Search results with tag "Surviving spouse"

GUIDE TO SURVIVING SPOUSE RIGHTS IN FLORIDA What …

probatestars.comGUIDE TO SURVIVING SPOUSE RIGHTS IN FLORIDA ... the rights of a surviving spouse can be waived or increased in properly drafted agreements. TIMELINE TO FILE A CREDITOR CLAIM. If a surviving spouse of a Florida decedent has a Marital Agreement, it is imperative that his or her attorney file a protective creditor claim to preserve ...

ORIGINAL APPLICATION FOR HOMESTEAD EXEMPTIONS

hcpafl.orgSurviving spouse of veteran who died while on active duty : All taxes . Surviving spouse: Letter attesting to the veteran’s death while on active duty . 196.081 . First responder totally and permanently disabled in the line of duty or surviving spouse : All Taxes . First responder or surviving : spouse . Proof of Disability, employer ...

Checklist for Estate Transfers - ICBC

www.icbc.com(deceased and surviving spouse are co‑lessees) Lessor and surviving spouse (lessee) Vehicles jointly leased by spouses do not form part of either spouse’s (lessee’s) estate. These vehicles remain registered in the name of the lessor. A new plate and lease agreement is required for surviving spouses in this situation.

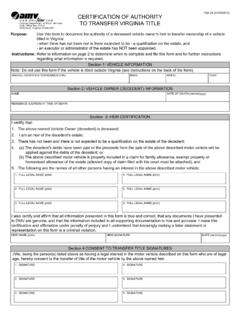

CERTIFICATION OF AUTHORITY TO TRANSFER VIRGINIA TITLE

www.dmv.virginia.govIf there is a surviving spouse and the vehicle is included in a claim for family allowance, exempt property or homestead allowance of the estate, only the surviving spouse must complete and submit this form. If there is no surviving spouse, all persons with an interest in the vehicle must be identified in Section 3 and, if of legal age,

Property Exemptions for Vets - South Carolina

dor.sc.govExemptions for Surviving Spouse - one vehicle registered solely in surviving spouse's name - home exemption if at time of veteran's death the surviving spouse acquires sole ownership in fee or for life Medal of Honor Recipients Who qualifies? - Medal of Honor Recipients What do I qualify for? -Tax exemption on home and land, up to one acre

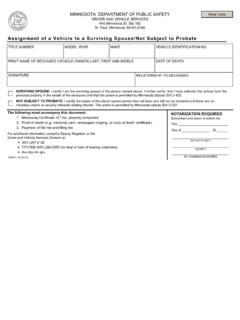

Assignment of a Vehicle to a Surviving Spouse/Not Subject ...

dps.mn.govSURVIVING SPOUSE: I certify I am the surviving spouse of the person named above. I further certify, that I have selected this vehicle from the personal property in the estate of the deceased and that this action is permitted by Minnesota Statute 524.2-403. NOT SUBJECT TO PROBATE:

APPLICATION FOR SURVIVING SPOUSE TRANSFER OF …

www.flhsmv.govThe surviving spouse must provide proof of identity; valid driver license or identification card from any state or a valid passport. Documentation Required: An original or certified copy of the death certificate is mandatory; a copy of the marriage certificate is required unless the name of the surviving spouse is shown on the death certificate.

Nebraska Homestead Exemption Application • Application …

revenue.nebraska.govsurviving spouse may be able to use the Qualified Surviving Spouse filing status. To qualify, the taxpayer must: • Be entitled to file a joint return for the year the spouse died, regardless of whether the taxpayer actually filed a joint return that year. • Have had a spouse who died in either of the two prior years.

INSTRUCTIONS FOR COMPLETING AFFIDAVIT OF HEIRSHIP

www.limerockresources.comINSTRUCTIONS FOR COMPLETING AFFIDAVIT OF HEIRSHIP 1. ... If married at time of death, surviving spouse’s name? _____ 7. If the Decedent was married at the time of death, what is the surviving spouse’s present address or, if spouse is now deceased, when did …

Death Records Corrections/Amendments - New York State ...

www.health.ny.gov• Change the surviving spouse All of these documents: • Certified Marriage record between the decedent and the spouse challenging the record (Grievant); • Affidavit from Grievant indicating they are the legal surviving spouse, setting forth the date and place of the marriage and stating that the marriage was never legally dissolved;

