Search results with tag "Application for extension of time"

SAMPLE FORM R APPLICATION FOR EXTENSION OF TIME …

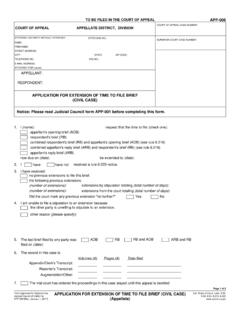

www.courts.ca.govAPPLICATION FOR EXTENSION OF TIME TO FILE BRIEF - INSTRUCTIONS If a party needs more than the 60 days already stipulated to, or if the opposing party ... on Form APP-006. Filling out the Application for Extension of Time to File Brief form: Caption (1) If you are appealing a case from San Diego or Imperial County, fill out the top box of the ...

APP-006 Application for Extension of Time to File Brief ...

www.courts.ca.govCOURT OF APPEAL CASE NUMBER: APPLICATION FOR EXTENSION OF TIME TO FILE BRIEF (CIVIL CASE) (Appellate) APP-006 [Rev. January 1, 2017] Page 2 of 2. I declare under penalty of perjury under the laws of the State of California that the information above is true and correct. 9. Date: (TYPE OR PRINT NAME) (SIGNATURE OF PARTY OR ATTORNEY) 10.

Tennessee Inheritance Tax Guide - TN.gov

www.tn.govAn extension of up to one year is granted provided one of the following is attached to the return filed on or before the extended due date: • Tennessee INH304 Application for Extension of Time to File Inheritance Tax Return. • Federal form 4768 Application for Extension of Time to File a Return and/or Pay U.S. Estate Tax.

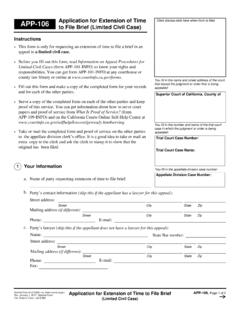

APP-106 Application for Extension of Time to File Brief ...

www.courts.ca.govI am requesting an extension on the time to file: I am requesting that the time to file the brief identified in be extended to . Signature of party or attorney

Refer to instructions before completing this return

www.state.nj.usCBT-200-T CORPORATION BUSINESS TAX TENTATIVE RETURN AND APPLICATION FOR EXTENSION OF TIME TO FILE 2017 For the period beginning _____, 20_____ and ending _____, 20____ Refer to instructions before completing this return Federal Employer I.D. Number N.J. Corporation Number

Form 8809 Application for Extension of Time To File ...

www.irs.govForm 8809 (Rev. November 2018) Department of the Treasury Internal Revenue Service . Application for Extension of Time To File Information Returns

Application for Extension of Time to File (REV-276)

www.revenue.pa.govSubmit this application before the return due date, usually April 15 for calendar year filers, and the 15th day of the fourth month following the close of the fiscal year for fiscal year filers. 3. WHAT AND WHERE TO FILE Submit the completed application along with the extension pay - ment voucher and payment, if applicable, to the following ad ...

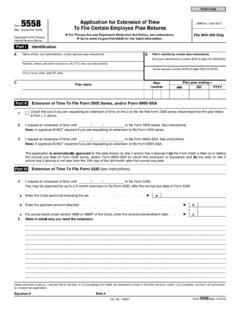

Form To File Certain Employee Plan Returns - irs.gov

www.irs.govForm 5558 (Rev. September 2018) Application for Extension of Time To File Certain Employee Plan Returns Department of the Treasury Internal Revenue Service