Transcription of ASX Code: APA Price: $9.81 12 Mth ... - aspecthuntley.com.au

1 Business SummaryAPA Group (APA) comprises of Australian Pipeline Trust and APTI nvestment Trust, operates natural gas transportation business with interestsin energy infrastructure across mainland Australia, including natural gaspipelines, gas storage facilities and a wind farm. APA also holds minorityinterests in a number of energy infrastructure enterprises including SEA GasPipeline, Energy Infrastructure Investments, GDI Allgas Gas Networks andDiamantina and Leichhardt Power :APA has an interest in 15000 km of high pressuregas transmission pipelines across mainland Australia, transporting more thanhalf of the natural gas used in Australia annually.

2 APA has ownershipinterests in, and operates, the Envestra Limited (Envestra) and the GDI (EII)Pty Ltd (GDI) gas distribution networks, which together have approximately28400 kilometres of gas mains and pipelines, and approximately milliongas consumer connections. APA also has minority interests in and operatesother energy infrastructure assets and businesses, including SEA GasPipeline, Energy Infrastructure Investments, EII2 and Ethane Pipeline :APA has strategic stakes in a number of investmentvehicles. These investments are: Mortlake Gas Pipeline (50%), Sea GasPipeline (50%), EII2 ( ), GDI(EII) (20%) and Energy InfrastructureInvestments ( ), Tamworth Gas Network (100%), South East AustraliaGas Pty Ltd (50%).

3 AssetManagement:APA provides asset management and operationalservices to the majority of its energy investments and to a number of thirdparties. Its main customers are Australian Gas Networks Limited ("AGN"),Energy Infrastructure Investments and GDI (EII). Asset management servicesare provided to these customers under long term ResearchGood operational result, balance sheet needs equity for growthBalance sheet headroom looks stretched if APA want to achieve their$300-400m pa capex target, but an acquisition provides the opportunity toover-raise at an accommodative share price APA is assessingacquisitions of gas transmission and distribution assets in the USA, andstated on the conference call the size of the deal would be material enoughto move the dial , but not transformational.

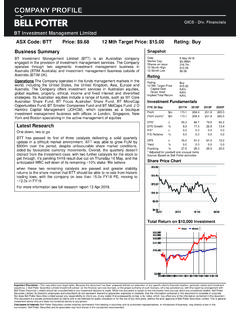

4 We have forecast adjusted gearing using the samemethodology as APA, see Figure 1 and Figure 2. On this basis, we thinkthe headroom on the balance sheet is currently ~A$450m, but reducing tozero by end-FY20 assuming +$300m pa new project capex spend, so thebalance sheet requires an equity raisein the next 1-2 years. An acquisition provides the opportunity to do so, andwith the share price ~5% ahead of our fundamental valuation, a raise maynot be too more information see research 21 Feb - UtilitiesAPA GroupASX Code: APAP rice: $ Mth Target Price: $ : NeutralImportant Disclaimer -This may affect your legal rights: Because this document has been prepared without consideration of any specific client's financial situation, particular needs and investmentobjectives, a Bell Potter Securities Limited investment adviser (or the financial services licensee, or the proper authority of such licensee, who has provided you with this report by arrangement withBell Potter Securities Limited) should be consulted before any investment decision is made.

5 While this document is based on the information from sources which are considered reliable, Bell PotterSecurities Limited, its directors, employees and consultants do not represent, warrant or guarantee, expressly or impliedly, that the information contained in this document is complete or does Bell Potter Securities Limited accept any responsibility to inform you of any matter that subsequently comes to its notice, which may affect any of the information contained in this document is a private communication to clients and is not intended for public circulation or for the use of any third party, without the prior approval of Bell Potter Securities Limited. This is generalinvestment advice only and does not constitute advice to any of Interest:Bell Potter Securities Limited receives commission from dealing in securities and its authorised representatives, or introducers of business, may directly share in thiscommission.