PERSONAL REPRESENTATIVE BUREAU OF MOTOR VEHICLES …

www.maine.govA surviving spouse may title the vehicle in his or her name only by submitting a title application in the spouse’s name (no fee is required if at the time of death, the deceased was a Maine resident and the vehicle was registered and titled in ... AFFIDAVIT OF SURVIVING SPOUSE

Estate Tax Waivers

www.tax.ny.govamount to be paid out exceeds $30,000, but does not exceed $50,000. Notification may be mailed to the department at the time payment is made to the beneficiary. If the surviving spouse is named on the insurance policy as the only beneficiary, the entire proceeds may be paid to the surviving spouse without a waiver and without notifying the ...

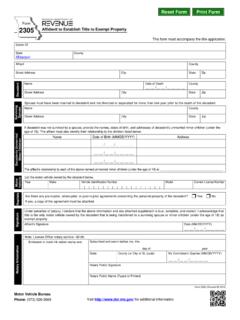

Form 2305 - Affidavit to Establish Title to Exempt Property

dor.mo.govSpouse must have been married to decedent and not divorced or separated for more than one year prior to the death of the decedent. Name County Surviving Spouse Street Address City State Zip If decedent was not survived by a spouse, provide the names, dates of birth, and addresses of decedent’s unmarried minor children (under the age of 18).

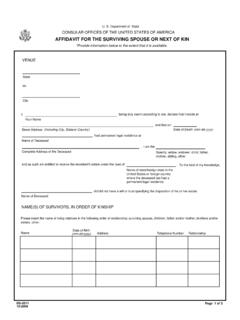

DS-5511 Affidavit for the Surviving Spouse or Next of Kin

eforms.state.govPlease insert the name of living relatives in the following order of relationship: surviving spouse, children, father and/or mother, brothers and/or sisters, other: Date of Birth Name Address Telephone Number Relationship DS-5511 10-2008 Page 1 of 3 (Including City, State/or Country) (mm-dd-yyyy) CONSULAR OFFICES OF THE UNITED STATES OF AMERICA

THE OFFICIAL NEWSLETTER SURVIVING SPOUSES & FAMILIES

soldierforlife.army.milToday, communicating with 1.25 million Retired Soldiers and surviving spouses who have varying levels of comfort with technology is a challenge. Further complicating communications are more frequent household moves and the myriad locations where the Army’s retired community lives from Australia and Kyrgyzstan to Mali, Germany and the

Pre-Retirement Lump Sum Beneficiary Designation

www.calpers.ca.govdesignation on file,the benefits will be payable to your surviving spouse/registered domestic partner to whom you have been married to or in a partnership with for either one year or prior to the onset of the injury or illness that resulted in death. Or,if there is no eligible surviving spouse/registered

Residence Homestead Exemption Application

comptroller.texas.gova surviving spouse) under Tax Code sections 11.131 or 11.132 may be filed up to 5 years after the delinquency date. Surviving spouse of a disabled veteran, who files under Tax Code sections 11.131 or 11.132, may file up to two years after the delinquency date, for a late application for residence homestead exemption.

REV-1737-1 OFFICIAL USE ONLY

www.revenue.pa.gova surviving spouse or member of the decedent’s family. The following information is submitted in support of the statement that the above individual was not domiciled in the. Commonwealth of Pennsylvania at the date of death. 1. Names and addresses of the decedent’s surviving spouse and members of his/her immediate family: Name and . R ...

Residence Homestead Exemption Transfer Certificate

comptroller.texas.govChief appraisers may use this form to certify information necessary to determine the exemption amount to which certain surviving spouses are entitled on a subsequently qualified residence homestead under Tax Code Section 11.131, 11.132, 11.133 or 11.134. SECTION 1: Property Owner/Surviving Spouse ...

Harris County Application for Appraisal District Residence ...

images.kw.comsurviving spouse of individual who qualified for age 65 or older exemption under tax code section 11.13(d) (Tax Code Section 11.13(q)): You may qualify for this exemption if: (1) your deceased spouse died in a year in which he or she

VA Accrued Benefits and Substitution Factsheet

www.benefits.va.govIf the death is that of a surviving spouse, the accrued benefit is payable to the Veteran’s children. However, accrued Dependent’s Educational Assistance (DEA) is payable only as reimbursement on the expenses of last sickness and burial. If the death is that of a child, the accrued benefit is payable to the surviving children of the Veteran.

