Transcription of Annuity withdrawal/surrender - MetLife

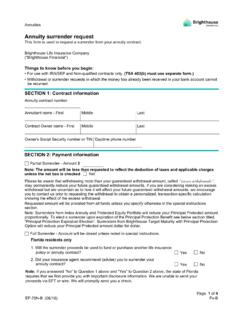

1 AnnuitiesNEF-ANNWDRWL-B (06/18)Page 1 of 5 Fs-B/fAnnuity withdrawal / surrender This form is used to request a withdrawal on your Annuity contract. New England Life Insurance Company ("Brighthouse Financial") Things to know before you begin: The Owner s signature is required in Section 7 of this form. If there is more than one Owner, all Owners must sign. Please use black ink. The withdrawal check will be mailed to the Owner's address of record, unless otherwise specified in Section 4. withdrawal charges (sometimes referred to as Contingent Deferred Sales Charges ) may apply to any withdrawal or surrender .

2 This form is not available for 1035 Exchanges or Annuitization. If this is a TSA contract, we will require the Individual Tax Sheltered Annuity 403b Distribution withdrawal Form. Please contact the Client Service Center for assistance. Please read the Federal Income Tax Status and Withholding section carefully and indicate a withholding election. withdrawal or surrender requests in which the money has already been received in your bank account cannot be 1: Owner/Annuitant informationAnnuity contract numberAnnuitant's name - FirstMiddleLastOwner's name - FirstMiddleLastStreet addressCity or townStateZIPO wner's Social Security number or taxpayer identification numberOwner's phone numberSECTION 2: Type of withdrawal Important: Please review your contract and/or prospectus for detailed information regarding early withdrawal penalties and other withdrawal provisions.

3 If you have elected Guaranteed withdrawal Benefit (GWB) or Lifetime withdrawal Guarantee (LWG), cumulative withdrawals that exceed the Annual Benefit Payment in any contract year may significantly reduce the value of the GWB or LWG benefit. If you elect the LWG and you make any withdrawals prior to age 59 , we will not make payments to you over your lifetime. If you elect GMIB Plus or the Enhanced Death Benefit riders, cumulative withdrawals in a contract year that exceed the dollar-for-dollar withdrawal limit may significantly reduce the value of the GMIB Plus and/or Enhanced Death (06/18)Page 2 of 5 Fs-B/fI request that the Company, subject to the terms of my contract, process the following transaction: TOTAL withdrawal Florida residents only1.

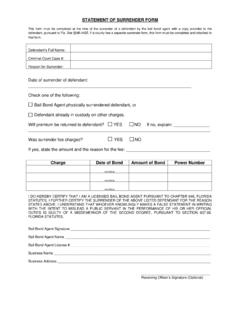

4 Will the surrender proceeds be used to fund or purchase another life insurance policy or Annuity contract?YesNo2. Did your insurance agent recommend (advise) you to surrender your Annuity contract?YesNoNote: If you answered "No" to Question 1 above and "Yes" to Question 2 above, the state of Florida requires that we first provide you with important disclosure information. We are unable to send your proceeds via EFT or wire. We will promptly send you a withdrawal options Minimum partial withdrawal amount is $100 ($500 for Preference Premier and American Forerunner Series).

5 Please be aware that withdrawing more than your guaranteed withdrawal amount, called excesswithdrawals , may permanently reduce your future guaranteed withdrawal amounts. If you are considering making an excess withdrawal but are uncertain as to how it will affect your future guaranteed withdrawal amounts, we encourage you to contact us prior to requesting the withdrawal to obtain a personalized, transaction-specific calculation showing the effect of the excess and complete one of the following withdrawal options: Net Partial withdrawal (Your check will be for the amount requested.)

6 Your contract value will be reduced by this amount plus any applicable withdrawal charges, federal/state tax.) $Gross Partial withdrawal (Your check will be for the amount requested less any applicable withdrawal charges,federal/state tax. Your contract value will be reduced by the amount requested.)$10% (or other , if less) of total purchase payments not subject to withdrawal charge (available once each contract year after the first contract anniversary.)%Maximum amount not subject to withdrawal charge (the amount which includes the sum of all purchase payments available without penalty and all gain available.

7 Current Annual Benefit Payment allowed under the Guaranteed withdrawal Benefit (GWB) or Lifetime withdrawal Guarantee Benefit (LWG). (This option only applies to contracts where the GWB or LWG Rider has been elected.)of the current Annual Increase Amount under Predictor or Predictor Plus. (This option applies only to contracts where the Predictor or Predictor Plus rider has been elected.) * Percentage must be less than or equal to the Annual Increase Accumulation Rate, as provided on your contract schedule page, in order for the withdrawal adjustment that applies to the Annual Increase Amount to be equal to the dollar amount of the 3.

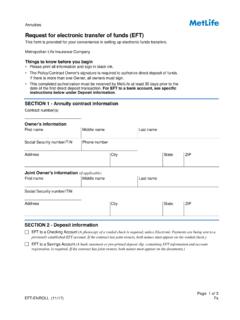

8 Source of withdrawal - Use whole percentages only If no source is indicated, the withdrawal will be made from each portfolio or account in the proportion that it bears to the contract choicesPercentage Funding choicesPercentage %%%%%%Total 100%NEF-ANNWDRWL-B (06/18)Page 3 of 5 Fs-B/fSECTION 4: Payment instructionsChoose One (Optional): A check will be sent to the address on record if Electronic Funds Transfer or Alternate Payee is not selected Electronic Funds Transfer (EFT) to a pre-authorized bank account already on fileNote: EFT to a pre-authorized bank account will be processed as requested.

9 We will send a check to the address of record until the account is verified/authorized for EFT. A voided check must be included for account Check for the benefit of (FBO) the contract ownerAlternate payee name (Bank, Brokerage Firm, etc.)Bank addressCityStateZIPA ccount number (if applicable)Special instructions:Stop MSA deductionsElectronic Payment (MIDAS) ProgramMSA Number (if known):SECTION 5: Income tax withholding election The IRS requires us to withhold federal income tax at a rate of 10% from the taxable portion of your payments.

10 You can elect not to have tax withheld. Even if you elect not to have income tax withheld from your payments, you are liable for payment of income tax on the taxable portion of your payments. You may also be subject to tax penalties under the estimated tax payment rules if your payments of estimated tax and withholding, if any, are not adequate. Additionally, a 10% federal tax penalty may apply to the taxable amount if the Owner is under age 59 . A distribution from a Roth IRA attributable to a conversion within five years from the conversion may be subject to the 10% penalty tax.