6 Bell Potter Securities and its associates may hold shares in the companies on issue12 Month High12 Month Low30 April 2019$11,575m1, $ $ Mth Target PriceCapital GainGross YieldImplied Total ReturnNeutral$ FundamentalsFYE 30 Jun2018A2019F2020F2021 FProfit$ (norm)*$ * Growth% * Relative% * Adjusted for goodwill and unusual itemsSource: Based on Citi estimatesShare Price ChartTotal Return on $10,000 InvestmentProfit & Loss ($M)2014A2015A2016A2017A2018 ASales Revenue1,3231,5032,0602,2952,356 Total Revenue ex. ,3241,9342,0612,2962,356 EBITDA7408111,3181,4661,516 Depreciation & Amortisation----------EBIT58460379789693 7 Net Interest-318-313-495-510-507 Profit Before Tax266290302386430 Income Tax-66-86-123-149-165 Outside Equity after Tax200204180237265 Significant Items after Tax144356------Reported Profit after Tax344560180237265 Preferred Dividends----------Cash Flow ($M)2014A2015A2016A2017A2018 AReceipts from Customers1,4621,5852,2862,5082,635 Funds from Operations6947571,3211,4431,523 Net Operating Cashflow4325628629741,032 Capex-447-6,262-457-377-876 Acquisitions & Investments-0-17-217-1--Sale of Invest.

7 & Investing Cashflow-571-5,490-674-378-876 Proceeds from Issues--1,838----505 Dividends Paid-301-303-440-479-490 Net Financing Cashflow665,333-517-286-450 Net Increase Cash-74405-328311-294 Cash at Beginning81741285395 Exchange Rate at End741285395101 Ratios and Substantial Shareholders2014A2015A2016A2017A2018 AProfitability RatiosEBITDA Margin% Margin% Profit Margin% on Equity% on Assets% RatiosNet Debt/Equity% 5 Substantial ShareholdersBNP Paribas Nominees Pty Sheet ($M)2014A2015A2016A2017A2018 ACash & Equivalent741285395101 Receivables156255263290252 Inventories1721252529 Other Current Assets2333486368 Current Assets203721421772449 Prop. Plant & Equipment5,5748,3559,1899,1509,692 Intangibles1,3214,6974,5404,3584,176 Other Non-Current Assets170126657882 Non-Current Assets7,76913,93214,42214,27414,778 Total Assets7,97314,65314,84315,04615,227 Interest Bearing Debt4,7089,3069,7249,7019,651 Other Liabilities7689641,0891,3671,450 Total Liabilities5,47610,27010,81411,06811,100 Net Assets2,4964,3834,0293,9784,127 Share Capital1,8163,1953,1953,1153,288 Reserves-116-309-395-208-331 Retained Earnings20146418261105 Outside Equity ,0321,0471,0101,064 Total Shareholders Equity2,4964,3834,0293,9784,127 Current Analyst Recommendations ** Source: Morningstar.

8 This chart shows the spread of recommendations from thosebroker analyst's in Australia with research coverage of this & DirectorsPrincipalsCompany SecretaryMs Nevenka CodevelleDirectorsMr Michael J McCormack(Chief Executive Officer,Managing Director)Ms Shirley Eleanor In't Veld(Non-Executive Director)Mr Steven Crane(Non-Executive Director)Mr Peter Wasow(Non-Executive Director)Mr James Ernest Fazzino(Non-Executive Director)Mr Michael Anthony Fraser(Non-Executive Director,Non-ExecutiveChairman)Ms Debra (Debbie) Lyn Goodin(Non-Executive Director)To access further Research or for information regarding our recommendations and ratings please 2019 Morningstar, Inc. All rights reserved.

9 Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liabilityfor its use or distribution. Any Morningstar ratings/recommendations contained in this report are based on the full research report available from Morningstar or your adviser. Any general advice or class service havebeen prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation orneeds. Refer to our Financial Services Guide (FSG) for more information at You should consider the advice in light of these matters and if applicable, the relevant ProductDisclosure Statement before making any decision to invest.

10 Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performancedoes not necessarily indicate a financial product s future performance. To obtain advice tailored to your situation, contact a professional financial adviser. Some material is copyright and published under licence fromASX Operations Pty Ltd ACN 004 523 GroupBell Potter Securities ResearchAFS Licence No. 243480 ABN 25 006 390 772 Email

![Untitled-3 [mainetelugu.com]](/cache/preview/2/c/1/8/b/9/9/0/thumb-2c18b990e0e1ca0ebe759f358ed7d88a.jpg)