Search results with tag "Form 3372"

Dealer Manual - Chapter 8 - Michigan

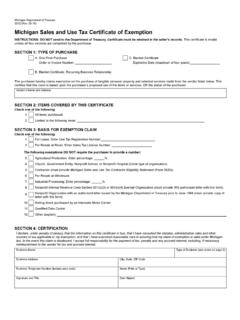

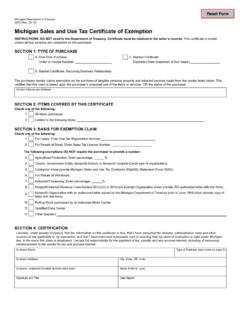

www.michigan.govc) Form 3372 Exemptions. Dealers can accept these forms presented by customers certifying they are exempt from sales tax. The Michigan Department of Treasury indicates there is no need to verify this type of exemption with the Department. Simply keep a copy of the form in your deal jacket for audit purposes.

3372, Michigan Sales and Use Tax Certificate of Exemption

www.michigan.gov3372, Page 2 . Instructions for completing Michigan Sales and Use Tax Certificate of Exemption (Form 3372) Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. All fields must be . completed; however, if provided to the purchaser in electronic format, a signature is not required.

3372, Michigan Sales and Use Tax Certificate of Exemption

mi-aimh.org3372, Page 2 Instructions for completing Michigan Sales and Use Tax Certicate of Exemption (Form 3372) Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions. It is the Purchaser’s responsibility to ensure the eligibility of the exemption being claimed. All claims are subject to audit.