Transcription of 2021 Budget Highlights - assets.kpmg

1 Budget Statement and Economic Policy of the Government of Ghana for the 2021 Fiscal Year2021 Budget HighlightsMarch 2021 2021 KPMG, a partnership registered in Ghana and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative ( KPMG International ), a Swiss entity. All rights SarpongSenior Partner Consolidation, Completion and Continuation The year 2020 was challenging for countries all over the world of which Ghana is no Government took some really difficult decisions including locking down some parts of the country at the outbreak of the pandemic last year as well as providing support to vulnerable individuals and businesses.

2 These actions impacted the economy and business growth in , some countries recorded negative growth in 2020, we achieved a positive growth rate of albeit lower than the initial target. The year 2020 will remain in our history as one of the most challenging years that we have faced as a people. Several businesses and individuals experienced economic hardships due to the adverse impact of the novel corona virus pandemic. Government in supporting businesses and individuals rolled out a number of stimulus packages including the CAPBuSS Fund, free water and electricity to lifeline consumers, distribution of food to households etc.

3 These initiatives had an adverse impact on government s planned expenditure for 12 March 2021, the Minister of Parliamentary Affairs, Hon Osei Kyei-Mensah-Bonsu, presentedthe 2021 Budget Statement and Economic Policy ( the Budget ) under the theme Consolidation, Completion and Continuation to Parliament on behalf of the President. This sets the tone for Government s planned activities for the first year of the President s second mandate. The 2021 Budget is focused on activities targeted towards economic recovery following the pandemic.

4 This is important to ensure that businesses and individuals are cushioned and supported to build more capacity for growth. The key priority areas of the Budget include delivering COVID-19 containment measures and vaccination, creating and sustaining jobs, implementing the GhanaCARES Programme, promoting entrepreneurship and wealth generation and making fiscal space for implementation of priority programmes. Revenue mobilisation is crucial for the achievement of these priorities. Government will require innovative ways to raise additional revenue and contain expenditure levels so as to create the fiscal space to realise these targets and , Government would have to continue its efforts in digitising its processes and systems to facilitate and sustain an enabling environment for businesses to thrive and survive in the face of fierce competition by the global community.

5 It is imperative that the private and public sectors find efficient and innovative ways to collaborate in building a stronger and better post pandemic KPMG, we believe it is essential that the business community actively engages with Government to inform policy and foster the co-creation of interventions that support inclusive growth. 0102 ExecutiveSummaryGlobalDevelopments03 TheEconomy040506Ta xSectorInitiativesInitiatives OutlookContents 2021 KPMG, a partnership registered in Ghana and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative ( KPMG International ), a Swiss entity.

6 All rights Economic Revitalisation through Completion, Consolidation and Continuation 2021 BudgetTheme 2021 KPMG, a partnership registered in Ghana and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative ( KPMG International ), a Swiss entity. All rights & Strategic Pillars of the 2021 BudgetSTRATEGIC PILLARSPRIORITIES COVID-19 Containment Measures & VaccinationImplementation of the GhanaCARES ProgrammeConsolidation and completion of existing programmes/projectsCreation of fiscal space for implementation of priority programmesSecurityEntrepreneurship and wealth creationCreating and sustaining jobsRestoring and sustaining macroeconomic stability with a focus on debt sustainability over the medium-termRevitalising and transforming the economy through the implementation of

7 The GhanaCARES Programme to ensure the socio-economic transformation that results in a modernised, competitive, and resilient economy to promote inclusive and sustainable growthBuilding a robust financial services sector to support growth and developmentProviding a supportive private sector environment for entrepreneurship, domestic businesses and Foreign Direct Investment (FDI) to thriveDeepening structural reforms to make the machinery of Government work more efficiently and effectively to support socio-economic transformation. In particular, implement reforms to increase revenue mobilisation and the efficiency of public expenditures 2021 KPMG, a partnership registered in Ghana and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative ( KPMG International ), a Swiss entity.

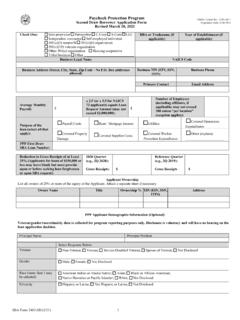

8 All rights Summary 2021 KPMG, a partnership registered in Ghana and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative ( KPMG International ), a Swiss entity. All rights DEVELOPMENTSTHE ECONOMYOUTLOOKKEY INITIATIVESTAX INITIATIVESEXECUTIVE SUMMARY2021 Budget at a monthsImport GDP growth growth & resilienceExpenditure (excl. arrears)Revenue Public billion(as at Dec. 2020) billionOverall GDP growth rateFiscal deficitPrimary deficitEnd-period Inflation 2021 KPMG, a partnership registered in Ghana and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative ( KPMG International ), a Swiss entity.

9 All rights DEVELOPMENTSTHE ECONOMYOUTLOOKKEY INITIATIVESTAX INITIATIVESEXECUTIVE SUMMARYTax Sector Clean-up Levy of 5% on profit before tax of Health Levy made up of: One (1) percentage point increase in national Health Insurance Levy (NHIL) from to One (1) percentage point increase in Value Added Tax (VAT) Flat Rate from 3% to 4% and Pollution Levy (SPL) of 10 pesewas on the price per litre of petrol/diesel under the Energy Sector Levies Act (ESLA) Sector Recovery Levy (Delta Fund) of 20 pesewas per litre on petrol/diesel under the Energy Sector Levies Act (ESLA) amendment to the Fees and Charges (Miscellaneous Provisions) Act, 2018 (Act 983)

10 To cater for automatic annual adjustment of road tolls1. Permanent tax-exemption of capital gains on listed securities2. Provision of COVID-19 support to cushion registered individuals or entities with the Ghana Revenue Authority who have fulfilled their first quarter 2021 tax obligation. This comprises: A waiver of penalty and interest on accumulated tax arrears up to December 2020 Thirty percent (30%) rebate on the income tax due for companies in hotels and restaurants, education, arts and entertainment, and travel and tours for the second, third and fourth quarters of 2021 Suspension of the quarterly income tax instalment payments for the second, third and fourth quarters of 2021 for small businesses using the income tax stamp system Suspension of the quarterly instalment payments of the vehicle income tax for the second.