Transcription of APPLICATION FOR WITHDRAWAL HARDSHIP - Voya Financial

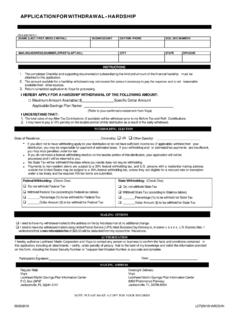

1 09/27/2016 LO720001 HARDSHN APPLICATION FOR WITHDRAWAL HARDSHIP (PLEASE PRINT) (NAME (LAST, FIRST, MIDDLE INITIAL) BUSINESS UNIT DAYTIME PHONE SOC. SEC NUMBER MAILING ADDRESS (NUMBER, STREET & APT. NO.) CITY STATE ZIP CODE completed Checklist and supporting documentation substantiating the kind and amount of the Financial HARDSHIP mustbe attached to this amount available for a HARDSHIP WITHDRAWAL may not exceed the amount necessary to pay the expense and is notreasonable available from other Return completed APPLICATION to Voya for HEREBY APPLY FOR A HARDSHIP WITHDRAWAL OF THE FOLLOWING AMOUNT: Maximum Amount Available $ Specific Dollar Amount Applicable Savings Plan Name.)

2 (Refer to your confirmation statement from Voya) I UNDERSTAND THAT: total value of my After-Tax Contributions (if available) will be withdrawn prior to my Before-Tax and Roth may have to pay a 10% penalty on the taxable portion of this distribution as a result of the early of Residence: Citizenship: US Other (Specify): If you elect not to have withholding apply to your distribution or do not have sufficient income tax (if applicable) withheld from your distribution, you may be responsible for payment of estimated taxes. If your withholding and/ or estimated tax payments are insufficient, you may incur penalties under tax law.

3 If you do not make a federal withholding election on the taxable portion of this distribution, your APPLICATION will not be processed and it will be returned to you. No State Tax will be withheld if the state where you reside does not require withholding. Payments to non-resident aliens are subject to a 30% federal withholding tax, and persons with a residential mailing address outside the United States may be subject to a 30% federal withholding tax, unless they are eligible for a reduced rate or exemption under a tax treaty and the required IRS tax forms are submitted.

4 I elect to have my WITHDRAWAL mailed to the address on file by first class mail at no additional change. I elect to have my WITHDRAWAL mailed using United Parcel Service (UPS) Next Business Day Delivery or, in some cases, Express Mail. I understand that a non-refundable fee of $ will be deducted from my account for this service. I hereby authorize Lockheed Martin Corporation and Voya to contact any person or business to confirm the facts and conditions contained in this APPLICATION , including all attachments. I certify, under penalty of perjury, that to the best of my knowledge and belief the information provided on this form, including the Social Security Number or Taxpayer Identification Number, is accurate and complete.

5 Participant s Signature: Date: Regular Mail: Voya Lockheed Martin Savings Plan Information Center Box 24747 Jacksonville, FL 32241-4747 Overnight Delivery: Voya Lockheed Martin Savings Plan Information Center 8900 Prominence Parkway Jacksonville, FL 32256-8264 NOTE: PLEASE MAKE A COPY FOR YOUR RECORDS S10 FOR116m MAILING ADDRESS AUTHORIZATION MAILING OPTIONS Federal Withholding: (Check One) Do not withhold Federal Tax Withhold Federal Tax (according to Federal tax tables) Percentage (%) to be withheld for Federal Tax Dollar Amount ($) to be withheld for Federal Tax State Withholding.

6 (Check One) Do not withhold State Tax Withhold State Tax (according to State tax tables) Percentage (%) to be withheld for State Tax Dollar Amount ($) to be withheld for State Tax WITHHOLDING ELECTION INSTRUCTIONS Salaried Savings Plan 09/27/2016 LO720001 HARDSHN HARDSHIP WITHDRAWAL INSTRUCTIONS Name Social Security Number You have requested a WITHDRAWAL from your Salaried Savings Plan (SSP) account. The Internal Revenue Service requires that you establish HARDSHIP in order to receive a distribution from your account. This form must be completed and signed by you to establish HARDSHIP .

7 NATURE OF HARDSHIP AND REQUIRED DOCUMENTATION Check items which describe your HARDSHIP and explain if indicated. unreimbursed medical expenses for you, your spouse, your dependent(s)* or your primary beneficiary payment of expenses to prevent foreclosure on, or eviction from, your primary residence uninsured expenses directly related to a natural disaster or catastrophic event expenses directly related to institutionalizing you, your spouse or your dependent(s)*, but not including detention centers, jails or prisons expenses for the funeral of your spouse, your dependent(s)* or your primary beneficiary tuition (including room, board, books and fees)

8 For the next 12 months of primary (grades 1 to 8), secondary, or post- secondary education and related educational fees for you, your spouse, your dependent(s)* or your primary beneficiary the need to replace your or your spouse s lost wages, net of any other benefits received, due to an absence of pay for a period of at least four consecutive weeks. A request for lost wages must be filed while on prolonged absence or within 30 days of your or your spouse s return to work. the down payment, closing costs and other nonreimbursed expenses related to the purchase or major renovation of your primary residence; this does not include mortgage payments or refinancing.

9 NEED FOR WITHDRAWAL I hereby certify that the requested amount is not in excess of the amount needed to satisfy this immediate and heavy Financial need and that these funds are not otherwise available: 1. through a loan from the Salaried Savings Plan, 2. through reimbursement or compensation by insurance, 3. by reasonable liquidation of my assets, to the extent that such liquidation would not itself cause an immediate and heavy by Financial need, 4. by cessation of all of my contributions under the Plan, 5. by other distributions from plans maintained, or by borrowing from commercial sources on reasonable commercial terms.

10 I understand that my Financial resources shall be deemed to include those assets of my spouse and minor children that are reason- ably available to me. DISTRIBUTION GROSS-UP OPTION Check One Box Only I elect to have my distribution grossed-up to reflect the federal withholding requested. I understand this amount will be automatically deducted from the taxable portion of this distribution. I have included this calculation in the amount I have requested. I do not elect the gross-up option. Note: Failure to make an election will result in waiving the gross-up option.