Transcription of Fund Speak, May 2018 - ICICI Direct

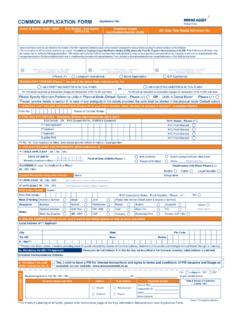

1 Fund Speak, March 2018 Refer page 3 for product labelling.(An open ended equity linked saving scheme with a 3 years lock-in period)Type of SchemeInvestment ObjectiveFund Manager**Allotment DateBenchmark IndexMinimum InvestmentAmountSystematic InvestmentPlan (SIP)Load StructurePlans AvailableOptions AvailableMonthly Average AUM ( Cr.)`as on February 28 , 2018thMonthly Avg. ExpenseRatio(Statutory Levies)Includingas on February 28 , 2018thProduct LabellingMirae AssetEmerging Bluechip FundMirae asset Prudence FundMirae asset India Equity Fund*An open ended equityoriented schemeThe investment objective of thescheme is to generate long termcapital appreciation by capitalizingon potential investmentopportunities through predominantlyinvesting in equities, equity relatedsecurities.

2 There is no assurance orguarantee of returnsMr. Neelesh SuranaMr. Harshad Borawake(since May 2008) and(sinceMay 01, 2017)04 April, 2008thS&P BSE 200 (TRI)Entry load: NAExit load:If redeemed within 1 year (365 days) from the date of allotment: 1%If redeemed after 1 year (365 days) from the date of allotment: NILR egular Plan and Direct PlanGrowth Option and Dividend Option (Payout & Re-investment)6, Plan: Direct , Plan: Direct , Plan: Direct Plan: generate income and capitalappreciation from a diversified portfoliopredominantly investing in Indianequities and equity related securities ofcompanies which are not part of the top100 stocks by market capitalization andhave market capitalization of atleast100 Crores at the time of Scheme does not guarantee orassure any returns`Mr.

3 Neelesh Surana,(since inception of the fund)09 July, 2010thNifty Free Float Midcap 100 (TRI)The investment objective of the Scheme is togenerate capital appreciation along withcurrent income from a combined portfolio ofequity & equity related instruments and debtand money market instruments. The Schemedoes not guarantee or assure any Neelesh Surana& Mr. Sudhir KediaMr. Mahendra Jajoo()(since April 01, 2017 .for Debtportion - (since 8 September 2016)thsinceInception)29 July, 2015thCRISIL Hybrid 35+65 -AggressiveIndex@An open ended equityfundAn Open Ended Equity OrientedAsset Allocation Scheme`5,000/- and in multiples of 1/-thereafter.

4 Minimum AdditionalApplication Amount: 1,000/-per application and in multiplesof 1/- thereafter.```Fresh lumpsum subscription/switch-into all the Plans & Options of MiraeAsset Emerging Bluechip Fundthrough any mode including StockExchange platform has beentemporarily suspended with effect fromOctober 25, 2016`5,000/- and in multiples of 1/-thereafter. Minimum AdditionalApplication Amount: 1,000/-per application and in multiplesof 1/- thereafter.```Monthly and Quarterly:Minimum of .1000/-(multiples of . 1/- thereafter),minimum 5 installments.``Monthly : Minimum of .1000 (multiple thereafter) minimum 5 shall be allowed maximum of upto.

5 25,000/- per installment per PAN. SIPis available on 10th of each month. Witheffect from 15th December detail refer addendum datedNovember 30, 2017.```Monthly and Quarterly: Minimum (multiples of . 1/-thereafter), minimum 5 installments.``This product is suitable for investorswho are seeking*: Capital appreciation along with currentincome over long term Investment predominantly in equitiesan equity related instruments withbalance exposure to debt and moneymarket investmentsThis product is suitable for investorswho are seeking*: Long - term capital appreciation predominantly investments in Indianequities and equity related securities ofcompanies which are not part of the top100 stocks by market capitalizationThis product is suitable forinvestors who are seeking*.

