Transcription of 슈피겐코리아 (192440) - imgstock.naver.com

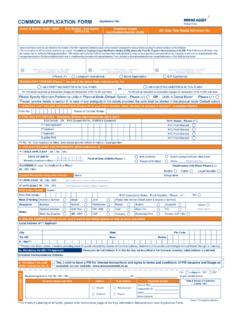

1 / Company Report ( ) (12M, ) 68,500 (18/01/31) 46,850 46% (17F, ) 51 Consensus (17F, ) 45 EPS (17F,%) MKT EPS (17F,%) P/E(17F,x) MKT P/E(17F,x) KOSDAQ ( ) 291 ( ) 6 (%) (%) (12M) 52 ( ) 37,150 52 ( ) 53,800 (%) 1 6 12 [ / ] 02-3774-1426 02-3774-1832 (192440) 4Q17 Preview: 206 (+ YoY, + QoQ). 4Q17 791 (+ YoY, + QoQ), 206 (+ YoY, + QoQ) . 583 143.

2 616 152 . X 8 . X 10 .. 4Q17 464 . 214 . 8 .. , .. 2017 2018 2017 2,224 (+ ), 508 (+ ) . 1H17 2H17 .. 2018 . 2018 2,644 (+ ), 595 (+ ) .. 30% , 20% . 2018 ( ).

3 (Amazon) .. 12 68,500 " " , 12 63,200 68,500 . 12 Forward EPS 7,614 PER 9 ( 10 9 , ) .. 2018 PER .. (12 ) 12/14 12/15 12/16 12/17F 12/18F 12/19F ( ) 142 148 179 222 264 286 ( ) 48 44 44 51 59 66 (%) ( ) 41 37 39 39 47 52 EPS ( ) 8,725 5,999 6,202 6,328 7,543 8,388 ROE (%) P/E ( ) P/B ( ) (%) : K-IFRS , : , KOSDAQ 2 mirae asset Daewoo Research 1.

4 : 1. ( , %, %p) 2017F 2018F 2016 2017F 2018F 4Q17F 1Q 2Q 3Q 4QF 1QF 2QF 3QF 4QF YoY QoQ EPS 573 1,487 1,655 2,612 1,888 1,401 1,639 2,614 6,202 6,328 7,543 1,840 : , 2.

5 ( , %, %p) 2017F 2018F 2019F 2017F 2018F 2019F 2017F 2018F 2019F - EPS 5,736 5,555 6,396 7,153 6,328 7,543 8,388 : , mirae asset Daewoo Research 3 2. 3. : , : , 4. iPhone X 5.

6 S8 : , : , 6. 8 7. : iPhone Case : , : , 01020304002550751001Q151Q161Q171Q18F (L) (R)( )(%)02040608002550751001Q141Q151Q161Q171 Q18 FOthersHuaweiSamsungAppleApple Portion( )( )(%) (100= ) 4 mirae asset Daewoo Research Global peer group 3. ( ,%) -1M -3M 17F 18F 19F 17F 18F 19F 17F 18F 19F 17F 18F 19F 291 222 264 286 51 59 66 39 47 52 478 322 380 416 44 55 61 32 39 45 552 800 926 1,018 10 53 66 6 45 53 7,955 6,847 7,825 8,637 305 535 609 167 303 355 LG 2,970 7,641 8,528 9,033 296 410 424 175 265 271 MURATA 35,659 13,443 15,282 16,304 1,719 2,232 2,586 1,460 1,754 LITE-ON 3,670 7,799 8,052 8,340 333 405 431 116 329 CHICONY 2.

7 029 2,868 3,074 3,290 190 220 237 151 173 CATCHER 9,433 3,417 4,056 4,548 1,205 1,362 1,497 831 1,010 AAC 21,806 3,540 4,619 5,604 1,038 1,385 1,715 916 1,224 MERRY Elec. 1,344 974 1,241 1,404 99 124 140 101 115 : Bloomberg, 4. ( , %) ROE PER PBR EV/EBITDA 17F 18F 19F 17F 18F 19F 17F 18F 19F 17F 18F 19F LG 9 20 2 7 MURATA LITE-ON CHICONY CATCHER AAC MERRY Elec.

8 : Bloomberg, 8. PBR-ROE 9. EV/EBITDA-EBITDA Growth : Bloomberg, : Bloomberg, LG MURATALITE-ONCHICONYCATCHERAACMERRY02468 010203040(PBR, )(ROE, %) LG MURATALITE-ONCHICONYCATCHERAACMERRY02460 10203040(PBR, )(ROE, %) LG MURATALITE-ONCHICONYCATCHERAAC0204060800 5101520(EBITDA Growth, %)(EV/EBITDA, ) mirae asset Daewoo Research 5 10. 11. (I) : Thomson Reuters, : Thomson Reuters, 12.

9 (II) 13. (III) : Thomson Reuters, : Thomson Reuters, ( )(-3M=100) ( )(-3M=100) ( )(-3M=100) Elec.( )(-3M=100) 6 mirae asset Daewoo Research (192440) ( ) ( ) ( ) 12/16 12/17F 12/18F 12/19F ( ) 12/16 12/17F 12/18F 12/19F 179 222 264 286 149 125 164 207 57 67 78 84 50 7 39 75 122 155 186 202 14 22 24 25 79 105 127 136 13 40 42 45 44 51 59 66 72 56 59 62 44 51 59 66 66 141 147 154 2 0 3 3 2 3 4 4 2 2 2 3 7 40 43 45 0 0 0 0 2 2 1 1 46 51 62 69 215 265 311 361 7 12 15 16 21 42 44 46 39 39 47 52 6 8 9 9 0 0 0 0 0 11 11 11 39 39 47 52 15 23 24 26 39 39 47 52 1 1 1 1

10 0 0 0 0 0 0 0 0 39 35 47 52 1 1 1 1 39 35 47 52 22 43 45 47 0 0 0 0 194 222 266 314 EBITDA 44 52 61 67 3 3 3 3 FCF 26 -24 42 47 49 59 59 59 EBITDA (%) 131 168 212 259 (%) 0 0 0 0 (%) 194 222 266 314 ( ) valuation ( ) ( ) 12/16 12/17F 12/18F 12/19F 12/16 12/17F 12/18F 12/19F 28 10 46 51 P/E (x) 39 39 47 52 P/CF (x) 7 14 14 15 P/B (x) 1 1 1 1 EV/EBITDA (x) 0 0 0 0 EPS ( ) 6,202 6,328 7,543 8,388 6 13 13 14 CFPS ( ) 7,377 8,530 9,811 10,818 -10 -31 -3 -3 BPS ( ) 31,406 36,594 43,640 51,349 ( ) 9 3 -1 -1 DPS ( ) 500 600 700 800 ( ) -1 -21 -2 -3 (%) ( ) -7 -8 0 0 (%) -10 -14 -15 -16 (%) -5 -55 -10 -11 EBITDA (%) ( ) -2 -34 -3 -4 (%) ( ) -1 0 0 0 EPS (%) ( ) -2 -1 -7 -7 ( )