Application for Residence Homestead Exemption Property …

www.dallascad.orgsurviving spouse of individual who qualified for age 65 or older exemption under tax code §11.13(d) (tax code §11.13(q)): You may qualify for this exemption if: (1) your deceased spouse died in a year in which he or she qualified for the exemption under Tax Code

Transferring property when someone dies…

www.courts.ca.govsurviving spouse • Life insurance, death benefits or other assets not subject to probate that pass directly to the beneficiaries • Unpaid salary or other compensation up to $5,000 owed to the person who died. • The debts or mortgages of the person who died. For a complete list, see Probate Code § 13050. Can I subtract the dead

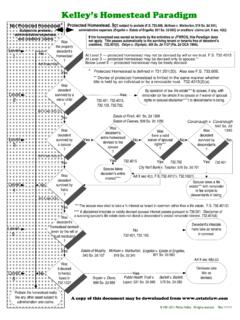

Kelley’s Homestead Paradigm - FLTA

www.flta.orgNov 01, 2011 · a surviving spouse’s life estate does not divest a descendant’s vested remainder interest. 732.401(4). ** Devise of protected homestead is limited in the same manner whether title is held by an individual or by a revocable trust. 732.4015(2)(a). If the homestead was owned as tenants by the entireties or JTWROS, this Paradigm does not apply.

AFFIDAVIT - Department of Justice and Constitutional ...

www.justice.gov.za1. Surviving spouse: 2. Children and date of their birth. Also state names of *predeceased children and their dates of death: Ignore questions 3, 4 and 5 if the deceased left children or descendants. 3. Father of deceased: Mother of deceased: Ignore questions 4 and 5 if the parents are both alive. 4 Brothers and sisters of the deceased. State ...

NEXT OF KIN AFFIDAVIT - New York State Comptroller

www.osc.state.ny.usNEXT OF KIN AFFIDAVIT State of New York State of New York City of _____ Office of the State Comptroller ... That she/he is the surviving spouse. That the affiant herein is informed and believes that the sum of $_____ was due and owing the decedent from the State of New York at the time of the decedent’s death for _____ and ...

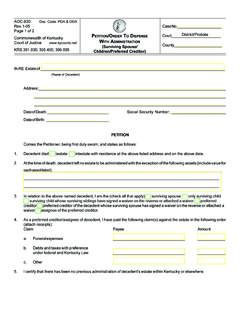

AOC-830 Doc. Code: PDA & ODA Rev. 1-05 Case No. Page 1 …

trs.ky.govPETITION/ORDER TO DISPENSE WITH ADMINISTRATION (Surviving Spouse/ Children/Preferred Creditor) AOC-830 Doc. Code: PDA & ODA Rev. 1-05 Page 1 of 2 Commonwealth of Kentucky Court of Justice www.kycourts.net KRS 391.030; 395.455; 396.095

PROPERTY TAX BENEFITS FOR ACTIVE DUTY MILITARY AND …

floridarevenue.comtotal exemption from ad valorem taxes on property they own and use as their homesteads. A similar exemption is available to disabled veterans confined to wheelchairs. Under certain circumstances, the veteran’s surviving spouse may be entitled to carry over the exemption. See Form DR-501. (see ss. 196.081 and 196.091, F.S.)

VR-005 04-21

mva.maryland.govto the surviving spouse. MARYLAND EXCISE TAX If the vehicle is purchased from a licensed dealer, the excise tax is 6% of the full purchase, less trade-in allowance. Transactions for vehicles less than 7 years old, purchased from someone other than a dealer, accompanied by a notarized bill of sale, the tax is 6% of the greater of the purchase

FOR UAW-CHRYSLER RETIREES

www.uawtrust.orgPension Deduction ... Your health plans and/or benefits may change as a new retiree or Surviving Spouse. Depending on your geographic location and Medicare status, you may have several plan options available to you, ... (medical) benefits, and additional benefits. MA PPO plans also utilize a nationwide network of doctors

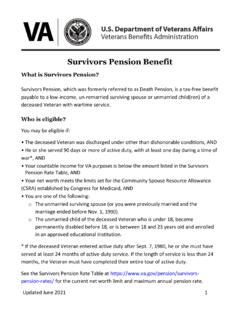

VA Survivors Pension Benefit Factsheet

www.benefits.va.govo The unmarried surviving spouse (or you were previously married and the marriage ended before Nov. 1, 1990). o The unmarried child of the deceased Veteran who is under 18, became permanently disabled before 18, or is between 18 and 23 years old and enrolled

