Search results with tag "Hvut"

Note: The form, instructions, or publication you are ...

www.irs.govvehicle use tax (HVUT) for the tax period listed above to the federal Department of Transportation (DOT), U.S. Customs and Border Protection (CBP), and to state Departments of Motor Vehicles (DMV). The information disclosed to the DOT, CBP, and state DMVs will be my vehicle identification number (VIN) and verification that I have paid the HVUT.

V1 DIVISION OF MOTOR VEHICLES STATE OF ALASKA …

doa.alaska.govHEAVY VEHICLE USE TAX (HVUT) COMPLIANCE . Motor Vehicles with a taxable gross weight of 55,000 pounds or more are subject to HVUT Compliance Taxable gross weight is defined as the sum of the following: • Empty weight of the motor vehicle, and • Empty weight of trailer or semi-trailer(s) customarily used with motor vehicle, and

812 DIVISION OF MOTOR VEHICLES STATE OF ALASKA …

doa.alaska.govHeavy Vehicle Use Tax Compliance Section (HVUT) Motor Vehicles with a taxable gross weight of 55,000 pounds or more are subject to HVUT Compliance Taxable gross weight is defined as the sum of the following: • Empty weight of the motor vehicle, and • Empty weight of trailer or semi-trailer(s) customarily used with motor vehicle, and

OREGON COMMERCIAL REGISTRATION APPLICATION

www.oregon.govHVUT - Federal law requires current proof of payment of the Federal Heavy Vehicle Use Tax (HVUT) when registering vehicles 55,000 pounds or more for an Oregon taxable declared weight, gross weight or combined gross weight. This proof must be received by Motor Carrier Services within 120 days of registering a vehicle.

IRP New and Renewal Registration Checklist

oklahoma.govA copy of receipted HVUT Schedule 1, Form 2290 (if applicable). Verified proof of Financial Responsibility (Liability Insurance). Verified copy of Operating Lease Agreement (if applicable). The Fleet(s) to be registered accrues distances in Oklahoma. Verified proof of Residency or Established Place of Business as outlined below:

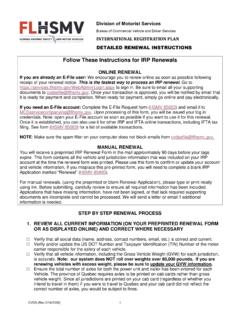

Follow These Instructions for IRP Renewals

www.flhsmv.govProof of payment of Federal Heavy Vehicle Use Tax . For vehicles registered at 55,000 lbs. or greater, you must provide one of the following acceptable proofs of current payment of the Heavy Vehicle Use Tax (HVUT): A legible copy of Form 2290, Schedule 1, stamped received .

IRP ON OSCAR - Government of New York

irb.dmv.ny.govNov 08, 2016 · Proof of HVUT (Heavy Vehicle Use Tax) IRS Form 2290 schedule 1 stamped received by the IRS if the vehicle has a max weight of 55,000 lbs. or higher and the purchase date of the vehicle is more than 60 days prior to your entry on OSCAR. • Proof of HUT ( NYS Highway Use Tax) Form MT- 370.1.

Heavy Highway Vehicle Use Tax (HVUT) and IRS validated ...

www.cvisn.dor.ga.govGEORGIA DEPARTMENT OF REVENUE MOTOR VE HIC L E D IVI SI ON P.O. Box 740381, Atlanta, GA 30374-0381 Tel: 1-855-406-5221 Lynnette T. Riley, Commissioner Georgia Steele, Director For more information, please visit the Georgia Trucking Portal at