Example: barber

Search results with tag "Mileage allowance"

Tax benefits for ultra low emission vehicles - GOV.UK

assets.publishing.service.gov.ukMileage Allowance Relief (MAR) - electric and hybrid cars are treated in the same way as petrol and diesel cars. A) Taxes applicable to all ULEV users 1. Fuel Duty 1.1 Fuel duty is paid on each litre of road fuel purchased (or on each kilogram in the …

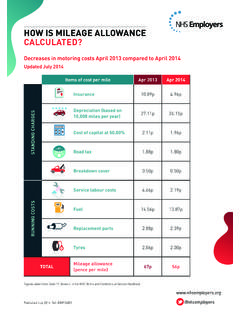

HOW IS MILEAGE ALLOWANCE CALCULATED? - NHS Employers

www.nhsemployers.orgItems of cost per mile Apr 2013 Apr 2014 STANDING CHARGES Insurance 10.89p 4.96p Depreciation (based on 10,000 miles per year) 27.11p 26.15p Cost of capital at 50.00% 2.11p 1.96p Road tax 1.88p 1.80p Breakdown cover 0.50p 0.50p RUNNING COSTS