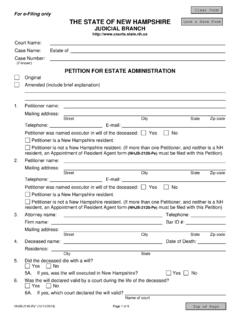

For e-Filing only THE STATE OF NEW HAMPSHIRE

www.courts.nh.gov13F. If the decedent had no surviving spouse, parents or children, grandchildren etc. (to the fourth degree of kinship) list the decedent’s brothers and sisters, if living, and the children and grandchildren of any deceased brothers and sisters. If none, list the grandparent(s) of the decedent, if living.

Harassment and Discrimination Prohibited

www.mn.govApr 07, 1988 · The prohibition against harassment and discrimination based on age prohibits such conduct based on a person’s age if the person is over the age of 18. Marital status: Whether a person is single, married, remarried, divorced, separated, or a surviving spouse, and includes

State-by-state analysis of IRAs as exempt property Roth ...

www.thetaxadviser.comDelaware Del. Code Ann. tit. 10, §4915 Yes Yes An IRA is not exempt from a claim made pursu-ant to Title 13 of the Delaware Code, the title that pertains to domestic relations orders. Florida Fla. Stat. §222.21 Yes Yes An IRA is not exempt from a claim of an alternate payee under a QDRO or claims of a surviving spouse pursuant to an order deter-

SEPARATION AGREEMENT (Without Minor Children of the ...

images.template.netadministration, all rights as surviving spouse, heir, legatee, and next of kin, in the estate of the other, and all rights to administer the estate of the other, and in all property rights that each now has, or may acquire in the future, except as specifically agreed in this Separation Agreement.

Transfer of Ownership When the Vehicle Owner is Deceased

dmv.ny.govonly by next of kin. The value of the one vehicle cannot be more than $25,000. l. MV-349.1 (Affidavit for Transfer of Motor Vehicle) — This form is used by the surviving spouse or. a minor child under 21 years of age. The value of the one vehicle cannot be more than $25,000 (see form for exceptions). * Copy of the Death Certificate

SENIOR PROPERTY TAX HOMESTEAD EXEMPTION

www.denvergov.orgextended this exemption to the surviving spouse of a disabled veteran who previously received the exemption. Applications are available from the Colorado Department of Military and Veterans Affairs at 1355 S. Colorado Blvd., Bldg. C, Suite 113, Denver, CO 80222. Their telephone number is

Surviving spouse's benefits in private pension plans

www.bls.govpension to the surviving spouse. 3These plans do not require a reduction of retiree's accrued pension when employee and spouse are the same age. Under their provisions, the spouse receives an average of 49 percent of the accrued pension. For 2 out of 3 plans in this group, the retiree's or spouse's benefit is reduced if there is significant age ...

SURVIVING SPOUSE, CHILDREN, NEXT OF KIN, LEGATEES …

probate.cuyahogacounty.usSURVIVING SPOUSE, CHILDREN, NEXT OF KIN, LEGATEES AND DEVISEES (R.C. 2105.06, 2106.13 2107.19) [Use with those applications or filings requiring some or all of the information in this form, for notice or other purposes. Update as required.] The following are decedent’s known surviving spouse, children, and the lineal descendants of deceased ...

Similar queries

GUIDE TO SURVIVING SPOUSE RIGHTS IN FLORIDA, Rights, Surviving spouse, Florida, Surviving, Spouse, VIRGINIA, Surviving Spouse/Not Subject, The surviving spouse, Minnesota, APPLICATION FOR SURVIVING SPOUSE TRANSFER, Homestead Exemption Application, Application, AFFIDAVIT OF HEIRSHIP, Death Records Corrections/Amendments, Affidavit, Maine, 2305, Affidavit for the Surviving Spouse or Next of, Children, Surviving spouses, Beneficiary Designation, Benefits, Exemption, Surviving children, Property, Not subject to probate, Probate, NEXT OF KIN AFFIDAVIT, New York State Comptroller, Pension, Plans, Divorced, Separation Agreement, Next, Transfer, NEXT OF KIN, Denver, Surviving spouse's benefits in private pension plans