLICANT NAME (last) (first)