6 Long - term capitalappreciationinvestments in equities,equityrelated securities Investors understand that their principalwill be at moderately high riskModeratelyLowHighLowHighLOWHIGHM oderatelyRiskometer*Investors should consult their financial advisers if they are not clear about the suitability of the FeaturesFundSpeak2**For experience of Fund Managers refer page * mirae asset India Opportunities Fund was renamed as mirae asset India Equity Fund with effect from March 01, 2018@CRISIL Balanced Fund Index has been renamed as CRISIL Hybrid 35+65 Aggressive Index with effect from January 31, FACTSKey FeaturesType of SchemeInvestment ObjectiveFund Manager**Allotment DateBenchmark IndexMinimum InvestmentAmountSystematic InvestmentPlan (SIP)Load StructurePlans AvailableOptions AvailableMonthly Average AUM ( Cr.)

7 `as on February 28 , 2018thMonthly Avg. ExpenseRatio()Including Statutory Leviesas on February 28 , 2018thProduct LabellingMirae asset Great Consumer FundAn open-ended consumptionoriented sector schemeThe investment objective of the scheme is togenerate long term capital appreciation byinvesting in a portfolio of companies/funds thatare likely to benefit either directly or indirectlyfrom consumption led demand in India andacross the Asia Pacific region. The Schemedoes not guarantee or assure any Ankit JainMs. BhartiSawant(Domestic Investments)(since Oct 2016) and(Overseas Investments)(since August 2014)29 March, 2011thS&P BSE 200 (65%) & S&PAsia Pacific Emerging BMI(35%) Index (TRI)Monthly and: 1,000/- (multiplesof 1/- thereafter), minimum 5 installments``QuarterlyEntry load: NAExit load:If redeemed within 1 year (365 days) from thedate of allotment: 1%If redeemed after 1 year (365 days) from thedate of allotment: NILR egular Plan and Direct PlanGrowth Option and Dividend Option (Payout & Re-investment) `5,000/- and in multiples of 1 Additional Application Amount.

8 1,000/- per application and in multiples of1/- thereafter.```RiskometerFundSpeak3*Inves tors should consult their financial advisers if they are not clear about the suitability of the understand that their principalwill be at high riskModeratelyLowHighLowHighLOWHIGHM oderatelyFUND FACTS**For experience of Fund Managers refer page asset Tax Saver FundAn open ended equity linkedsaving scheme with a 3 yearlock-in periodThe investment objective of thescheme is to generate long termcapital appreciation from a diversifiedportfolio of predominantly equity andequity related instruments. TheScheme does not guarantee orassure any Neelesh Surana(since Inception)28 December, 2015thS&P BSE 200 (TRI)`500/- and in multiples of500/- thereafter`Minimum installment of 500/-(monthly / quarterly frequency) andin multiples of 500/- thereafter.

9 ``Entry Load:NAExit Load: Plan: Direct Plan: Direct product is suitable forinvestors who are seeking*: Growth of capital over longterm Investment predominantlyin equity and equity relatedinstrumentsThis product is suitable for investorswho are seeking*: Long-term Capital appreciation Investment in equity & equity relatedsecurities of companies benefitingdirectly or indirectly from consumptionled demand in india & across the Asiapacific regionInvestors understand that their principalwill be at moderately high riskModeratelyLowHighLowHighLOWHIGHM oderatelyKey FeaturesType of SchemeInvestment ObjectiveFund Manager**Allotment DateBenchmark IndexMinimum InvestmentAmountSystematic InvestmentPlan (SIP)Load StructurePlans AvailableOptions AvailableProduct LabellingMonthly and Quarterly.

10 1,000/- (multiples of 1/- thereafter), minimum 5 installments```5,000/- and in multiples of 1/-thereafter. Minimum Additional Application Amount: 1,000/- per application and in multiplesof 1/- thereafter.```RiskometerFundSpeak4*Inves tors should consult their financial advisers if they are not clear about the suitability of the product.**For experience of Fund Managers refer page no. 14 mirae asset Dynamic Bond FundAn open-ended income schemeThe objective of the Scheme is to generateo p t i m a l r e t u r n s t h r o u g h a c t i v emanagement of a portfolio of debt andmoney market instruments.